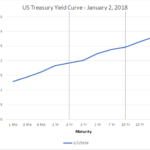

Who’s afraid of the inverted yield curve? The financial press has been worrying about the yield curve[1] recently. The yield curve is “flattening,”[2] and that flattening “raises a warning flag.”[3] If you read the articles, you’ll see that the authors are most concerned about the possibility that the yield curve may become “inverted.” This raises [Learn more…]

Securities

Updating Preferred ETFs – An Analytical Approach

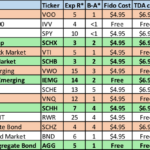

Every year, we review and update the preferred exchange-traded funds (ETFs) in Sensible Financial’s investment models. We focus on (1) minimizing tracking error, the difference in return between a fund and its benchmark index and (2) cost-efficiency – we want your investments to follow the model closely at the lowest possible cost. In our ETF [Learn more…]

Sensible Financial’s Preferred ETFs

Every year, Sensible Financial reviews each mutual fund holding to ensure that you are invested in the best possible funds consistent with your target allocation and investment strategy. In defining “best”, we consider two primary criteria: (1) cost and (2) tracking error relative to our target indices. 1). There are three primary cost categories for [Learn more…]

Should you be concerned about exchange traded funds (ETFs)?

A recent Wall Street Journal article raises concerns about exchange-traded funds (ETFs). Specifically, on August 24th, a day of extraordinary stock market volatility, several ETFs traded well below the values of their underlying securities (their net asset values or NAVs). You might wonder whether you should be concerned about this issue – after all, Sensible [Learn more…]

Taking Advantage of Lower ETF Fees

As competition increases, ETF fees continue to drop. Rick Miller comments on how Sensible Financial® Planning client’s benefit from lower fees. Read the full story here.