Every year, Sensible Financial reviews each mutual fund holding to ensure that you are invested in the best possible funds consistent with your target allocation and investment strategy.

In defining “best”, we consider two primary criteria: (1) cost and (2) tracking error relative to our target indices.

1). There are three primary cost categories for mutual funds:

- The expense ratio – the annual management fee charged by the fund manager – is the most obvious. If this fee is 0.05% or 5 basis points, you’re paying $5 for every $10,000 invested. Because of the large position sizes in your portfolio, this cost is usually the most significant.

- The bid-ask spread is the hidden cost of buying and eventually selling a security. In exchange for providing liquidity to the market, Fidelity and TDA demand a profit. Let’s say that an ETF bid (the price at which we sell) is $100, and the ask (the price at which we buy) is $100.05. This means a bid-ask of $.05 or 0.05%. Part of the spread is assigned to the purchase, and part to the sale, so that the spread is the cost of a “round-trip” or a purchase and sale. This spread is fairly consistent over time in the ETFs we trade. The cost of the spread is incurred only when buying and selling – when rebalancing or raising cash. Since we tend to trade infrequently and hold for long periods, this cost tends to be very low as a percentage of return over the life of the position.

- Fidelity and TDA also charge transaction costs for some ETF and mutual fund trades. These are reflected in the table below. Depending on the ETF or fund, there may be no transaction cost. This cost is usually the least significant.

| ETFs | MFs | Notes | |

|---|---|---|---|

| Fidelity | $4.95 | $30 | DFA & Vanguard - extra $20 for buys |

| TDA | $6.95 | $24 | DFA is only $9.99 |

2). We are very conscious of the underlying assets that ETFs and other mutual funds hold. Just because two ETFs hold the same name “emerging markets” does not mean that they necessarily have the same exposures. In choosing ETFs, we seek to minimize tracking error – the deviation between the index or target that the fund manager is seeking to match, and the benchmark Sensible Financial has selected.

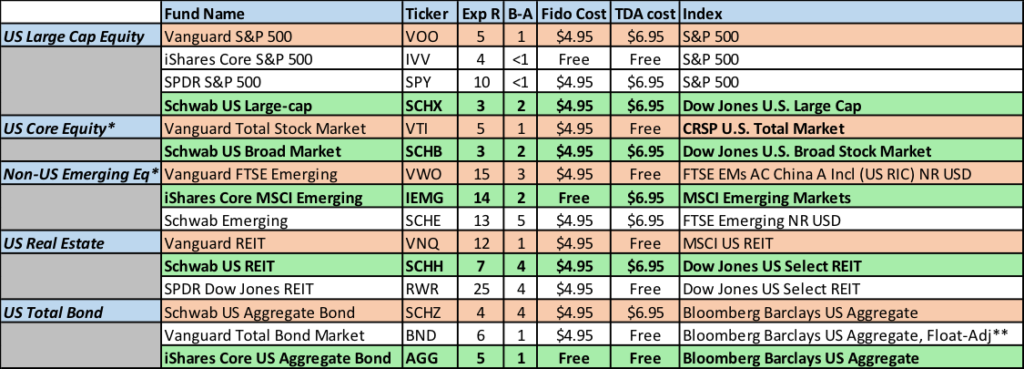

This year, we made some changes in our preferred ETFs. Previously preferred ETFs are shaded orange, and new preferred holdings are shaded green. The non-shaded are other ETFs we considered. (Exp R is Expense ratio and B-A is bid ask spread).

- US Large Cap Equity: Changed from VOO to SCHX.

- Cost: We reduced the expense ratio from 0.05% to 0.03%. Higher bid-ask is justified.

- Benchmark: SCHX tracks a broader index – about 750 companies compared to VOO’s 500. Because these indices are value-weighted, the lower-cap companies only have a small impact on index performance. The difference in risk exposure is minimal.

- US Core Equity: Changed from VTI to SCHB.

- Cost: We reduced the expense ratio from 0.05% to 0.03%. Higher bid-ask is justified.

- SCHB tracks a broader index – about 2500 companies compared to VTI’s 4000. Both indices are value-weighted, and difference in risk exposure is minimal.

- Non-US Emerging Equity: Changed from VWO to IEMG.

- Cost: We reduced both the expense ratio and bid-ask.

- Benchmark: This was tricky. VWO’s benchmark has slightly more exposure to China than IEMG’s. IEMG’s benchmark has exposure to small-cap companies while VWO’s does not. We analyzed returns and determined that the difference was minimal. In addition, the small-cap exposure is in line with Sensible’s all-cap approach.

- US Real Estate: switched from VNQ to SCHH.

- Cost: Expense ratio was cut in half. The higher bid-ask is justified.

- Benchmark: SCHH tracks a broader index – about 100 companies compared to VNQ’s 150. Both indices are value-weighted, and difference in risk exposure is minimal.

- US Total Bond: switched from SCHZ to AGG.

- Cost: Expense ratio is only slightly higher, but bid-ask spread is much lower and zero transaction fee with both custodians allows more flexibility.

- Benchmark: No difference.

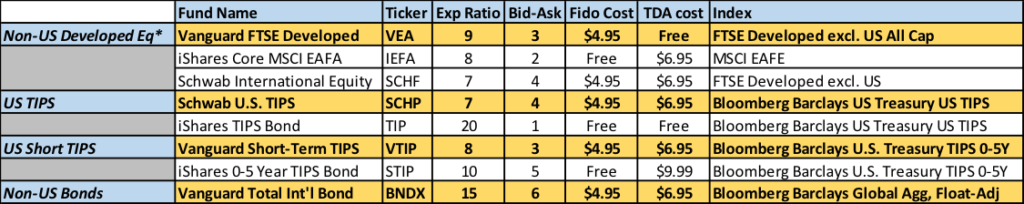

Below are preferred ETFs that we left unchanged – these are in orange. The non-shaded ETFs are other options we explored.

- Non-US Developed Equity: VEA’s benchmark has exposure to mid-cap and small-cap companies. This is not the case with the other two options. We determined that keeping this exposure is important, even with the higher expense ratio.

- US TIPS & US Short TIPS: Current ETFs are less expensive.

- Non-US Bond: BNDX is unique. It contains a mix or foreign government and corporate bonds and hedges currency risk, while most fund companies separate these types of bonds into more than one fund, and their ETFs are not hedged. Vanguard (manager of BNDX) offers this mix of assets in one ETF at an attractive price while its competitors do not.

When we change our preferred funds, we do not immediately replace the new with the old. This would incur far too many gains in taxable accounts. Instead, we use the new ETFs for purchases of their respective asset classes, and trim the old ETFs for sells.

Our selection of ETFs, as well as mutual funds, is consistent with our low-cost investment philosophy that we believe best serves your financial needs. Expenses can change over time, so it is important that we assess our preferred holdings annually. Your advisor is readily available to discuss these changes. To speak with a member of the Sensible Financial team, click here.

Table 1

* We usually use DFA funds for “US Core Equity” and Non-US Emerging Equity” exposure – ETFs are used only when DFA is not an option.

** The float-adjusted index differs from the non-float-adjusted index in that it excludes securities that are held by corporations and other entities as long-term investments. The float-adjusted index is smaller.

Table 2

* We usually use DFA funds for “Non-US Developed Equity” exposure – we use ETFs for this exposure primarily when DFA is not an option.