Every year, we review and update the preferred exchange-traded funds (ETFs) in Sensible Financial’s investment models. We focus on (1) minimizing tracking error, the difference in return between a fund and its benchmark index and (2) cost-efficiency – we want your investments to follow the model closely at the lowest possible cost.

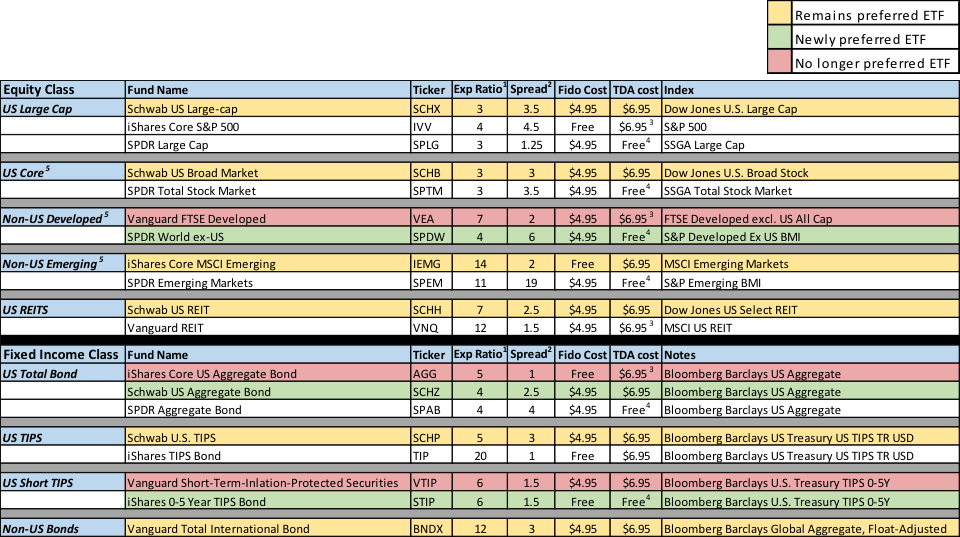

In our ETF review, we begin by identifying low expense ratio ETFs that are broadly aligned with our preferred asset classes. We compare each identified ETF’s target index with the index we use for that asset class — this helps limit tracking error so that your portfolio performance will more closely follow its benchmark. Finally, we take a detailed look at costs, focusing on three aspects (highlighted in a June, 2017 article):

- The expense ratio – the annual management fee charged by the fund manager – is the most obvious fee. If this fee is 0.05% or 5 basis points, you’re paying $5 per year for every $10,000 invested. Because of the large position sizes in your portfolio, this cost is usually the most significant.

- The bid-ask spread is the hidden cost of buying and eventually selling a security. In exchange for providing liquidity, the middleman in this transaction (the market maker) demands a profit – the difference between the buy and the sell price. Let’s say that an ETF bid (the price at which we sell) is $100, and the ask (the price at which we buy) is $100.05. This means a bid-ask of $.05 or 0.05%. The spread is the cost of a “round-trip” buy and sell. Part of the spread (usually half) is assigned to the buy, and the remaining portion is assigned to the sale. The spread is usually consistent over time in ETFs we trade. Because we tend to trade infrequently and hold for long periods, this cost is often small over the life of the position.

- Fidelity (Fido in the table) and TD Ameritrade (TDA) usually charge transaction fees for ETF trades. Fidelity charges $4.95, and TDA charges $6.95. (Each custodian has its own list of ETFs that trade fee-free.) This cost is usually the least significant of the three.6

Recently, SPDR (the ETF division of State Street Global Advisors) launched new ETFs. In an attempt to gain market share, SPDR partnered with TDA to exempt many of their new funds from transaction fees on the TDA platform. We considered these funds in our analysis. As you might imagine given the small impact of transaction fees on total cost, this impact was minimal.

The table summarizes our detailed analysis and our selections.

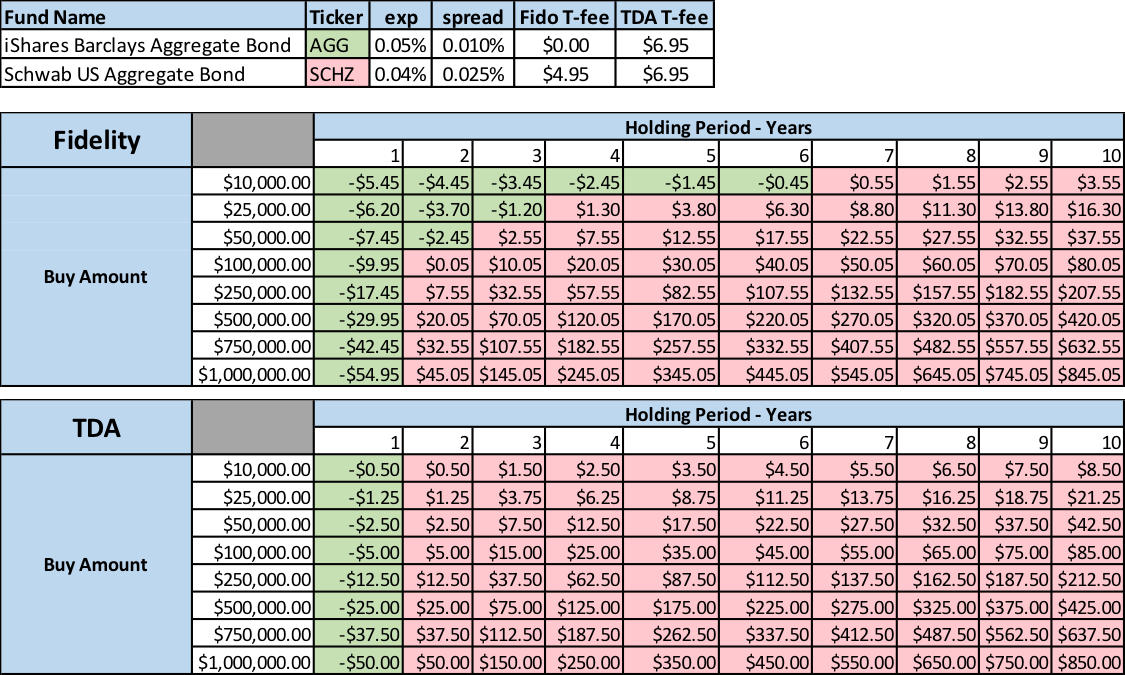

In addition to looking at the expense ratio, spread, and transaction fee, we analyze the dollar amount of purchases (Buy Amount) and the holding period (Holding Period – Years) to estimate the total cost of holding a particular fund. In the tables below, AGG is more cost efficient in the green cells, and SCHZ is more cost efficient in the red cells.

- Most of this difference in cost-efficiency can be attributed to the expense ratio – SCHZ’s 0.04% vs. AGG’s 0.05%.

- The bid-ask spread also plays a role. Because this is essentially the “round-trip” cost of buying and selling a security, its impact is proportionally reduced over longer holding periods. This explains why AGG (spread of 0.01%) is preferred over short periods and SCHZ (spread of 0.025%) is preferred over long periods. In the last year, the spread of SCHZ has tightened as the fund assets have grown and the trading volume has risen. With more buyers and sellers in the market for a security, market makers can comfortably bridge a smaller gap between bid and ask and still turn a profit.

- At Fidelity, the standard ETF transaction fee is $4.95. AGG is exempt from this.7 This has a greater proportional impact on cost for smaller trade sizes.

Our clients tend to be long-term investors. Therefore, we’ve selected SCHZ as the preferred holding for US aggregate bond exposure in our Sensible model portfolios.

This analysis illustrates how we apply a low-cost approach in constructing your portfolio. Fund expenses can change over time, so we assess our preferred holdings annually. Your advisor is available to discuss these changes. To speak with a member of the Sensible Financial team, click here.

1. Expense ratio is in basis points (a one hundredth of a percent).

2. Spread (in basis points) is estimated based on an average of 5 randomly selected days

3. Fund now has a transaction fee, was previously free to trade.

4. Fund now is free to trade, previously had a transaction fee.

5. Asset class invests in ETFs when DFA funds are ineligible.

6. Over the life of the holding, the total cost is (Position Value) x (holding period x expense ratio + bid-ask spread) + transaction fee.

7. AGG is managed by BlackRock, a large asset management firm partnered with Fidelity. Many iShares ETFs are exempt from transaction fees at Fidelity.

Edward Samp is an Investment Operations Specialist at Sensible Financial. To ask Edward or another member of our team about planning for your financial future, please get in touch!