The SECURE Act 2.0 builds on the initial SECURE Act of 2019, changing the retirement planning space, and increasing retirement flexibility.

401(k)

The IRS Announced Higher 401k And IRA Contribution Limits For 2019 – How Much Should You Save?

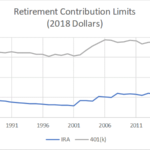

This article originally appeared on Forbes.com. On November 1, the IRS announced cost of living increases to IRA and employer plan contribution limits for 2019. The IRA annual limit increased from $5,500 to $6,000; the employer plan limit (applicable to 401(k)s, 403(b)s, most 457 plans and the Federal Government’s Thrift Savings Plan or TSP) increased [Learn more…]

What Should You Do With Your Old Employer Retirement Account When Changing Jobs?

With the economy picking up, more people are changing jobs. This article will focus on just one of the implications of moving to a new job: what should you do with your old employer retirement plan? You have three options, each of which I will address in turn, highlighting the factors that we use to [Learn more…]