In a previous article, I described QCDs (Qualified Charitable Distributions) and a few of their general rules. In this article, I’ll discuss the advantages and disadvantages of using QCDs to aid in your charitable giving.

Advantages of QCDs

Excluded from taxable income

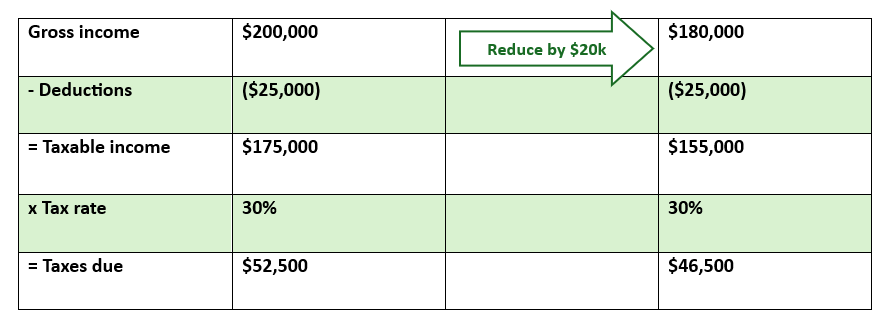

As discussed in my first article, IRA checks made payable to charity are not included in taxable income. Here’s an example based on a $20,000 gift:

Usually when you donate to a qualified charity, you receive a charitable deduction for the value of the donation. However, you only benefit from that deduction if the sum of your itemized deductions exceeds your standard deduction. With QCDs, however, you receive a tax benefit regardless of whether you itemize or take the standard deduction. Instead of getting a tax deduction for the donation, the QCD is simply excluded from income.

Counts towards RMD

Once you reach a certain age (currently 73 or 75 depending on your birth year), the IRS requires that you begin taking out a certain amount from your retirement accounts each year. This is known as a Required Minimum Distribution (RMD). When you take money out of a pre-tax account, you pay taxes on it.

QCDs count towards your RMD. If you do not need the RMD to support your spending, QCDs can be a way to reduce your taxable income by reducing your RMD.

Helps manage IRMAA and other income-based deductions

To minimize taxes or taxable income some people would prefer to take out as little as possible from retirement accounts. QCDs count towards your RMD but also reduce taxable income. They can reduce income to allow eligibility for certain income-based deductions and to manage IRMAA (Income-Related Monthly Adjustment Amount). IRMAA is a surcharge on Medicare Part B premiums based on your Modified Adjusted Gross Income.

You can read more about IRMAA here.

QCDs only reduce pre-tax and not basis in IRA

You can always contribute to an IRA. However, you are only eligible to receive a tax deduction for the contribution if your income is below a certain threshold. If you are ineligible for a deduction, that contribution increases the “basis” in your IRA. Unlike contributions from which you received a tax deduction, basis is not taxable upon withdrawal.

If you have basis in your IRA, when you make a withdrawal, the distribution is prorated. This means that if 75% of the IRA was basis and 25% was pre-tax, that 25% of the withdrawal would be taxable and the basis would be tax-free.

Unlike regular distributions from your IRA, QCDs can only be made from pre-tax dollars. Therefore, over time, the percentage that is basis will increase. This means that more of your non-charitable distributions will be tax-free in future.

Disadvantages of QCDs

Need to document to receive tax benefit

When you make a QCD, the custodian will include the distribution with normal distributions on the 1099-R.

To receive a tax benefit, you need to notify your accountant that you made QCDs, and you need to retain the acknowledgement from the charity. Failing to do so can result in paying tax on QCDs unnecessarily.

More cumbersome than a Donor Advised Fund

Donor Advised Funds make charitable giving enjoyable and easy. A QCD is also relatively simple logistically but is more cumbersome than the Donor Advised Fund. You (or your advisor) will need to ensure there is sufficient cash in the account to cover any checks you write. Additionally, receiving a tax benefit requires more diligence than the Donor Advised Fund.

If you donate to many charities each year, QCDs might be cumbersome. Not only will you need to mail all checks with the letters to the charity, but you’ll also need to keep all acknowledgements from the charity. In this situation, a Donor Advised Fund would be much easier logistically as you would only need to retain tax documents related to the Donor Advised Fund contribution for tax purposes (not the grants to the various charities).

QCDs do not eliminate capital gains

While QCDs do allow you to receive a tax benefit regardless of whether you itemize or take the Standard Deduction, they do not reduce your unrealized gains as the distributions come from retirement accounts. If you donate stock to a DAF, you will receive a deduction for the gift, and avoid the capital gains tax liability on the unrealized gain.

Contribute to a Roth IRA instead of a Traditional IRA if you make QCDs

If you are still making deductible IRA contributions and wish to also make QCDs, consider making Roth IRA contributions instead. This is because any deductible IRA contributions reduce the total QCDs you can exclude from gross income. For example, if you made $10k in QCDs and made a $7.5k deductible IRA contribution, you would have to include $7.5k of your QCDs in taxable income. If you made a Roth IRA contribution instead, you could exclude the full $10k in QCDs from taxable income.

Each investor has different financial needs. If you have questions, the advisors at Sensible will be happy to discuss your alternatives and act on your decisions.

This is part 6 in a series on charitable giving. Here are the links to read the other five.

Part one

Part two

Part three

Part four

Part five

The information in this article is not intended as tax advice. Sensible Financial does not provide accounting or tax services. You should consult your tax professional before making any decisions.