This is the third article in the charitable giving options series. My first two articles (part 1 and part 2) described how charitable giving can reduce your tax liability and illustrated strategies and vehicles such as the Donor Advised Fund that can maximize your tax benefit. This article will explore the advantages and disadvantages of Donor Advised Funds in greater detail.

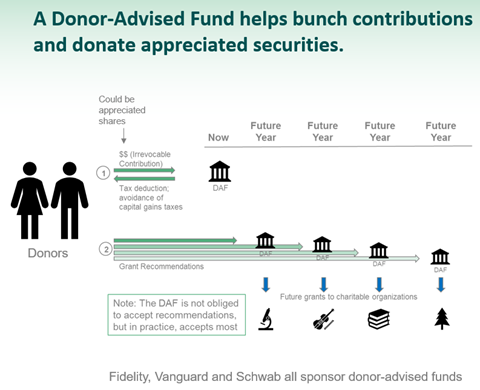

A Donor Advised Fund (DAF) is a charity into which you make contributions and receive an immediate tax deduction. You have the option to instruct the charity on how to invest the balance. You then recommend grants to your charities of choice over time. Donor Advised Funds often allow grants to many different charities. If your preferred charity is not available, you may be able to request they be added as an option.

Advantages to a Donor Advised Fund

Supports tax-efficient charitable giving strategies

The main benefit of a Donor Advised Fund is the ability to implement two tax-efficient giving strategies: “bunching” many years of donations into a single year and donating highly appreciated assets (securities or even more complex assets such as real estate). You can read in detail about these tax benefits in my second article.

Simplifies charitable giving

Previous articles discussed how Donor Advised Funds simplify donations of complex assets for charities. Donor Advised Funds also streamline donations for you as a donor. You can automate recurring gifts (annual, semi-annual, quarterly or monthly) with specified start and end dates, you can make one-time gifts quickly, and you can easily view gifting history.

Specify sources and uses

Donor Advised Funds allow you to specify how the charity will identify and/or use the gift. Most let you choose to gift either anonymously, in the name of the DAF, or including your name and address. Some DAFs even permit gifts in honor or in memory of a loved one. You can also specify whether your gift is to be used for special purposes or where it’s needed most.

Engage others in charitable giving

Some Donor Advised Funds offer another appealing feature that can engage your loved ones in charitable giving. Fidelity Charitable has a program, Gift4Giving, that allows you to dedicate a portion of your account to others. These appointed individuals can recommend grants to charities of their choice. In the event they don’t make any grants after a certain time, usually one year, the funds are returned to your Donor Advised Fund.

Disadvantages

Irrevocable

Contributions to Donor Advised Funds are irrevocable (they are charitable gifts, after all). Keep this in mind especially if you choose to bunch multiple years of contributions into one year.

Fees

In addition to the investment fees, Donor Advised Funds charge management fees. The amount of the fee varies by sponsor. Vanguard, Schwab and Fidelity charge 0.6% of assets on the first $500k and a lower percentage on dollars above that amount.

The tax-free growth combined with the additional tax savings from bunching contributions and donating highly appreciate stock may outweigh these administrative fees. However, if you plan to make small and infrequent donations to charity, it may make sense to donate directly to charities and avoid the Donor Advised Fund fees.

Minimum grants

Some Donor Advised Fund sponsors have contribution and grant minimums. While Schwab and Fidelity have $0 contribution minimums and low minimum grant requirements ($50), Vanguard’s minimums are higher ($25k for initial contribution, $5k for additional contributions and $500 for grants).

The Congress has become concerned that some DAFs are inactive. In response, Fidelity Charitable and others have established guidelines and rules requiring that a percentage of funds be distributed within certain time frames. Fidelity requires that annual grants to charities be greater than 5% of total Giving Accounts balances at Fidelity. If this minimum is not met, Fidelity or Schwab Charitable will contact donors to request grant recommendations.

However, this may be unlikely, as this Fidelity Charitable report explains that “three-quarters of donors’ contributed dollars are distributed to charities within five years”.

Donor Advised Funds need not follow grant recommendations

While Donor Advised Funds are not obligated to follow grant recommendations, in practice they almost always do (as long as it is a legitimate charity). If DAFs did not follow donor instructions, they would risk losing fund participants.

International charities

While some Donor Advised Funds allow grants to international charities, some do not. If you are interested in making grants to international charities, contact the DAF to determine whether such grants are supported.

Do you think a DAF might be a good vehicle for your charitable giving? Contact your advisor to discuss opening and funding a Donor Advised Fund. My next article will detail ways to maximize the tax benefits of your DAF contribution by choosing the best assets and time frame to donate.

The information in this article is not intended as tax advice. Sensible Financial does not provide accounting or tax services. You should consult your tax professional before making any decisions.

Photo by micheile dot com on Unsplash