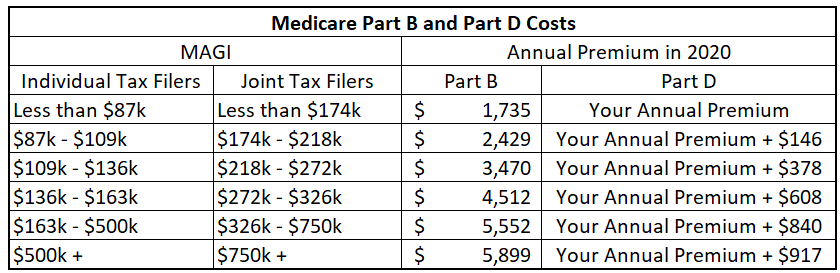

Nearly all retirees rely on Medicare to provide healthcare coverage in retirement. Medicare charges a basic premium of $1,735 per year for Part B coverage. Many retirees also enroll in Medicare Part D to cover prescription drugs, with a cost that is specific to the plan they choose. It may come as a surprise that you may pay more than these base premiums and the extra amounts you pay (surcharges) are subject to change each year. Luckily, through proactive planning, you may be able to minimize or avoid paying Medicare premium surcharges.

What is IRMAA?

IRMAA sounds like the next tropical storm off the coast of Florida, but in fact, it stands for Income Related Medicare Adjustment Amount. Introduced through the Medicare Modernization Act of 2003, Medicare adds surcharges to Part B and Part D premiums for those with higher incomes. If your Modified Adjusted Gross Income (MAGI) is above a certain level, you may have to pay an additional amount on top of your standard Part B and Part D premiums. Only about 5% of all Medicare beneficiaries pay any IRMAA at all. The “Adjustment Amount” dictates the surcharge on top of the base premiums, which apply only once you enroll in Medicare Parts B and D.

How does Medicare calculate my premiums?

You can see how much IRMAA, if any, you may be subject to in the table below.

How does Medicare determine premiums for this year when this year’s MAGI is still unknown? Medicare determines your current year premiums based on income from two years ago. For example, MAGI from your 2018 tax return is used in determining your 2020 premiums. If you are subject to IRMAA, you will receive an “Initial IRMAA Determination” letter indicating your additional premiums.

These annual premiums are per person. Your base Part D premium depends on the plan you select, and the surcharge is added to that premium.

Retirees collecting Social Security generally have Medicare premiums, including the IRMAA surcharges, deducted automatically from their monthly checks. Those on Medicare who are not yet collecting Social Security receive a monthly bill for their premiums.

What can you do to lower your Medicare premiums?

Option 1: File a Medicare IRMAA Life-Changing Event form for alternative calculation method

If you receive an “Initial IRMAA Determination” letter, don’t panic. Medicare offers an alternative calculation method if you’ve experienced what they consider a life changing event. Life changing events include:

- Marriage / divorce / annulment

- Death of a spouse

- Work stoppage or reduction

- Loss of income producing property

- Loss of pension income

- Employer settlement payment

If you experience one of these life changing events, you can fill out Form SSA-44 to indicate that premiums should be based on your current year income instead of income from two years prior. You will need to provide documentation of the change and will also need to estimate your current year MAGI. Completing the form is beneficial only if your MAGI in the current year puts you in a lower IRMAA bracket than the income from two years prior.

This form is relatively straightforward, and you can file it more than once. For example, if you retire in 2020 at age 65 and begin Medicare, you may want to file this form in 2020 and 2021 indicating a work stoppage. Medicare would then use your estimated MAGI for years 2020 and 2021 (years in which you are retired) instead of 2018 and 2019 (when you were still working).

If you experience a year with unusually high income (from selling a property, Roth conversions, selling stock, winning the lottery, etc.) and you don’t experience one of the life changing events above, there is no avoiding the potential bump in IRMAA that will be paid in two years. The good news is IRMAA is recalculated each year so a one-time spike in income affects you only for one year, assuming income returns to normal levels.

Option 2: Optimize your income sources to help avoid or minimize additional increases in IRMAA.

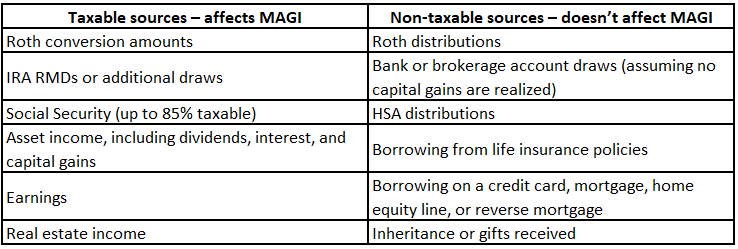

This second method involves working in tandem with your financial advisor and your tax accountant to manage your income sources. Going over an IRMAA threshold by just $1 can cause you to pay hundreds or thousands of dollars more in Medicare premiums. It’s important to consider sources of income that affect your MAGI and proactively plan so you can minimize or avoid the IRMAA surcharges.

Example: A married couple with a large pension and RMDs (Required Minimum Distribution) has anticipated income of just over $210k this year. We worked with them and determined it would be better to draw additional income for travel from their brokerage account than their IRA to avoid increasing their MAGI above the $218k threshold. This slight adjustment helped them avoid crossing the next IRMAA threshold and saved them roughly $2,500 in combined Medicare surcharges.

Some strategies to consider:

- Converting part of your IRA to Roth in early years of retirement to help reduce the size of future RMDs

- Giving to a tax efficient charity to minimize MAGI, including Qualified Charitable Distributions or gifting of appreciated stock

- Developing long-term strategies for selling appreciated securities over several years

- Optimizing income from taxable and non-taxable sources to help manage MAGI

The table below outlines various sources of income and indicates whether they count towards MAGI.

Nobody likes surprises that involve paying more for health insurance. You now understand how Medicare determines premiums and whether surcharges will be due, based on your income. Through proactive planning and understanding your options, you may be able to avoid some of these surcharges.

Implementing these strategies may not make or break your financial plan, but as one client recently remarked during a call about IRMAA, “every little bit helps”. Your financial advisor and tax accountant can help you assess and manage your own situation.