Long-term care is help with daily living over a prolonged period, whether that’s helping you dress or moving from one place to another. If you’re used to living independently, it can be daunting to think about needing long-term care insurance. However, someone turning 65 today has an almost 70 percent chance of needing long-term care in their remaining years. It’s best to plan. We presented a webinar on this subject. If you missed it, you can watch it now.

Each person’s experience of aging will be different, but some possibilities are more likely. The predictability of aging lets you plan for general contingencies. Then, if you develop an age-related illness, you and your support network will be better prepared.

The sticker price of long-term care can be very large, but it probably overstates the net impact on your finances. Every financial plan can adapt to apply some resources to long-term care, as needing long-term care may lower many of your other planned expenses. One way to prepare financially in case you need long-term care is to sign up for long-term care insurance, or LTCi.

Will I need long-term care?

As people get older, they tend to become less physically active and strong. Their crystallized intelligence (life experience and wisdom) grows, but their fluid intelligence (rapid calculation, quick decision-making, etc.) declines. They are more at risk of illness, especially chronic illness. Some of these illnesses, like Parkinson’s disease or heart failure, can cause a person to need long-term care.

What is long-term care?

Though medical conditions can cause someone to need long-term care, long-term care is not medical care. Medical care always prevents or treats a medical condition. Long-term care, on the other hand, helps with day-to-day tasks. These tasks are called Activities of Daily Living (ADLs) and Instrumental Activities of Daily Living (iADLs).

How do you qualify for LTCi benefits?

LTCi policies have specific qualifications you must meet to receive benefits. To qualify, you must be unable to perform two or more ADLs and/or have a severe cognitive impairment. ADLs are the fundamental skills you need to care for yourself. These include:

- Eating

- Bathing

- Dressing

- Transferring (between a bed and chair or wheelchair)

- Toileting

- Continence

Being unable to perform two or more of these would qualify you for long-term care insurance benefits. Having one or more severe cognitive impairments would also qualify you for benefits. Severe cognitive impairments include:

- Loss of short- or long-term memory

- Difficulty orienting as to person, place, or time

- Issues with deductive or abstract reasoning

- Judgement lapses related to safety

Can you need long-term care but not qualify for insurance benefits?

If you struggle with some activities of daily life, called instrumental activities of daily life (iADLs), you might need long-term care. But, unless you also have a severe cognitive impairment or cannot perform two ADLs, LTCi won’t cover this care. IADLs are activities you do every day to take care of yourself and your home. They are more complex than ADLs and require skills like planning.

Examples of iADLs include:

- Shopping

- Housekeeping

- Accounting

- Food preparation

- Telephone

- Transportation

- Managing medication

- Errands and appointments

Where can I receive long-term care?

Because long-term care helps with activities of daily life, you can receive long-term care wherever you live. Who provides the care depends on where you live. For example, if you receive long-term care at home, a family member or private aide might help you. But if you receive long-term care in a nursing home, your helper is more likely to be a skilled nursing assistant or personal care assistant. Places you can get long-term care include:

- Your home and community

- Your own home

- An adult day facility

- An assisted living or Alzheimer’s facility

- A skilled nursing facility (nursing home)

- A continuing care retirement community (CCRC) (offers independent living, assisted living, and nursing facility all on one campus)

Funding long-term care with insurance

There are four approaches to paying for long-term care. Each has pros and cons.

- Family delivery, in which your loved ones care for you. It is inexpensive for you and comes with the comfort of familiar relationships and people you trust. It can also be financially, physically, and emotionally burdensome for your caregiver(s) and can cause family tension.

- Self-funding, where you hire professionals out of pocket to provide long-term care. This approach affords you more control over your quality of care. However, it puts you at risk of depleting your assets early or having less money to leave to your heirs.

- Medicaid is an option for those who lack the funds for private care. The government pays for your care, but that care can be of lower quality.

- Long-term care insurance provides benefits if you need long-term care. This approach preserves your retirement assets, offers you peace of mind, and lowers the barriers to seeking long-term care if you need it. On the other hand, you may never use the benefits.

LTCi plans can cover long-term care expenses

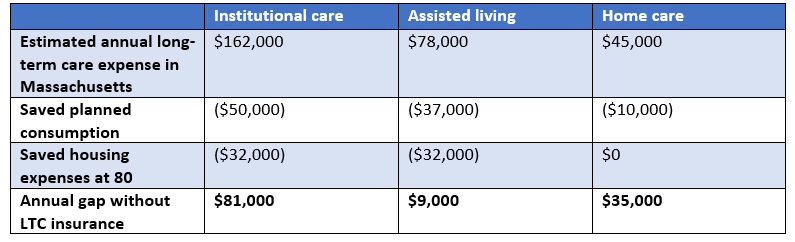

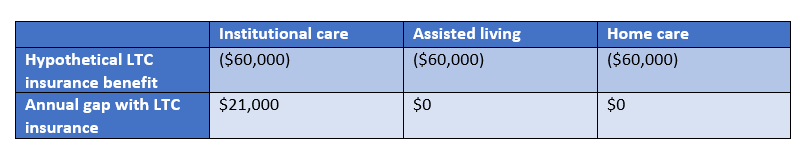

Here are the estimated annual costs of different types of long-term care. For home care, we assume you would pay $31 an hour for four hours of care per day. When someone needs long-term care, they usually spend less on other things. For example, they usually stop traveling for leisure. When someone gets long-term care in a residential setting like a nursing home or assisted living facility, they may sell their home and eliminate the associated expenses. Despite these savings, long-term care typically adds annual expense in any setting.

Let’s see what happens to these expenses when we add a long-term care insurance benefit. We’ve chosen a typical plan with a $60,000 annual benefit and a five-year policy. The LTCi fully covers the gap for assisted living or in-home long-term care and significantly reduces the gap for institutional care.

Long-term care insurance policy structure

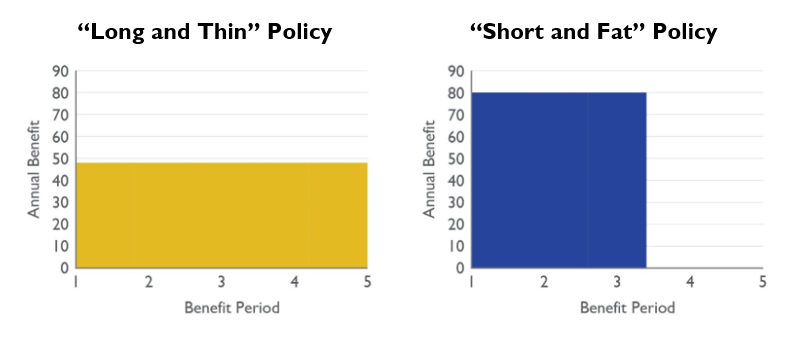

The example policy in the table has a $5,000 monthly benefit ($60,000 a year) and covers five years of care. Together, an LTCi policy’s monthly benefit and coverage duration constitute its “benefit pool”. When using your LTCi benefits, you cannot spend them faster than the monthly benefit. But you can spend them more slowly, extending the duration the policy supports.

In addition to a benefit pool, LTCi commonly has “riders”. For example, an inflation rider increases benefits over time to keep pace with inflation. A shared-care rider lets spouses share a benefit pool.

Choosing the right long-term care insurance policy

Long-term care insurance is a complex product. Choosing an LTCi policy calls for an experienced insurance broker who specializes in LTCi, understands how medical conditions relate to insurability, and is familiar with the underwriting process. However, it’s good to learn the basics for yourself, so you can ask your broker informed questions.

In general, Sensible Financial recommends policies that are “long and thin,” providing smaller benefits each year for a longer duration. Long and thin policies usually have lower premiums, while still providing the same lifetime pool as an equivalent “short and fat” policy

What LTCi doesn’t cover

When making a contingency plan for long-term care, don’t forget that LTCi might not cover all the help you need. Because LTCi only covers help with ADLs, not iADLs, there are some types of assistance it won’t pay for. This includes things like preparing meals, transportation, housework, financial management, and shopping. Even if you have LTCi, you might have to hire a home health aide to cook and clean, use a rideshare service for transportation, or do your grocery shopping online.

Long-term care insurance can be a wise investment

Needing more help is a normal part of aging. If you become ill or disabled, long-term care will be essential for you to live your best life for as long as possible. Long-term care is expensive, but many people’s budgets have some capacity to pay for it. If you need long-term care, long-term care insurance (or Medicaid, if you are eligible) will pay benefits to help cover the cost.

If you are planning your retirement or entering your 60s or 70s, now is the time to consult with an expert about whether LTCi should be part of your aging contingency plan. Sensible Financial is here for your questions about LTCi. Get in touch with us online or over the phone for help with thinking about LTCi and retirement planning. We’re happy to help.

Photo by Alexander Grey on Unsplash