When you’re young, the milestones roll by constantly – old enough to drive, old enough to drink, old enough to vote. When you turn 35, you could run for president. Yet the truly exciting age is 65, when you become eligible for Medicare. But what is Medicare, and how does it work?

As most government programs are, Medicare is complicated and at times downright Kafaesque. Looking at all the rules, parts, and instructions can make you feel like you’re swimming in a sea of alphabet soup. Like a soup recipe, Medicare is easier to understand if you know all the ingredients that go into it. So, let’s get started. Or, if you prefer, view the information from this article in our webinar The ABC’s (and D’s) of Medicare.

What is Medicare?

Medicare is the federal government’s health insurance system for U.S. citizens or permanent residents who are age 65 or older or have a qualifying disability. The Johnson administration started Medicare and its sister program Medicaid in 1965. The goal of Medicare and Medicaid is to improve public health and support Americans without health insurance.

Americans automatically become eligible for Medicare when they turn 65, regardless of their income or preexisting conditions. People with disabilities can become eligible for Medicare when they’re younger than 65. To become eligible, they must have what the Social Security Administration calls a “qualifying disability”. A qualifying disability is a health condition lasting at least 12 months that significantly limits a person’s ability to do basic work-related activities like lifting, standing, walking, sitting or remembering. For example, if you developed ALS and began to have muscle weakness and difficulty speaking, you would qualify for Medicare.

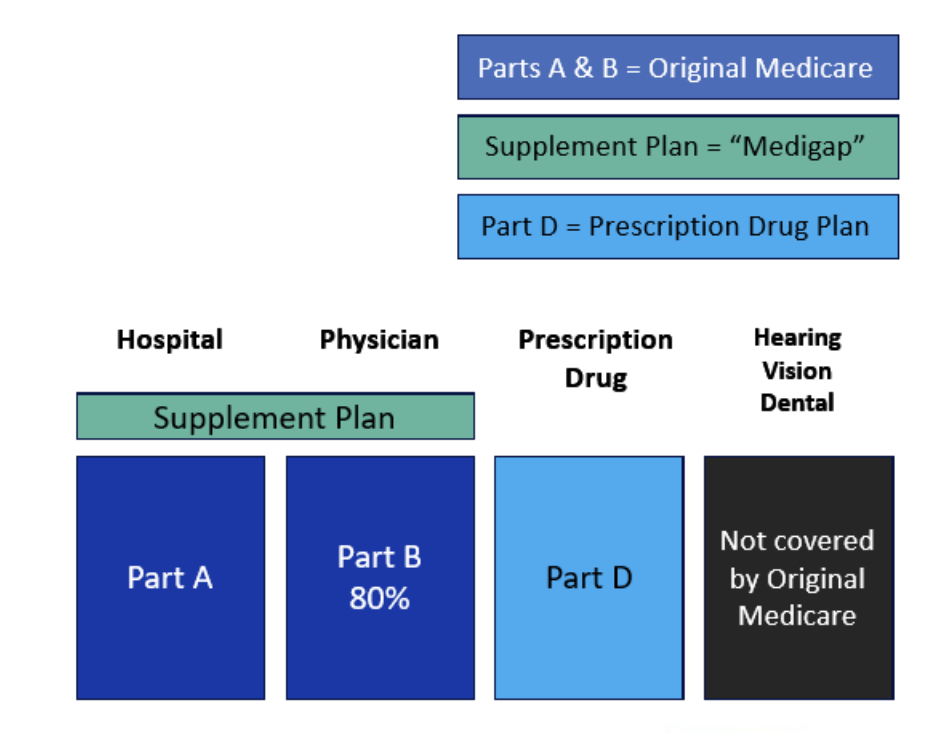

Medicare coverage is divided into categories called “parts”. If you’ve heard someone reference Medicare Part D, they were talking about the part of Medicare that pays for prescription drugs.

Some parts of Medicare are free. Other parts have premiums, deductibles or copays. Despite those costs, Medicare is more affordable than private insurance for almost everyone.

The difference between Medicare and Medicaid

Medicare and Medicaid sound similar. They’re both government health insurance programs. However, they serve different people.

Medicare, as we’ve already discussed, is for people 65 and older, or with a qualifying disability. Medicaid, though, is for people with low incomes and limited financial resources.

Think of it this way: Medicare is for older or disabled people, who often need more healthcare than average. Medicaid is for people who need financial aid. We won’t go into detail on Medicaid today.

How does Medicare work?

The most common Medicare questions we hear are “What does Medicare cover?” and “How much does it cost?” Unfortunately, there’s not a blanket answer to either of those questions. Each part of Medicare covers different types of medical care. Some parts are free. Others have variable costs depending on your needs.

We refer to Medicare Part A as hospital coverage, and Medicare Part B as physician coverage. If you opt into Medicare, you must enroll in both Part A and Part B (though not necessarily at the same time). Together, these parts make up Original Medicare. Parts A and B cover most Medicare-eligible expenses, except for prescription drugs from a pharmacy.

Original Medicare is based on a fee-for-service model. “Fee-for-service” is a health insurance system where the insurer pays doctors and other health care providers a fee for each service they render. This rewards medical providers for the volume and quantity of services they provide, regardless of the outcome of those services.

Under Original Medicare, there is a nationwide network of doctors who accept Medicare patients. You can see any of them you like, even if they are located outside your town or state.

Medicare supplement plans, called Medigap, are optional plans that cover the portion of healthcare expenses (besides prescription drugs) that Parts A and B do not. Neither original Medicare nor supplements cover routine hearing, vision, or dental services.

Medicare Part C, also known as Medicare Advantage, is an alternative to Original Medicare (Parts A and B), although it still covers what Original Medicare covers, and more. Medicare Advantage replaces Original Medicare’s fee-for-service model with a “managed care” model. This model is like a private insurance HMO or PPO, with a more limited network of providers. The managed care model strives to more efficiently manage patients’ care. This keeps healthcare costs low, for both them and their providers.

Medicare Part D covers prescription drugs from the pharmacy.

Medicare Part A: hospital coverage

There are no premiums for Medicare Part A for most people. As long as you’ve paid Medicare taxes for 40 quarters (10 years), your premium is $0. However, Medicare Part A has deductibles and co-pays. The longer your hospital stay, the greater the co-pay.

Medicare Part A pays for a large proportion of:

- Nursing care

- In hospitals, when you’re admitted as an inpatient

- During short stays in skilled nursing facilities or rehab centers

- In your home, via a home health agency or during hospice care

- Hospital and skilled nursing facility services and amenities

- A semi-private room

- Meals

- Lab tests, prescription drugs and medical supplies you receive at the facility, and rehabilitation

Medicare Part A only pays for stays in skilled nursing facilities during specific circumstances. It just covers stays in a skilled nursing facility for short-term rehabilitation, such as post-surgery recovery. It won’t pay for a long stay in a nursing home.

For Medicare to pay for short-term skilled nursing facility stays after a hospital visit, you must have spent three full days and nights in the hospital after being formally admitted as an inpatient. Medicare won’t pay for your rehab if your hospital status was “under observation”. If you have a hospital stay and will need rehabilitative care afterward, you should advocate for inpatient status well before you leave the hospital.

Medicare Part B: physician coverage

Medicare Part B pays for most non-inpatient medical care. Unlike Part A, Part B has a premium.

Medicare Part B covers 80 percent of these services:

- Medical and surgical services performed by a doctor

- Diagnostic and lab tests outside hospitals and nursing homes

- Preventive services like flu shots, mammograms or cholesterol tests

- Medical equipment and supplies

- Outpatient hospital treatment at an emergency room, clinic or ambulatory surgical unit

- Hospital care when you’re “under observation” (i.e., not inpatient)

- Prescription drugs given in a doctor’s office

- Physical, occupational and speech therapies

- Outpatient counseling like seeing a dietician, addiction specialist or mental health therapist

Costs of Medicare Part B in 2024 include:

- A monthly base premium of $174.70, plus a premium surcharge if your modified adjusted gross income (MAGI) is greater than $103,000 if you’re single or $206,000 if you’re married and file jointly

- Lifetime premium penalties for late enrollment

- An annual deductible of $240

- A 20 percent co-pay

- No out-of-pocket maximums

Medicare Supplement plans (Medigap)

Unlike Parts A and B, Medigap is private insurance. Rather than buy it from the government, you have a selection of insurance providers to choose from. Medigap pays for much of what Original Medicare doesn’t cover, including Part A deductibles (though not Part B) and, on some plans, emergencies abroad.

You must be enrolled in Original Medicare before you can get Medigap. Anyone can enroll in Medigap during their first six months on Medicare. After that, your enrollment options depend on your health.

Most states offer ten different Medigap plans. Massachusetts, Minnesota and Wisconsin offer fewer policies. In Massachusetts, there are two policies accessible to most people. One is the basic policy and the other one has additional benefits. When you first enroll, choose the best policy you can afford!

2024 Medigap costs include:

- Monthly premiums in addition to Part B premiums (about $100 to $200 a month, depending on the plan)

- A deductible (on some plans)

Medicare Part D: Prescription Drug Coverage

Medicare Part A covers a large portion of prescription drugs you receive during a hospital stay. Part B covers a large portion of prescription drugs you receive at a doctor’s office, like a flu shot or Botox injections for migraines. That leaves prescription drugs you buy from a pharmacy and administer to yourself. Medicare Part D covers those drugs. This includes daily medications like statins or blood pressure medication. It also includes short-term prescriptions, like a two-week course of antibiotics for an infection.

As with Medigap, Medicare Part D plans are insurance from a private company, rather than from the government. Each Part D plan has a different formulary. A formulary is the list of drugs that a plan covers, plus the copay for each drug. Formularies categorize drugs into different tiers of cost. The lower tiers of a formulary contain generic drugs with small (or nonexistent!) copays. Higher tiers contain brand-name and specialty drugs with higher copays.

Insurance providers can change their formularies every year, as well as their costs, benefits, and Medicare status. And they often do change. It’s smart to check your Part D plan’s formulary at least once a year to make sure your medications are on the formulary at an affordable price. You can always change Part D plans during open enrollment.

2024 costs of Medicare Part D include:

- An average monthly base premium of $56

- Possible surcharge based on MAGI

- Deductibles and copays or coinsurance

- Out-of-pocket maximums

- Lifetime premium penalties for late enrollment

Medicare Part C/Medicare Advantage

Medicare Part C, or Medicare Advantage, is an alternative to Original Medicare with Medigap and Part D. With Medicare Advantage, the Medicare program pays each plan provider a fixed amount each month per Medicare beneficiary enrolled in that plan, regardless of the amount of healthcare the beneficiary uses. Advantage is a managed care insurance plan, similar to an HMO or PPO with a limited network of providers.

Medicare Advantage covers the same services as Parts A and B. But many Advantage plans offer coverage beyond Parts A and B, like prescription drugs and routine vision, hearing, and dental care. To use Medicare Advantage, you still need to enroll in Parts A and B and pay premiums for Part B. However, you won’t need to sign up for Medigap or Part D.

2024 costs of Medicare Part C include:

- Low or no monthly premiums for most plans

- Deductibles and copays or coinsurance

- An out-of-pocket maximum less than $8,850, including Part A and B deductibles

Medicare Advantage: a viable alternative?

Original Medicare and Medicare Advantage each have different benefits and downsides. Which one will work better for you depends on your medical and financial situation. Both options are popular. In 2023, about half of all Medicare enrollees were enrolled in Medicare Advantage.

| Criterion | Original Medicare | Medicare Advantage (Part C) |

| Service model | Fee-for-service | Managed care (HMO, PPO) |

| Access to physicians | Any doctor who accepts Medicare | Limited to a local network. Out-of-network care costs more or isn’t covered |

| Stability of benefits | Benefits rarely change (except Part D) | Can change annually (including the network) |

| Prior authorization | Not required in most cases | Required to see a specialist |

| Level of complexity | Separate Medigap and Rx drug plans | All-in-one plans |

| Scope of benefits | No coverage for routine vision, hearing, and dental | Many plans include all these extras, and more |

| Out-of-pocket expenses | Higher monthly premiums; potentially lower co-pays and out-of-pocket maximums | Low (or no) monthly premiums; potentially higher co-pays and out-of-pocket maximums |

You might prefer Medicare Advantage if you:

- Like the idea of low or no premiums

- Are willing to seek prior authorization before seeing a specialist

- Don’t mind finding new physicians if your current physicians are not in the plan’s provider network (or leave the network)

- Like the idea of having extra benefits, such as routine

- Dental

- Hearing

- Vision

Can I switch Medicare plans?

Yes, but only during certain windows of time, or during special circumstances.

During Open Enrollment, between Oct. 15 and Dec. 7 every year, you can switch between:

- Medicare Advantage and Medigap/Rx Drug plans (after the first year on Medicare, you may be subject to medical review, depending on your state)

- Two stand-alone Rx Drug plans

- Two Medicare Advantage plans

During the Disenrollment Period, from Jan 1 to Feb. 14, you can switch from Medicare Advantage to Medigap/Rx Drug

You also have the option to switch Medicare plans during a Special Enrollment Period. You enter a special enrollment period when:

- You move permanently outside your plan’s service area

- Your Medicare Advantage plan withdraws service from your area

- You lose coverage from COBRA, an employer, or union health plan

You can request to switch between two Medigap plans anytime. Depending on the state you live in, the insurer might deny your request based on your health. In 12 states, including Massachusetts, there are no such limitations.

Choosing Medicare coverage

Hopefully we’ve clarified the alphabet soup of Medicare coverages and options. Not quite ready to order a big bowl of it? Reach out to Sensible Financial.

Photo credit: bhofack2