Sensible Financial has been concerned about inflation for quite a while, owing especially to the large and growing US budget deficit. TIPS (Treasury Inflation Protected Securities) have been part of the client portfolios we manage for many years, but in 2022, we strengthened client portfolios’ defenses against inflation by implementing a “TIPS for Treasuries” strategy. This article looks at how that has worked thus far.

TIPS are US Treasury bonds that adjust principal and interest payments for actual inflation experienced during the term of the bond. Contrast them with standard (“nominal”) US Treasury bonds, where the interest rate and principal repayment amount is fixed. Investors owning nominal bonds (including those owning bond mutual funds) can be hurt in periods of high inflation, as the amount repaid at the bond’s maturity is less valuable in terms of purchasing power, as are the semi-annual Interest payments. TIPS provide protection against this effect. For a more complete description of TIPS, see these Sensible Financial webinars: TIPS (Treasury Inflation Protected Securities) and TIPS for Beginners.

The returns on US Treasury bonds and TIPS will be very close to each other if actual inflation matches the inflation that is expected when the bonds are purchased. In fact, the difference in interest rates between the two types of bonds is a good indicator of what the market believes inflation will be over any period (“break-even inflation”). TIPS returns will be better than nominal Treasury bonds if inflation is higher than expected, and not as good as nominal Treasury bonds if inflation is lower than expected.

Sensible’s TIPS strategy

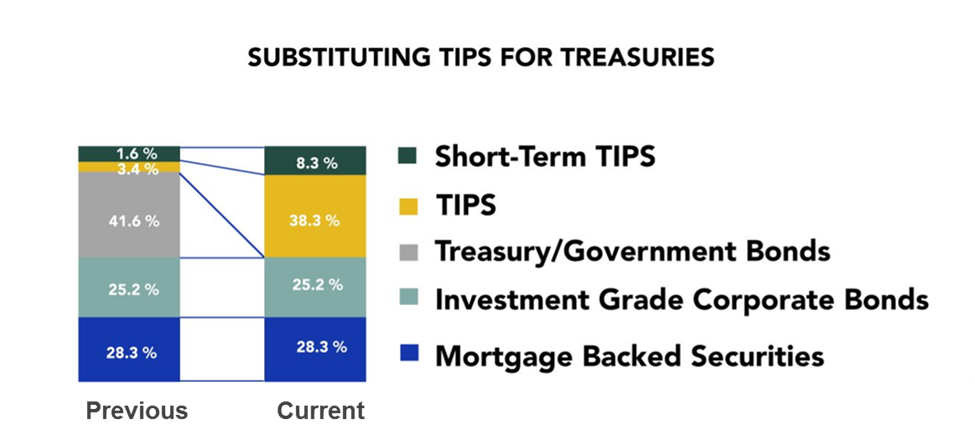

Sensible Financial’s TIPS for Treasuries strategy replaced the allocation to nominal US Treasury bonds with TIPS in client portfolios. To do that, we had to “deconstruct the Agg”. The “Agg”, or US Aggregate Bond Index, consists of three primary components: US Treasury bonds, mortgage-backed and other government-related agency securities, and investment-grade corporate bonds. The Agg is a core bond holding in many portfolios, as it represents nearly the entire US investment grade bond market. The three major components of the US bond market are packaged nicely in mutual funds offered by several large companies, but these companies do not offer a version of those funds that does what we wanted to do: replace nominal Treasury bonds with TIPS. So, we replaced the allocation to the US bond index fund with index funds representing each of the component parts, except that we used TIPS index funds rather than US Treasury index funds (as illustrated below). We began this conversion in Q2 of 2022 and implemented it in all client portfolios where possible over the following several weeks.

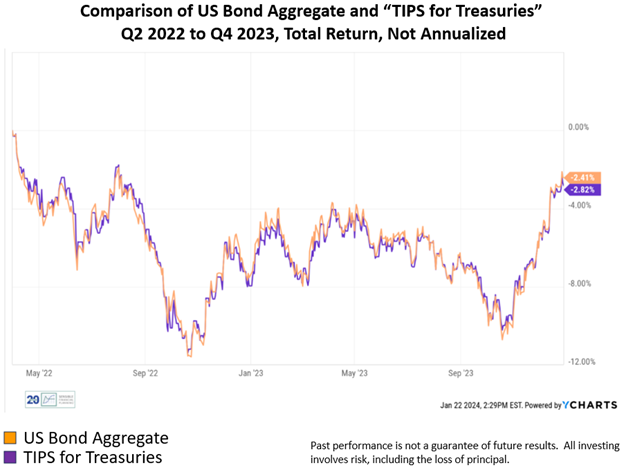

Now, 21 months or so after we implemented the strategy, it is appropriate to see how it has worked. To do so, we compared the returns over 7 quarters of the aggregate US bond index to the returns of what replaced it: TIPS + mortgage-backed securities + corporate bonds, in their proper proportions. What we found is that for the 21 months beginning Q2 2022 and ending Q4 2023, the TIPS for Treasuries strategy slightly underperformed the US bond aggregate, as shown in the following chart.

As you can see in the chart above, the returns for the two strategies were very close during this 21-month period (0.41%, which is the difference between –2.41% and –2.82%; this is 0.23% annualized) – indicating that on average over this period, inflation turned out to be very close to what the market expected. During shorter periods on the chart, one can see that one strategy, or the other, was a little behind or ahead. This indicates that inflation was different from market expectations for that period, or that inflation expectations changed (affecting real or nominal interest rates).

Did the returns reflect the changes?

Only looking at returns, however, misses part of the point in implementing this strategy. That is because TIPS provide insurance against unexpectedly high inflation. For this 21-month period, inflation was high, but not unexpectedly high relative to market expectations. As a result, the insurance part of the TIPS didn’t have a large payoff. But there is value in the insurance, nonetheless. If one’s house does not burn down, one doesn’t feel that the homeowners’ insurance didn’t have value – the conditions that would cause a payoff did not occur. But the protection was in place and there was value from it.

One can extend the analogy to homeowners’ insurance further. When one purchases that type of insurance, it’s not because the homeowner is betting that their house will burn down. They are buying protection in case it does. Similarly, we are using TIPS not because we are making a bet that inflation will be higher than what the market expects. Rather, we are buying protection for our clients in case it is.

Lastly, one could observe that returns were poor during this period for both strategies. That is true and resulted from the steep increase in interest rates that occurred. That change affected all bonds – both TIPS and nominal bonds – similarly. Rick Miller addressed that subject in these Sensible Financial articles: Why Are Bonds Down? and Bonds Are Down But It’s Not All Negative. 2022 was one of the worst years in history for bond returns. The poor returns on bonds in client portfolios had nothing to do with the TIPS strategy and everything to do with interest rates.

In summary, Sensible Financial started implementing our TIPS for Treasuries strategy in Q2 2022. During the 21 months that followed, returns to this strategy slightly lagged the strategy that it replaced. However, investors had the peace of mind of knowing that had inflation surged in a way that the market did not expect, they would have been protected. We plan to maintain the strategy going forward for the same reason.

If you have questions, please contact your advisor.

Photo by Vincent Yuan @USA on Unsplash