[Learn more…]

Mortgage

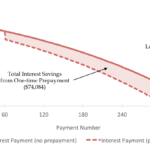

How Does Prepaying your Mortgage Actually Work?

[Learn more…]

Reverse Mortgages, Part 2: Increasing financial flexibility by leveraging the equity in your home

[Learn more…]

Reverse Mortgages: Increasing financial flexibility by leveraging the equity in your home

[Learn more…]