When you make an extra payment on your mortgage, that money goes directly toward reducing the balance on your loan. Because of how the loan is structured, the extra payment triggers a cascade effect that speeds up the repayment of the loan. In what follows, I discuss the mechanics of your mortgage and illustrate exactly how prepaying works. Armed with this information, in my next article, I will focus on how prepaying your loan can be thought of as a financial investment. Although I focus on home loans, the following analysis is readily applicable to all types of fixed-payment debt such as student and auto loans.

How does your mortgage work?

You pay your home loan on a fixed repayment schedule of regular installments over a specified period. This process is referred to as amortization. Assuming you don’t make any extra payments towards the loan, amortization of a fixed rate mortgage is rather straightforward. A 30-year fixed rate mortgage with a 4% interest rate means a $2,387 monthly payment on a $500,000 loan. This monthly payment is fixed, meaning it never changes over the duration of the loan. Although the total monthly payment is fixed, the interest portion of each payment and the part that goes towards the balance (or principal) will vary each month. The total payment is your principal and interest (or P&I) payment (most mortgages also include payments for taxes and insurance, which I’m excluding for the purposes of this discussion).

The interest portion of the monthly payment declines every month because it is calculated as a percentage of the outstanding loan balance, which declines every month. We can calculate each interest payment as:

Interest payment = Interest rate X Beginning of period loan balance

In our 30-year fixed rate mortgage example, interest payments are $1,667 on the first payment and only $8 on the last payment. The principal payment is simply the total monthly payment less the interest payment. Because the interest payment declines each month, the principal payment increases each month.

How does prepaying your mortgage work?

So far, so good. You pay a fixed amount each month on your mortgage, with an increasing share of that payment going toward principal every month. Now, suppose you make a one-time prepayment on your loan. Does that payment go directly toward paying down the principal or does it prepay your interest? Does your monthly loan payment or its duration (loan maturity) change?

When you make an extra payment on your loan you directly reduce your principal (and thus increase your equity) by exactly that amount. But wait; there’s more! Prepaying your mortgage triggers a cascade effect that speeds up the repayment of your loan. Think back to the interest payment formula above. Because your monthly interest payments are based on the outstanding balance on your loan, which is now lower due to the prepayment, every future interest payment will be lower as well. Lower interest payments mean higher principal payments. Not only does your extra monthly payment go toward the principal, so does the interest you save by making that extra payment. Ultimately, you pay off your loan faster and pay less in interest. However, your total monthly payment (or P&I) will never change.

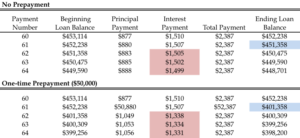

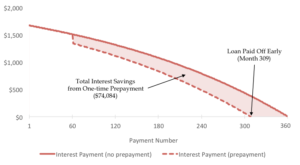

In the 30-year fixed rate mortgage example, a one-time $50,000 additional payment in month 61 will directly reduce the loan balance by $50,000 from $451,358 to $401,358 (see blue highlighted cells in the table). Because interest payments are based on the (now lower) outstanding loan balance, all future interest payments will be lower (see red highlighted cells in table). If no other extra payments were made over the course of the loan, this one-time prepayment would result in paying off the loan 51 months early (see figure). Because you end up paying off the loan sooner you will pay $74,084 less in total interest payments over the duration of the loan (see red shaded area in figure).

Table. Making an additional principal payment will immediately reduce the balance on your loan (see blue) and all future interest payments (see red).

Figure. Making an additional principal payment will ultimately reduce the duration of your loan and save you money on total interest payments (see red shaded area).

Conclusion

Ultimately, prepaying your home loan reduces three things: 1) the outstanding balance of the loan, 2) all future interest payments, and 3) the duration of the loan. In my next article, I will use these facts to tackle the question of how prepaying your loan can be thought of as a financial investment. Because of the way amortized loans work, there are general rules of how best to think about paying down debt in the context of your overall portfolio. However, because mortgage interest is tax deductible, things can get complicated! Stay tuned.

To speak with an advisor about planning for your financial future, contact us!