In this article we’ll discuss how to think about measuring risk capacity in terms of living standard risk. We’ll then show you how to create a backup budget and how this exercise can lead to a more nuanced risk capacity analysis.

We previously wrote about backup budgets here. To summarize, we typically measure risk capacity relative to a household’s current living standard. By using a backup budget (modified consumption budget) instead, we can be more precise when determining a household’s risk capacity. Using this approach, households with consumption flexibility may find that they can “afford” more risk. If your household has a flexible view of consumption spending, taking time to figure out your backup budget offers a more precise measure of risk than simply guessing.

How does living standard factor into risk capacity analysis?

Sensible Financial asks all clients to complete a consumption budget. This worksheet supports estimates of a household’s current consumption spending or living standard.

When we create a financial plan, we first fund “committed” spending, including housing costs, taxes, insurance, and special expenses like childcare and college. We then solve for a client’s sustainable living standard. That is the amount a family can afford to spend on consumption assuming an all bond or low-risk investment portfolio. If the current living standard is less than or equal to the sustainable living standard, the client is living within their means.

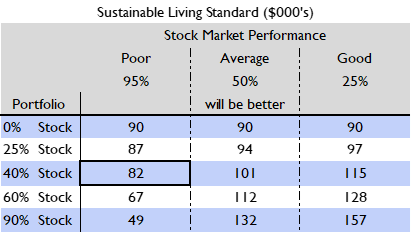

Unless a household invests solely in government bonds, its sustainable living standard will fluctuate with stock returns from year to year. Sensible can run simulations to show how a household’s living standard might fluctuate given different allocations between stocks and bonds. We categorize returns as “good” (the best 25% of market trajectories), “average” (the best 50%) or “poor” (95% of trajectories are better). We recommend clients focus on the “poor” markets projections to determine whether a given allocation to stock is affordable. If spending in poor markets would be less than its current living standard, a household might wish to choose a less risky portfolio. We can illustrate this with a simple example.

Assume the Gucci household fills out a budget and estimates they are spending $75,000 per year on consumption. After an analysis, Sensible Financial determines that their sustainable living standard is $90,000. The Guccis live large (by their own admission), but are still living within their means. Assuming they invest only in bonds, they can spend an additional $15,000 per year every year for their lives. But what if they invest their financial assets in some mix of stocks and bonds? We can show them a range of living standard outcomes by running their plan hundreds of times and changing only the performance of the stock market. Below we’ve illustrated the results of their financial plan with four different stock allocations: 25%, 40%, 60% and 90%.

Using their current living standard and poor markets to measure risk capacity, they can afford as much as 40% stock without risking a reduction to their current living standard. Spending $82,000 per year (bold outlined cell) exceeds their current spending of $75,000. By contrast, a 60% or 90% stock portfolio would require them to reduce spending if market returns were poor. In order to maintain their current spending, the Guccis should invest no more than 40% of their portfolio in stock.

But what if the Guccis decide that $75,000 is not the correct minimum living standard? After all, they are “living large.” If their investment returns were poor, they believe they could find acceptable ways to reduce spending. A backup budget allows for a more accurate measure of their risk capacity.

How do you calculate your own backup budget?

To create a backup budget, review all the categories of spending in your current budget, line by line, and determine which, if any, you could reduce and by what amount. Some categories will be less flexible than others. Perhaps spending on groceries and cell phone plans are relatively inflexible. Other expenses, such as gifts to family and club memberships, may be more flexible.

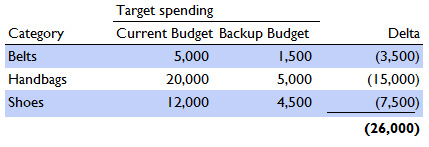

The Guccis review their consumption budget and identify the below categories as flexible. They then calculate how much they could reduce spending in each category based on their preferences.

The Guccis determine they could afford to spend $26,000 less on their current living standard. This leads to a backup budget of $49,000 ($75,000 minus $26,000). With their backup budget in hand, the Guccis can reassess their risk capacity.

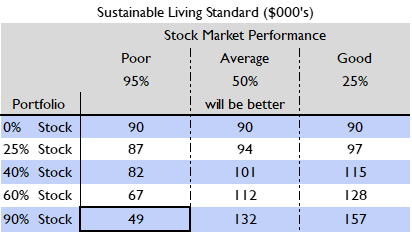

Measuring risk capacity with a backup budget

Returning to the simulation analysis with the Gucci’s new backup budget, they can now afford as much as a 90% stock portfolio. Even if markets were poor (highlighted cell), in 95% of simulated futures they could spend at least $49,000, which equals their backup budget level.

This analysis is a simplified version of the approach we take with clients. We use a complex market simulation entailing many assumptions. We discuss them in detail with clients when we help them determine their risk capacity. Sensible Financial does not recommend to clients how much risk they can afford. We provide supporting analysis to help clients make that decision. We hope this series of articles gives you a better sense of how we measure risk capacity and whether a backup budget might be a useful approach for you and your family. If you would like to discuss your backup budget, or any aspect of this article, please contact your advisor.

Read part 1 of Backup Budgets here.

Photo by Mick Haupt on Unsplash