A client’s sustainable living standard (their highest or optimal living standard) is an essential component of any sensible financial plan. Among other things, it serves as the basis for how we evaluate risk capacity, or how much stock market risk a household can accept without negatively affecting their living standard.

COVID-19 impacted the world in many ways. One repercussion of the pandemic is that living standards declined for most people due to the need for social distancing. Spending on vacations, going out to eat, and cultural activities stopped almost overnight. A silver lining to this (hopefully) once-in-a-lifetime event may be that it helps us come to a more nuanced understanding of risk capacity.

In this article we will introduce how a “Backup Budget” can lead to a more accurate way to measure risk capacity. You may find this article useful if you found your spending to be more flexible than you thought prior to the pandemic.

When it comes to spending there are three types of households. One, those who are spending more than what they can afford. These households’ current spending exceeds their sustainable living standard. Two, households whose spending is more or less equal to what they can afford. Three, households who spend less than what they could afford. This type of spending leads to surplus. What they do not spend they save.

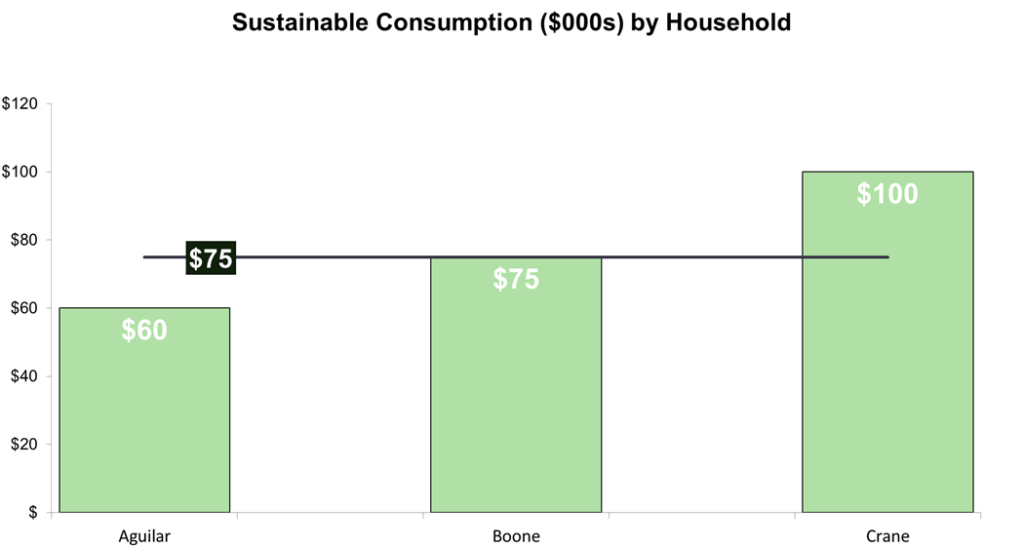

Three hypothetical households and their living standards

The chart below illustrates these three different types of households. The green columns show the sustainable living standards for the Aguilar, Boone and Crane households. The dark green line shows their current spending or $75k per year.

The Aguilar household can afford to spend $60k on their living standard, but they currently spend $75k. They are living beyond their means. Without changes to their financial plan, they will run out of money. By contrast the Boones are spending exactly what they can afford. Because they do not have any surplus, they should invest their assets in safe securities like bonds to make sure they do not experience a decrease in their living standard if stock markets perform poorly. Finally, the Cranes are spending only $75k when they could afford to spend $100k. The Cranes have financial surplus. The $25k per year they do not spend is their risk capacity. If they invest this surplus in risky assets and lose all their money, they experience no change in their living standard.

Traditionally, we have used our clients’ current spending as the basis for their risk capacity. We assume that people choose to maintain their current living standard over time and that they choose a mix of stocks and bonds that does not require a change in their spending even in poor stock markets. We propose that a Backup Budget may be a better indicator of risk capacity in certain situations.

A Backup Budget is the minimum amount you would be willing to spend on your living standard. You could calculate your Backup Budget in a few ways. First, you could go through your normal budget and strip out nonessential spending by category. Perhaps that club membership is something you would sacrifice for the ability to take more stock risk. Or perhaps dining out could be less frequent. Second, your spending in the pandemic might be a good proxy for a Backup Budget. Whether this approach to risk capacity makes sense to you may boil down to how flexible you are about your living standard.

Does a Backup Budget make sense for me?

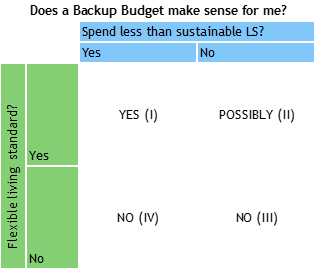

A Backup Budget may be a good idea depending on how you answer the following questions. One, are you flexible in terms of your living standard? Two, are you currently living within your means? The below chart summarizes four possible scenarios:

When households spend less than their sustainable living standard (quadrants I and IV) they have surplus or financial flexibility. Think back to the Cranes. A Backup Budget may make sense, but only if your living standard is flexible (I). A Backup Budget would allow you to take even more risk — more than just the surplus, but you might have to decrease spending if market returns are poor. If you live within your means and your living standard is not flexible (IV), there is no reason for a Backup Budget. Your current living standard determines your risk capacity. You can risk your surplus but nothing more.

What about households like the Aguilars who spend more than they can afford (II and III)? A Backup Budget is probably not a good idea. If you are in this situation, your risk capacity is low or even zero. Investing in stocks could lead to an even less viable plan if market returns are poor. However, if you are spending right at your sustainable living standard, like the Boones, and your spending is flexible, then a Backup Budget could let you take more risk (II).

Ultimately, lots of factors can impact a household’s risk capacity. Working longer, downsizing later in life, or accessing home equity with a reverse mortgage can all increase financial flexibility. A Backup Budget under certain circumstances is another factor that can inform risk capacity. If your spending is flexible and you like the idea of a Backup Budget, contact your advisor about incorporating this approach into your financial plan.

Frank Napolitano wrote this article jointly with Gyb Spilsbury.

“Stock market dice roll” by QuoteInspector.com is licensed under CC BY-ND 2.0