- Investment risk and its potentially negative consequences can be a scary proposition for retirees, who might find it difficult to recover from a significant market downturn.

- By restructuring your portfolio to include more predictable retirement income, you can greatly increase the probability that your retirement assets will sustain you through retirement.

- To increase income predictability, you have to be willing to give up some potential upside. However, this might be an acceptable trade-off in your retirement years.

- Predictable income can come from many sources. A retirement income plan can coordinate these sources to produce the income you need, when you need it.

In a prior article, I described Retirement as a scary proposition for some people. I mentioned the two main reasons, loosely characterized as Personal and Financial. I addressed only the personal aspects in that article and stressed that adequate planning and structuring of a personally fulfilling post-retirement life prior to fully retiring is essential to a successful transition. In this newsletter, I address the main financial concern of retirees – the fear of outliving one’s hard-earned savings — and what you might do to alleviate this concern.

Most Americans will receive some form of Social Security benefits during retirement. For many, Social Security will be the primary source (maybe even the only source) of retirement income because the average wage earner has not saved enough. For many people in this situation, retirement will likely not be that comfortable. They might be forced to alter their lifestyle significantly to make the monthly check last. People who have saved substantially more (including – hopefully – most readers of this newsletter), and who may have other income sources such as a pension or rental income, often share the same concern as their lower net worth fellow Americans, but they have more options available to them during retirement. One reason the transition to retirement is unnerving is that people approaching retirement are suddenly faced with a 180 degree change in orientation: they have spent most of their earning years accumulating assets through saving and investing and they must now start decumulating. Many soon-to-be-retirees have a lot of difficulty coming to terms with this change in orientation, not to mention that they may have no idea how to implement it. It’s as if they’ve forgotten the reason they were accumulating in the first place – to start drawing down savings once earnings have ceased. Some people think that once they retire, they will be able to live on investment earnings alone (as well as Social Security) and preserve principal for their children and other heirs. Unless you are very wealthy, this can be difficult to accomplish without dramatically reducing your living standard. And who wants to do that?!

If you have considerable savings and multiple income sources, what is the best way to generate sufficient income during retirement? The answer depends on several factors, including your intended retirement age, your health, and the amount, type and duration of your various income sources. For example, you might have an employer pension. You will likely have to take Required Minimum Distributions (RMDs) from retirement accounts at some point. Maybe you have rental property that generates steady monthly income. These income sources will likely have different start and end dates, and some will have options and limitations to consider. The challenge is to structure and sequence income distributions to most efficiently utilize your various income sources (including your retirement savings), while ensuring that you have enough income to cover your monthly spending needs throughout retirement.

Before you can develop a retirement income plan, it is important to answer one very important question: How much “guaranteed” monthly income do you want? Perhaps guaranteed is too strong a word here, since there are few real guarantees in life, other than death and taxes. If you prefer, you can substitute “predictable,” meaning reliable, steady, ongoing (maybe even for life), and very low-risk. Some types of income, such as employer pensions, are fairly predictable, as long as the pension provider remains financially solvent (most do, and even if they don’t, there are often Federal guarantees). Social Security benefits are also predictable, although they are likely to undergo some minor “adjustments” over time.

It is also possible to turn some of your retirement savings into predictable income. This requires removing these assets from the stock market (which is anything but predictable). By doing so, you will be foregoing potential growth in those assets. For many retirees, this is unnerving. They’ve spent most of their adult life investing in stocks and bonds (or stock and bond mutual funds) and feel they must rely on the market to provide some investment growth during retirement, at the very least to keep up with inflation. They may also be comfortable investing in the market, and to entertain another paradigm at this late stage might be unsettling. For others, especially those who have always been skittish about investing, the prospect of removing a sizable chunk of savings from the stock market during retirement is actually a relief. They’ve reluctantly “played the accumulation game” for a long time, with varying degrees of success. Now it’s time to ratchet the risk way back so that they don’t lose what they spent so many years accumulating. They don’t mind trading considerable upside potential for a healthy dose of predictability.

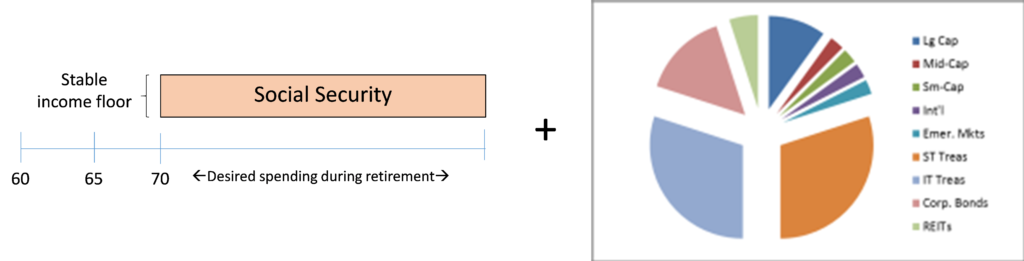

If you are in this first group – the traditional investors – you might prefer to simply decrease the amount of stocks (a.k.a. equities) in your investment portfolio and replace them with fixed income investments (bonds) of various kinds. This reduces the volatility (risk) of your portfolio and maintains your accumulation-oriented approach, even though you will start withdrawing money at some point to cover some of your living expenses. A combination of Social Security and monthly draws from your investment portfolio would suit you just fine.

The reason to reduce the amount of stock in your portfolio as you approach retirement is pretty well known: as you age, it is more difficult to recover from stock market losses because there are fewer years of employment earnings in which to replace the losses through saving. In the case of full retirement, there are no more such years. The recommended mix of stocks and bonds at a particular age is the subject of much academic research and literally tens of thousands of articles over many decades. Some experts argue that a new retiree should start with a moderately conservative mix of stocks and bonds and gradually become even more conservative over time (but never totally leave the stock market). Others advocate starting out retirement moderately conservative and then gradually taking on more stock exposure over time as the portfolio is drawn down. Then there are “bucket strategy” advocates, who try to accomplish both strategies simultaneously by assigning financial assets to different time-oriented “buckets”. The shorter-term buckets (money to be used in the next several years) are more conservatively allocated (less stock), and the longer-term buckets contain more stock (and more risk). The fundamental problem with all of these retirement investment strategies is that there is no guarantee that the market will continue doing what it has done in the past, and even if it does, there may be very long periods (perhaps as long as 20 years or more) in which it doesn’t behave in a manner that is consistent with the retiree’s retirement trajectory. If you are unfortunate in the path of investment returns you experience, you could find yourself financially “short” later in retirement. Nevertheless, many investors consider these risks and prefer to keep all of their money in stocks and bonds. It is, after all, what most people – including retirees – have done for years.

Figure 1: Orientation of traditional investors during retirement is to invest in risky assets (stocks and bonds) among a variety of asset classes. Only a small portion of their lifetime income is predictable. (Diagram is for illustrative purposes only. Asset class proportions were randomly selected.)

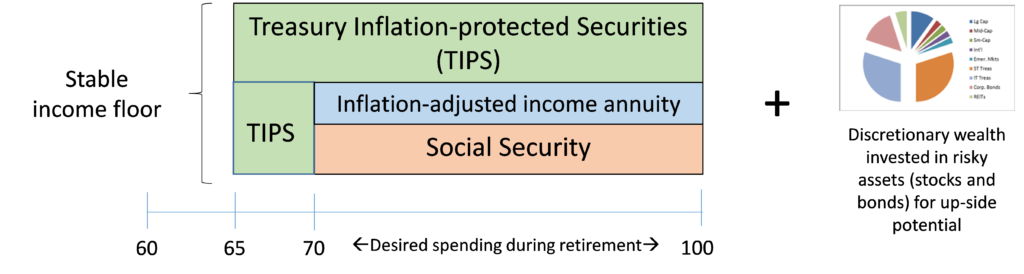

If you prefer to relinquish considerable upside potential of your retirement assets for more income predictability, you might consider an approach that combines traditional investing with “ Asset-Liability Matching.” With Asset-Liability Matching, you first identify the amount of spending you plan to do each year over the course of your life (these are your future liabilities). Then, you “match” that future spending with currently available retirement savings and various income streams, such as Social Security or a pension if you have one) that can be used to generate predictable income in those future years. You could also arrange it so that much of the income would be inflation-adjusted in order to preserve purchasing power. You would create an income “floor” through which you cannot fall, regardless of how the economy and stock market are doing. To ensure that the flooring will be available when needed, the portion of your retirement savings used for flooring would not be invested in “risky assets” (i.e., the stock market). Instead, you would use other financial instruments with predictable returns. Once you build the income floor, you can invest any remaining retirement assets – your “discretionary wealth”, if you will — in stocks and bonds for potential upside since you don’t need them to address your future spending needs. If these risky assets grow, you can use them to increase your living standard, or you can gift or bequeath them. You may not be happy if the assets decline in value, but you will still be comfortable. You designed your plan to not rely on them.

Predictable income has two or more of the following characteristics:

- Very low risk; not subject to market volatility (but by the same token, limited growth potential)

- Lasts a very long time; and in some cases, as long as you live

- At the very least, it keeps up with inflation.

So, what are some examples of income sources that we can use to build a predictable income floor?

- Social Security, in all its forms (retirement benefits, spousal benefits, survivor benefits, etc). Social Security possesses all of the above characteristics, and it continues for as long as you live. Think of Social Security as longevity insurance, or insurance against outliving your retirement assets if you live a very long time.

- Employer defined benefit pension plans (when taken as an annuity rather than as a lump sum) meet the first two criteria. With the possible exception of some government pensions, most employer pensions do not adjust with inflation, however.

- Immediate income annuity – an insurance product that can be purchased using retirement assets in return for an insurance company’s promise to pay a monthly stipend, starting immediately and for as long as you live. You can purchase an income annuity with inflation protection, whereby the monthly payment adjusts with changes in the inflation rate. Think of an income annuity as a “private pension”. This product should not be confused with a deferred or variable annuity. Immediate income annuities are also insured by state insurance consortia up to a certain amount.

- Longevity annuities (the subject of a prior newsletter article). Another type of income annuity that is bought today and guarantees income later in life, for as long as you live (although not inflation adjusted).

- Treasury Inflation-Protected Securities (TIPS) — individual bonds (not bond mutual funds) whose principal and interest payments are guaranteed (in today’s dollars) by the full faith and credit of the U.S. government. These bonds pay interest income twice a year, and pay the principal back at maturity. Unlike income annuities, TIPS do not generate income as long as you live, but they offer maturities (and interest income) as far out as 30 years in the future. As long as you don’t sell the bonds prior to maturity, you are guaranteed to receive the face value of the bonds in inflation-adjusted dollars at maturity, thus preserving purchasing power. TIPS are about as close as you can get to guaranteed inflation-adjusted income.

Figure 2: One example in which Asset-Liability Matching creates a stable and predictable income floor to address desired future spending. Discretionary assets (represented by pie chart) can be invested in the traditional way for potential upside. Risky asset portfolio would be smaller than for traditional retiree investment model shown in figure 1 above. (Diagram is illustrative and not drawn to scale.)

Figure 2 shows one example of flooring, using Social Security, an income annuity, and a TIPS “ladder”, or series of TIPS bonds that mature in different years. There are other ways to create an income floor. For example, if you have an employer pension or family trust income, you would add this income source to the flooring mix (visualize adding additional layers to the diagram). Also, the example assumes that all future spending would be covered by predictable income, which may not be the case. The amount of flooring appropriate for you depends in large part on how much excess spending capacity you have each year relative to what you intend to spend. If you have a large spending surplus each year, this suggests that you could probably take on more investment risk (for greater potential upside) and apply some of your risky assets toward your yearly spending requirements. If, on the other hand, your planned spending is closer to your spending capacity, you might appreciate a plan with more security from a larger floor and relatively less invested in the stock market.

Importantly, any discussion of investment “risk and return” addresses only the risky asset portfolio, not the assets used for flooring. Removing the flooring assets from the stock market suggests that they are no longer considered “investments”. Therefore, you should not consider them when you decide on an asset allocation target for your invested portfolio; nor should you include them in any calculation of stock market performance.

Low risk and predictable assets are not for everyone, but adding flooring to your retirement income plan can make the transition from accumulation to decumulation less scary.

On the other hand, as with any new idea, the notion of flooring can take some getting used to. You may never have heard of TIPS or inflation-adjusted income annuities before. Your advisor can help you explore the possibilities and implications. You have a long time to live in retirement – it’s worth thinking your plan all the way through.