Sustainable investing is still a relatively new phenomenon, but Sensible Financial offers sustainable investment options for their clients.

Raising Cash – A Deeper Look

Filling a one-time need for cash from your Sensible-managed portfolio takes a little time. While you may be able to withdraw cash immediately from your bank account, an investment account is different. Allow me to fully explain this step-by-step process. The process begins when you contact your advisor with your cash request. Perhaps there are [Learn more…]

Updating Preferred ETFs – An Analytical Approach

Every year, we review and update the preferred exchange-traded funds (ETFs) in Sensible Financial’s investment models. We focus on (1) minimizing tracking error, the difference in return between a fund and its benchmark index and (2) cost-efficiency – we want your investments to follow the model closely at the lowest possible cost. In our ETF [Learn more…]

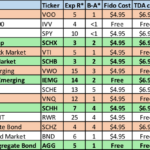

Sensible Financial’s Preferred ETFs

Every year, Sensible Financial reviews each mutual fund holding to ensure that you are invested in the best possible funds consistent with your target allocation and investment strategy. In defining “best”, we consider two primary criteria: (1) cost and (2) tracking error relative to our target indices. 1). There are three primary cost categories for [Learn more…]

How Sensible Financial Raises Cash for You

We strive to get cash to you when you need it. We understand that timely delivery of cash either for planned events or unexpected contingencies is important to you. Sensible Financial® has developed a process that balances your need to get cash quickly with your other interests, such as maintaining your target allocation, keeping trading [Learn more…]