This is Part 4, of 7-part series, read the other parts here: Part 1, Part 2, Part 3, Part 4, Part 5, Part 6, Part 7.

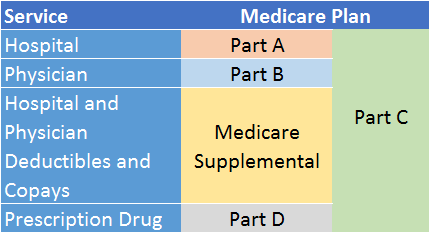

Medicare Supplemental Insurance, or Medigap for short, is optional insurance that you can buy separately from a private insurer to cover many out-of-pocket costs of traditional Medicare.

As I described in my previous Medicare articles, traditional Medicare (Parts A and B) typically covers 80% of Medicare-approved health care services. However, Medicare can be expensive due to premiums, deductibles, and the 20% co-pays. That is where Medigap insurance comes in. Bought as a supplement (not a replacement) to Medicare A and B, Medigap covers most of these residual out-of-pocket expenses. Some Medigap plans also cover a few services that Medicare does not cover at all, such as some wellness and preventive services. Even though Medigap isn’t free, you can save quite a bit in health care costs over your lifetime by purchasing this coverage.

To be eligible for a Medigap policy, you must already be enrolled in both Medicare Part A and Part B.

Different types of Medigap plans

Different types of Medigap plans

In all but three states (Massachusetts, Minnesota, and Wisconsin, discussed below), 10 different Medigap plans are available, each one with a standardized package of benefits. The plans cover varying amounts of Medicare A and B out-of-pocket expenses. The more Medicare expenses the Medigap plan covers, the more expensive the plan.

The 10 plans are (unimaginatively) labeled A, B, C, D, F, G, K, L, M, and N.1 Each lettered plan offers a different set of benefits standardized by Federal law. For any given plan, each Medigap provider must offer the same set of benefits as prescribed under law, although the price can differ among providers (more on that later).

Here is a summary of what each Medigap plan provides:2

| Medigap | Plans | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Benefits | A | B | C | D | F* | G | K | L | M | N |

| Medicare Part A coinsurance and hospital costs (up to an additional 365 days after Medicare benefits are used) | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% | 100% |

| Medicare Part B coinsurance or copayment | 100% | 100% | 100% | 100% | 100% | 100% | 50% | 75% | 100% | 100%*** |

| Blood (first 3 pints) | 100% | 100% | 100% | 100% | 100% | 100% | 50% | 75% | 100% | 100% |

| Part A hospice care coinsurance or copayment | 100% | 100% | 100% | 100% | 100% | 100% | 50% | 75% | 100% | 100% |

| Skilled nursing facility care coinsurance | 0% | 0% | 100% | 100% | 100% | 100% | 50% | 75% | 100% | 100% |

| Part A deductible | 0% | 100% | 100% | 100% | 100% | 100% | 50% | 75% | 50% | 100% |

| Part B deductible | 0% | 0% | 100% | 0% | 100% | 0% | 0% | 0% | 0% | 0% |

| Part B excess charges | 0% | 0% | 0% | 0% | 100% | 100% | 0% | 0% | 0% | 0% |

| Foreign travel emergency (up to plan limit) | 0% | 0% | 80% | 80% | 80% | 80% | 0% | 0% | 80% | 80% |

| Out-of-pocket limit (2017)** | $5120 | $2560 | ||||||||

| * Plan F is also offered as a high-deductible plan by some insurance companies in some states. If you choose this option, this means you must pay Medicare-covered costs (coinsurance, copayments, deductibles) up to the HD Plan F deductible amount before your policy pays anything. | ||||||||||

| ** For plans K and L, after you meet your out-of-pocket yearly limit and your yearly Part B deductible, the Medigap plan pays 100% of covered services for the rest of the calendar year. | ||||||||||

| *** Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don't result in an inpatient admission. | ||||||||||

| Medigap plans A, B, C, and D should not be confused with Medicare Parts A, B, C, and D. (The choice of naming convention was unfortunate.) | ||||||||||

Medigap providers in Massachusetts, Minnesota, and Wisconsin (called Waiver States) operate under laws that established standardized Medigap policies earlier than Federal law, so these programs were allowed to continue. Medigap plans sold in these states are not labeled with letters. In fact, they have comparably fewer plan choices (between two and four, depending on the state). The plans range from a leaner to a more robust set of benefits, and they do not map precisely to any of the above 10 standardized Medigap plans.

Services NOT covered by Medigap

Services that have not traditionally been covered by Medigap plans include:

- Long-term care

- Vision services (unless related to an underlying medical condition)

- Dental care (same as above)

- Eyeglasses

- Hearing aids

- Private duty nursing

In the past couple of years, however, Plan F (traditionally considered the most comprehensive of the 10 standardized plans) has given birth to a spin-off called a Medigap Innovative Plan. You won’t find this on the Medicare.gov web site, and not all states offer it. Innovative Plan F still includes all the benefits of regular Plan F, but it offers other benefits as well, such as some vision, dental, and hearing services. What is especially intriguing about this offering is that it doesn’t cost any more than regular Plan F. (Go figure!) However, I don’t expect to see long-term care or private duty nursing covered by these plans anytime soon. Innovative Medigap policies have been approved by almost two dozen states, although some state approvals were subsequently withdrawn. So, it is best to check availability with the insurance providers in your state.

Medigap policy providers

Unlike Medicare Parts A and B (and D), Medigap is not government-sponsored insurance; you buy it through private health insurance companies. Some are nationally recognized names, such as Blue Cross / Blue Shield, Transamerica, or United Health Care (sponsored by AARP). Others are offered by regional insurers, such as Harvard Pilgrim or Fallon Community Health Care (both of New England).3 You won’t have to look very hard to find an insurer. Just before you turn 65, you will likely receive marketing materials in the mail from most of the Medigap providers in your state. If you want to be proactive, you can go to www.medicare.gov and select “Supplements & Other Insurance” from the top menu, then select “Find a Medigap Policy.”

Medigap costs

There are no quality rankings for Medigap plans because the benefits provided by a given plan are the same regardless of the company you buy it from. However, the prices can vary from one provider to another. Each provider uses one of three pricing methods to determine the price you will pay:4

- Community-rated (also called no-age rated): you pay the same premium as everyone else in your geographical area who bought the same policy. The premium cannot increase each year based on your age.

- Issue-age-rated (also called entry-age-rated): Your premium is based on the age you’ve reached when you buy your policy, and it cannot increase each year based on your age.

- Attained-age-rated: Your premium is raised each birthday for as long as you keep the policy.

Community- and Issue-age-rated policies tend to cost more than Attained-age-rated policies at first. But as you get older, the latter becomes far more expensive than the other two. According to Consumer Reports, Medigap experts believe the community-rated policies are the least expensive over time.

Regardless of how the premiums are calculated, keep in mind that premiums can (and probably will) go up periodically because of inflation and other factors.

When obtaining quotes, always ask the insurance providers what method they use to calculate the premium. Also, ask them at what rate the premiums have increased over the past few years. Compare the answers across providers.

It is impossible to provide a specific premium amount for Medigap because it varies widely by plan, region, and provider. However, an unscientific sampling I did of Medigap plans in different parts of the country suggests a range of $45 per month at the low end to $250 per month at the high end (all plan types and various geographies combined) for a first-time enrollee at age 65. Therefore, it is reasonable to assume that you would likely pay $3,000 or less for a Medigap policy (in 2017).5

How to buy a Medigap policy

There are four steps to buying a Medigap policy:

- First, decide which benefits you want and need. You can use the above table as a starting point. If you desire more information about each benefit or are generally overwhelmed by the decision process, make an appointment to speak with someone at the State Health Insurance Assistance Program (SHIP) in your state. This is a state program that receives money from the Federal government to provide free local Medicare advice.6

- Go to Medicare.gov and find out which insurance companies sell Medigap policies in your state. (It is in the Supplements & Other Insurance menu.)

- Call the insurance providers and obtain quotes for the Medigap plan(s) you are interested in. Compare costs.

- Buy the Medigap plan of choice from the insurance provider of choice.

If you intend to purchase a Medigap policy (and I recommend that you do if you have Medicare Parts A and B), you might consider buying the plan with the most comprehensive set of benefits that you can afford at the time of purchase, because upgrading later might be more difficult and costly.

When is the best time to buy a Medigap policy?

As I mentioned, Medigap is optional insurance. However, if you intend to buy it, timing is critical. You want to buy it within six months of enrolling in Medicare Part B – for most people, this is either at age 65 or, if you are covered by your or your spouse’s employer plan, once you are no longer enrolled in that plan. Within that six-month window, Federal law guarantees eligibility if you are 65 and older and have Medicare Parts A and B. Coverage is guaranteed for life, as long as you pay the premiums. You cannot be denied coverage or incur a surcharge due to your health or pre-existing medical conditions. Nor can the insurer impose a waiting period before your policy starts. Beyond six months, however, you may be vulnerable to some or all of these restrictions, and you might be subjected to medical underwriting. If you enroll in COBRA after you leave an employer plan, do not wait for COBRA (usually an 18-month duration) to end before signing up for Medigap.

You can also buy a Medigap policy if you are under the age of 65 and have a qualifying disability (provided you are enrolled in Medicare A and B). However, you will not have the full Federal guarantees until you turn 65. So, you will probably pay a lot more for your coverage, and it might be restricted in some way, unless your state has established some protections. However, when you turn 65, the full Federal protections will apply, and you will be able to change to a better (and probably less expensive) Medigap plan at that time.

Switching plans or providers once you have a Medigap policy

If you are already enrolled in a Medigap plan, but your insurer goes out of business or your Medigap coverage ends through no fault of your own, you have 63 days (from the date of termination) to switch to another provider or plan and retain the full Federal guarantee of coverage.

If you want to change from one Medigap plan or provider to another for any other reason, things can get more complicated depending on the reason for the switch and how long you’ve held the current policy. You might have to wait up to six months before your new plan will cover certain pre-existing conditions. If you are moving out of state and want to change to a different plan, you will need to check with your current or new insurance provider to see if they will offer you a different plan. You might have to pay more for your new plan. You may also have to answer some medical questions if you are switching outside of the open enrollment period. (Moving out of state and continuing with the same plan and provider is no problem.)

Bottom line: When switching Medigap plans or providers, proceed with caution.

My next article will cover Medicare’s Prescription Drug Program (Medicare Part D). You think Medigap is complicated? Fasten your seat belts for Part D.

Footnotes:

1 You probably noticed that some letters are missing between A and N. Some people have other plans that are no longer being sold but are still being honored for current holders.

2 Center for Medicare and Medicaid Services, www.cms.gov

3 Sensible Financial does not endorse Medigap providers. Use your due diligence in selecting a provider, or seek the advice of a professional Medicare/Medigap consultant.

4 Medicare for Dummies, by Patricia Barry of AARP, John Wiley & Sons, p. 217.

6 You can find the SHIP program for your state at www.seniorsresourceguide.com/directories/National/SHIP/

Rick Fine is a Senior Financial Advisor and CERTIFIED FINANCIAL PLANNERTM at Sensible Financial. Got a question for Rick about Medigap? Ask in the comments section below. To speak with someone from our dedicated team about how we can help you plan for your financial future, click here!