This is Part 7, of 7-part series, read the other parts here: Part 1, Part 2, Part 3, Part 4, Part 5, Part 6, Part 7.

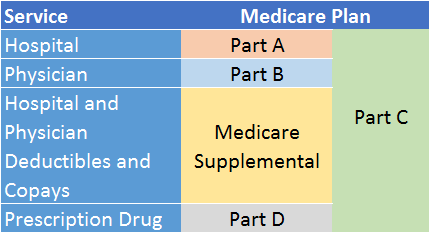

For those approaching 65 and just learning about Medicare, Medicare Part C (also known as Medicare Advantage, or MA for short) is perhaps the least understood part of Medicare. Medicare Advantage is a separate and distinct entity from the government-run Medicare A and B programs (also known as “original” or “traditional” Medicare). Marketed as an alternative to traditional Medicare, Medicare Advantage is administered by private insurance companies and is meant to be a “one-stop shop” for almost all aspects of Medicare coverage. You must still enroll in Medicare A (hospital coverage) and B (doctor and outpatient diagnostic coverage) to be eligible for Medicare Advantage. However, once you enroll, they will be administered by the Medicare Advantage plan instead of the government.

People who sign up for an MA plan do not need, and are not permitted to enroll in, a Medicare Supplement plan (Medigap). Moreover, at least 90% of Medicare Advantage plans now include prescription drug coverage. This means it is no longer necessary (or permitted) to enroll separately in a Medicare Part D (prescription drug) plan if your MA plan includes such coverage.

In fact, most Medicare Advantage plans administer everything that traditional Medicare covers except hospice care (palliative care for the terminally ill). Hospice care remains under the purview of traditional Medicare but is available to you even if you belong to a Medicare Advantage plan.

Beyond the basic requirement that MA plans cover at least the same basic health care services as Medicare A (hospital coverage) and B (physician coverage), MA plans operate mostly independently of government-run Medicare. They set their own premiums, co-pays, and deductibles, assemble their own doctor and hospital networks, and even offer services not covered by traditional Medicare.

Approximately one-third of all Medicare participants are enrolled in a Medicare Advantage plan.

The central difference between traditional Medicare and Medicare Advantage

The major difference between traditional Medicare and Medicare Advantage is that the former is a fee-for-service arrangement, whereas the latter is primarily managed care.

As a fee-for-service plan, traditional Medicare allows you to visit any doctor in the United States that participates in the Medicare program and is accepting new Medicare patients. There is usually no formal coordination of care among your various providers. In contrast, MA plans offer HMO (Health Maintenance Organization) and PPO (Preferred Provider Organization) arrangements, both considered managed care programs, similar to what you may be enrolled in prior to age 65.

The goal of managed health care is to improve coordination of health care delivery among patients’ various physicians, and to do it more efficiently and at a lower cost. If realized, these cost savings may lead to higher profitability for the plan administrator and lower premiums, deductibles, and co-pays for subscribers.

With an HMO plan, you are given a prearranged, limited set of doctors and hospitals in your local area from which to choose, and you are not allowed to go out-of-network unless you pay the entire cost of care. Moreover, you must first consult with your primary care physician if you need to see a specialist.

A PPO plan also has a prearranged network but allows you to choose health care providers out-of-network, albeit for a higher premium, deductible, and co-pay. With a PPO plan, you don’t need your primary care physician’s approval to see a specialist, but the plan administrator may still require the specialist to obtain prior authorization before the plan will cover a procedure or medication.

Approximately two-thirds of all Medicare Advantage enrollees belong to an HMO plan. The remaining third belong to a PPO plan or another less common type of arrangement not covered by this article.1

Things to think about when considering enrolling in a Medicare Advantage plan

Costs

The total out-of-pocket cost of health care under MA plans is often (but not always) less than with traditional Medicare, especially under an HMO arrangement. The companies that administer MA plans are subsidized by the Federal government to the tune of approximately $10,000 for each senior who signs up. The Medicare program also rates Medicare Advantage plans and grants yearly bonuses and other special perks to the highest rated plans. These government subsidies help keep the out-of-pocket costs down for subscribers. However, these subsidies are gradually being reduced, as set forth by the Affordable Health Care act of 2010 (Obamacare). This may cause the plans to cut back on benefits and/or raise fees over time.

Also, some Medicare Advantage plans have been known to charge higher co-payments for critical care services such as hospitalization and chemotherapy. In fact, some plans that boast low or no premiums charge higher deductibles and co-pays, which can result in higher total out-of-pocket costs for those who need a lot of expensive care. Although a maximum annual limit on enrollees’ out-of-pocket expenses is set by law, it is important to compare total costs among MA plans, as well as against traditional Medicare, when considering enrolling in an MA plan.

Ease of Purchase

MA plans are usually simpler to buy than traditional Medicare, although you still need to enroll in Parts A and B, and you will most likely pay for B premiums by having them automatically deducted from your Social Security benefit. However, with most Medicare Advantage plans, you pay one set of deductibles and co-pays and don’t have to sign up for a Medigap policy or a separate prescription drug plan.

Additional Services

Many MA plans cover healthcare services not typically found with traditional Medicare, such as certain routine vision, hearing, and dental services; chiropractic and acupuncture; and even gym membership discounts. Just be aware that some MA plans charge extra for these services.

Provider Choice

When considering an MA plan over traditional Medicare, keep in mind that your choice of doctors may be somewhat limited, especially with an HMO plan. Before enrolling, it is important that you check with the plan(s) under consideration to see if your preferred physicians (if you have any) are in the plan’s HMO or PPO network. Better yet, just ask your doctors. Also with an HMO plan, you will not be able to consult a specialist without first being referred by your primary care physician. Some people may find this type of arrangement constraining. That said, if the MA plan truly lives up to its central goal of providing more coordinated care, you may perceive a limited but well-coordinated physician network as an advantage rather than a disadvantage.

Provider Stability

The risk of having your favorite doctors leave or be dropped by an MA plan, or having the plan itself stop serving your geographic area, is greater than with traditional Medicare because the contracts between these plans and participating physicians are on a year-by-year basis. The plan must give you 60 days’ notice when your doctor leaves the network for any reason. Again, you may want to ask your doctors how long they’ve been with certain MA plans and if they’ve experienced any significant issues that might cause them to leave in the foreseeable future.

Geographic Coverage

If you plan to travel extensively or live out-of-state part of the year during retirement, you should think twice before signing up for an MA plan. HMO plans won’t reimburse you for health care costs outside of your immediate area (except in an emergency), and PPO plans might be too expensive if you are a frequent traveler who is likely to rely heavily on out-of-network services.

Also, MA plans are not as prevalent in rural areas. They tend to be concentrated in more populated urban and suburban centers. So, this might rule out an MA plan simply because of the region of the country you live in.

Quality

The Medicare program rates Medicare Advantage plans on a five-star basis considering 55 different criteria. A higher-rated plan is more likely to provide better quality service, be more affordable, and provide greater stability of coverage.

Finding a Medicare Advantage plan that best meets your needs

To find a Medicare Advantage plan that is right for you, you can find one on your own or work with a Medicare consultant.2 Either method will rely on Medicare’s Plan Finder, a web-based application that identifies Medicare Advantage plans that meet your specific criteria (go to https://www.medicare.gov/find-a-plan/questions/home.aspx). Once you provide the necessary data, the program generates a list of MA plans that it considers suitable given your geographic location and stated priorities and preferences.

Even though most MA plans now include prescription drug coverage, each MA plan has its own drug formulary (a list of drugs the plan covers, and at what cost to the subscriber), so not every plan will be suitable for you even if the non-drug portion of the plan looks great. To find a health plan that meets your needs in terms of both costs and coverage (including prescription drug coverage), I recommend first focusing Plan Finder on finding the MA plans that offer the best non-drug coverage (select an option that allows you to skip over the prescription drug section of the program). Once Plan Finder presents you with a list of suitable health plans, start over with the program and focus on finding a prescription drug plan that covers the drugs you take (see my article on how to find a prescription drug plan). Then, look for an overlap in Plan Finder’s recommendations for MA plans that offer health and drug coverage that meet your criteria. These are most likely the MA plans you want to consider. If you try to combine your search into one session, you may find a great MA plan that doesn’t cover the prescriptions you take (or does so at a high cost), or a poorly rated plan that does.

If you think this process seems a bit arduous, you’re right, which is why many people choose to work with a Medicare consultant. However you decide to go about your search, once you have found an MA plan that meets your criteria for both health and drug coverage, contact your doctors to see if they belong to the plan, and ask them about their experience working with the plan.

You can enroll in a MA plan directly through Plan Finder, by calling Medicare’s help line at (800) 633-4227, or by signing up on the MA plan’s web site.

Medicare Advantage or Traditional Medicare: how to choose

Medicare Advantage plans offer seniors a one-stop shop arrangement for well-coordinated medical care. They combine many elements of traditional Medicare into one easy-to-buy package, often at a lower cost than traditional Medicare. However, they also come with some restrictions and limitations.

Whether you should choose Medicare Advantage or traditional Medicare really comes down to what is most important to you. If you are relatively healthy and saving money on your health care is paramount, and you don’t plan to travel extensively in retirement, then an MA plan might be worth considering. If, on the other hand, you have ample financial resources for health care, do not want to be limited to the doctors and specialists you see, or you plan to live a snow bird lifestyle in retirement, then traditional Medicare will likely be a better choice.

Regardless of the path you take, make sure that the plan you choose provides adequate coverage for both doctor / diagnostic services and the prescription drugs you take. Re-evaluate your health / drug plan each year to make sure it still meets your needs and is affordable. If not, you have the right to switch to another MA plan or between MA and traditional Medicare at certain times of the year.3

Footnotes

1 Medicare Advantage offers several other types of payment arrangements: Medicare Private Fee-for-Service (PFFS) and Medicare Medical Savings Accounts (MSA), once on the rise, are now available in relatively few geographic areas of the country due to changes brought about by the Affordable Care Act. Medicare Special Needs Plans (SNPs) serve people who live in institutions, such as nursing homes and have at least one chronic disabling condition. They are similar in structure to HMOs and PPOs.

2 You can find no-fee Medicare consultants available in your state at www.seniorsresourceguide.com/directories/National/SHIP/

3 Medicare open enrollment is October 15th through December 7th. But there is also a disenrollment period (January 1st and February 14th) during which you can switch from Medicare Advantage to traditional Medicare. There are also circumstances in which you may be able to switch plans at other times of the year, depending on how long you’ve been with your current plan, whether you are moving out of your plan’s coverage area, and other factors.

Rick Fine is a Principal and CERTIFIED FINANCIAL PLANNERTM at Sensible Financial. Have a question for Rick about Medicare Part C? Ask in the comments section below. To speak with someone from our dedicated team about how we can help you plan for your financial future, click here!