In my previous articles, I explained the role divorce plays in Social Security benefits here and then specifically how divorced spousal and survivor benefits, two types of auxiliary benefits, are affected here. In this article, I will show how when a person files for benefits impacts their potential lifetime Social Security benefits.

Social Security may be your largest asset

For many people, Social Security is their largest financial asset. When we calculate the present value of a client’s Social Security benefit, that number is often around $1 million. But a person’s lifetime Social Security benefit could be much lower depending on several factors. One of the most important factors influencing a person’s lifetime Social Security benefit is timing, i.e., when someone chooses to file for benefits.

People eligible for Social Security retirement benefits can file for benefits as early as 62 and as late as 70. If a person files prior to full retirement age their benefit will be lower – as much as 30% lower if that person files at 62. If that same person delays filing until after full retirement age, their benefit will increase 8% every year, up to 24%, if they wait until age 70. (Full retirement age is 67 for everyone born after 1959). Social Security describes the benefit impact of early versus late retirement in detail on their website.

Timing makes all the difference

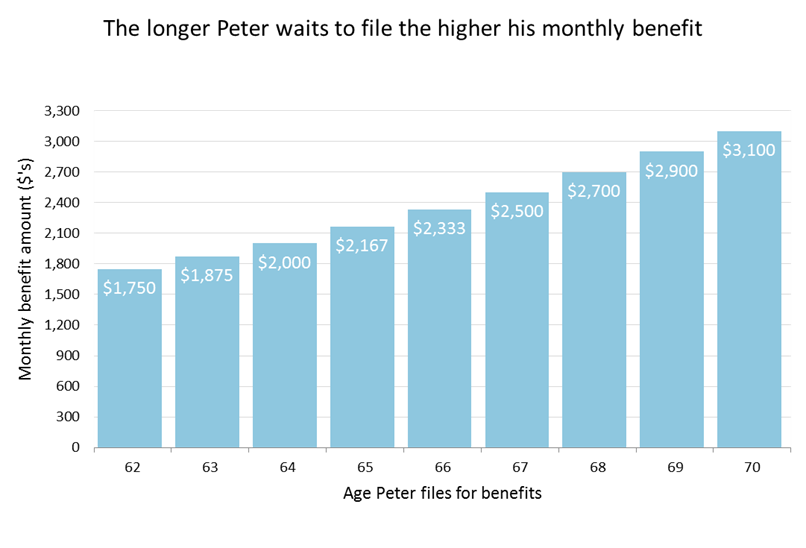

To illustrate the impact of filing age on a worker’s monthly benefit, I’ll return to my earlier example of Peter. Peter’s full retirement age is 67 and his primary insurance amount, the monthly retirement benefit he would receive if he filed at his full retirement age, is $2,500. The chart below shows Peter’s monthly Social Security benefit based on the age at which he files:

The difference in Peter filing at 62 versus 70 is a lot – an additional $1,350 per month or an increase of 77%. If Peter lives a long time, his lifetime benefit will be much higher if he waits to file until age 70.

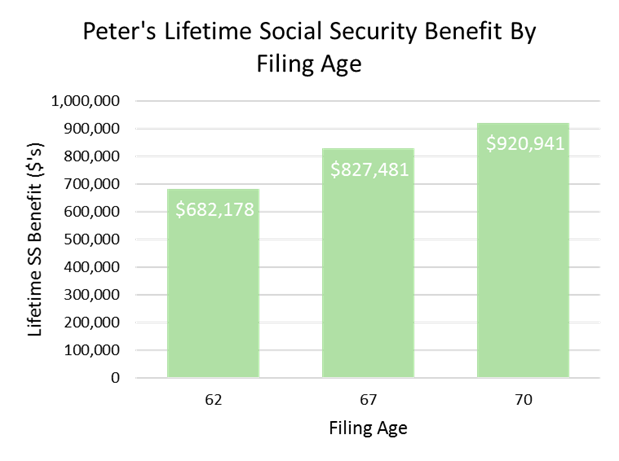

Peter’s potential lifetime benefit equals the present value of his Social Security benefits from now until the end of his life. To calculate present value, I use the monthly benefit amounts from above plus the following assumptions: one, Peter lives to age 100 and, two, the discount rate (the rate I use to convert future cashflows to today’s value) is 1% after-inflation. If Peter files at either 62, 67 or 70, his lifetime benefits are as follows:

The above graph illustrates that timing is important! If Peter lives at least an average life expectancy he will be better off delaying Social Security. If he lives to age 100, his lifetime Social Security is almost a quarter million dollars higher than if he filed at age 62.

Timing is extremely important when it comes to filing for Social Security retirement benefits. Timing is also important for divorced spouses who are eligible for spousal and survivor benefits, which I cover in my next article, here.