In my previous article I wrote about how divorce impacts Social Security retirement benefits. The main takeaway is that divorce has no impact on a person’s own retirement benefit. By contrast, divorce can impact auxiliary Social Security benefits, or benefits that a taxpayer’s family members may receive.

Married spouses are entitled to these benefits with few restrictions. However, divorced spouses must meet strict requirements to receive benefits on an ex-spouse’s record. In this article I’ll explain those requirements and show how auxiliary benefits are calculated.

Two types of benefits in particular impact divorced spouses – spousal benefits and survivor benefits. Ex-spouses may be entitled to receive either benefit subject to certain requirements, including the length of the marriage and whether the ex-spouse remarries. The rules are complex and are not made any easier due to key differences between spousal and survivor benefits.

I will use a hypothetical divorced couple to make clear who is who. Although I’ll be talking about Peter and Lois, a “traditional” American couple, the rules are the same for same sex married couples as well as for dual earning households.

Spousal Benefits

Spouses can receive spousal benefits, a type of auxiliary benefit, based on their partner’s earnings. A spousal benefit can be as much as one half of a spouse’s primary insurance amount (“PIA”). The PIA is the retirement benefit a worker would receive if they filed for Social Security retirement benefits at full retirement age – which ranges from 66-67 depending on a person’s birth year. For more on the PIA and how it is calculated see our article, which originally appeared in Forbes.

Divorced spouses may also be eligible to receive a spousal benefit, if they meet certain requirements. Specifically, a divorced spouse is entitled to a benefit on their ex-spouse’s Social Security record if

· They are at least 62 years old

· Their ex-spouse is either at least 62 or “disabled” according to Social Security

· The marriage lasted at least 10 years

· They are not married

· Their own PIA, if any, does not exceed one-half of their ex-spouse’s PIA (I’ve modified the language somewhat from Social Security’s website, here, for readability).

To better understand these rules and how much spousal benefit a former spouse may be entitled to, we’ll turn to our hypothetical couple.

Peter and Lois recently divorced after more than ten years of marriage. Peter is nearing retirement and has worked enough to have a PIA of $2,500. This is the monthly amount Peter will receive if he files for Social Security retirement benefits at 67, his full retirement age. Lois never worked in Social Security covered employment, instead staying home to raise their children. Lois would like to find out what Social Security benefit she might be entitled to as Peter’s ex-spouse.

The first two requirements concern timing. The earliest a taxpayer can claim Social Security retirement benefits is generally age 62; the same is true for spousal benefits. However, the rules for spousal benefits further require that the ex-spouse must also have reached 62 (or be “disabled”). This requirement can create issues, especially if there is an age gap between the ex-spouses. Lois is 60, two years younger than Peter, and therefore eligible to file for spousal benefits in two years. (Although she will be eligible to file for benefits in two years, her benefit will be highest if she waits to age of 67 to file – an issue I will cover in my next article).

The next two requirements deal with marriage. First, to claim spousal benefits, the marriage must have lasted 10 years, beginning with the date of the marriage and ending with the finalization of the divorce. In most states this is when the final divorce decree is issued. Second, one cannot currently be married to receive divorced spousal benefits. Since Peter and Lois were married at least 10 years and Lois is not currently married, and does not plan to be when she ultimately files, she satisfies these two requirements.

What if Lois or Peter remarries?

If Lois remarries, she would not be entitled to a spousal benefit. Whether or not Peter remarries has no effect on Lois’s benefit. Depending on her circumstances, it may be in Lois’s best interest not to remarry to maintain her spousal benefit. Interestingly, if Lois remarries and becomes single later, either due to death or another divorce, she could become eligible again for spousal benefits.

The PIA requirement sounds more complicated than it is. Recall that with married couples, a spouse is entitled to a benefit up to one-half of their spouse’s PIA. For divorced spouses, this requirement ensures that a person never receives more than one-half of their ex-spouse’s PIA when combined with their own retirement benefit, if they have one. The rule creates a ceiling that the total benefit, the sum of one’s own retirement benefit plus any eligible divorced spousal benefit, never exceeds one-half of the ex-spouse’s PIA. We can calculate a person’s spousal benefit using the following formula:

unreduced spousal benefit = (ex-spouse’s PIA ÷ 2) – taxpayer’s own PIA

NOTE – I say “unreduced” because spousal benefits are reduced if taken prior to full retirement age. To simplify the math below, I will assume that Lois always files for benefits at 67.

To calculate how much Lois would be entitled to receive in spousal benefits when she reaches her full retirement age, we divide Peter’s PIA by two. Since Lois did not work outside of the house and has no Social Security covered earnings on her own record, she would be entitled to $1,250 (or Peter’s $2,500/2) when she turns 67.

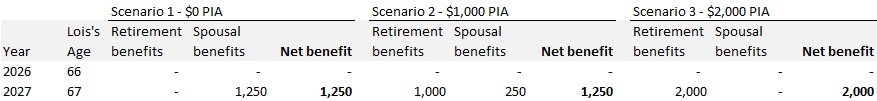

What if Lois had worked and earned a PIA on her own record? The formula above shows that she would receive a lower spousal benefit. This is true (!). Is the Social Security Administration punishing Lois for working? Not really. To see why, let’s change the numbers somewhat. Assume Lois did work in Social Security covered employment and earned enough for either a PIA of $1,000 or $2,000. What would her Social Security benefits look like instead?

If Lois’s PIA is $1,000, her unreduced monthly spousal benefit is $250 (or $2,500/2 – $1,000). On the face of it, she seems to be in a worse position than had she not worked at all (!). But spousal benefits add on to retirement benefits. While Lois collects less in spousal benefits compared to the nonworking scenario, when you add in her retirement benefit, which is $1,000 per month, her net monthly benefit is $1,250.

What if instead we assume Lois’s PIA is $2,000? The math here is very simple. According to the last requirement for divorced spousal benefits, since Lois’s $2,000 PIA exceeds one-half of Peter’s PIA, or $1,250 ($2,500/2), she does not qualify for spousal benefits. However, Lois is better off overall because her retirement benefit on her own record is $2,000 per month. The table below shows Lois’s various monthly Social Security benefits under all three scenarios:

I’ve spent a lot of time on Lois because Peter’s situation is very straightforward. No matter when Lois files or what amount she receives, her auxiliary benefit has no impact on Peter’s Social Security benefits. In fact, even if Peter remarries, Lois’s benefit will never impact Peter or his future spouse. Auxiliary benefits never reduce the benefits of either an ex-spouse or an ex-spouse’s dependents or family.

General conclusions about divorced spousal benefits

- They can make a huge difference to a divorced spouse’s retirement income, particularly if there are large discrepancies in earnings between ex-spouses

- As add on benefits they neither reduce nor replace one’s own Social Security retirement benefits

- As auxiliary benefits they have no impact on an ex-spouse’s benefit(s)

In additional to spousal benefits, ex-spouses may also be eligible for survivor benefits.

Survivor Benefits

Eligible family members can receive survivor benefits when a covered worker dies. Family members include not only a worker’s spouse and young children but also in some situations an ex-spouse.

When a covered worker dies, a surviving spouse and/or ex-spouse can receive up to 100% of the deceased worker’s benefit if the survivor has reached full retirement age. Note that unlike spousal benefits, which are based on a worker’s PIA, survivor benefits are based on the ex-spouse’s actual benefit. Survivor benefits are reduced if taken prior to full retirement age (the reduction is complicated but you can find more information on Social Security’s website or in my next article). If a surviving spouse or eligible ex-spouse is already receiving Social Security benefits when the covered worker dies, they will receive the higher of their current benefit(s) or survivor benefit.

Requirements for divorced spouses to be eligible for survivor benefits

- They are at least 60 years old (or at least 50 and “disabled”)

- The marriage lasted at least 10 years

- They are not currently married, unless they remarried after age 60 (50 if disabled)

- They are not entitled to a retirement benefit that is equal to or greater than the deceased worker’s PIA

(I’ve modified the language somewhat from Social Security’s website, here, for readability).

The requirements are similar to but differ importantly from those for divorced spousal benefits. For example, there is an age requirement to receive benefits, but for survivor benefits it is 60 versus 62 for retirement and spousal benefits. There is the same requirement that the marriage lasted ten years; however, a surviving divorced spouse can be currently married, so long as the subsequent marriage happened after the survivor turned 60 (or 50 if disabled). The final requirement is that the survivor cannot be entitled to a Social Security benefit that is greater than or equal to their ex-spouse’s entire PIA. This means that upon the death of an ex-spouse one would receive the higher of their own Social Security benefit(s) or a survivors benefit.

Survivor benefits present serious planning issues for ex-spouses. Unlike spousal benefits, where the ex-spouse has a degree of control over the timing and amount of the benefit, the two greatest factors that determine an ex-spouse’s potential survivor benefit are out of their control. Those factors are, one, when their ex-spouse files for retirement benefits and, two, when that person dies. We can illustrate the impact of these factors with an example.

Recall from above that if Lois never works outside the house, she will receive a spousal benefit of $1,250 per month when she turns 67. Peter’s PIA is $2,500, but the retirement benefit he receives will depend on the age at which he files, as illustrated below:

| Peter’s Filing Age | Peter’s monthly benefit |

| 62 | $1,750 |

| 67 | $2,500 |

| 70 | $3,100 |

If Peter dies at 71, Lois will be entitled to the higher of her survivors benefit, i.e. Peter’s retirement benefit, or her spousal benefit. Since her survivors benefit is always larger, Lois’s benefit will increase from $1,250 to either $1,750, $2,500 or $3,100. In every case, Lois is better off, but the variation is huge. Lois’s Social Security could increase by as little as 40% to as much as 148%! Adding to the uncertainty is the fact that Peter could live a long time. If Peter lives longer than Lois, she would never experience a benefits increase.

General conclusions about divorced survivors benefits

Once again we can draw a few general conclusions about divorced survivors benefits:

- The requirements are somewhat less strict than spousal benefits

- The potential benefit is larger than spousal benefits

- The actual benefit is affected primarily by factors out of one’s control, including when an ex-spouse files for retirement benefits and how long an ex-spouse lives

In my third and fourth articles on Social Security benefits for divorced individuals I will cover how when a person chooses to file for benefits can impact a person’s potential lifetime benefits.