For some Americans, Social Security may be their largest asset. Subject to certain rules, a divorced person is entitled to Social Security benefits on their ex-spouse’s record (more information in my previous articles here and here). These can be significant.

In this article I will talk about how timing affects Social Security benefits for eligible divorced persons. I will explain the rules that impact spousal and survivor benefits and I will conclude with some recommendations that divorcing and divorced persons can incorporate into their financial plans that may improve outcomes.

How Timing Impacts Spousal Benefits

A divorced individual may be eligible to receive auxiliary benefits on their ex-spouse’s record. These benefits include spousal benefits and survivor benefits. The size of these benefits depends in part on the age when an eligible divorced spouse files.

A divorced individual will receive their largest spousal benefit if they file at full retirement age. Unlike retirement benefits, spousal benefits do not increase when people file past full retirement age, but they decrease if people file beforehand. Social Security reduces spousal benefits by 25/36 of one percent for each month prior to full retirement age up to 36 months and an additional 5/12 of one percent if the number of months exceeds 36. (More information is available on Social Security’s website). This means if an eligible divorced spouse files at age 62, generally the earliest one can file for spousal benefits, their benefit would be 25% lower. To illustrate what this could mean in terms of someone’s lifetime benefit, I’ll return to the example of Lois from my previous article.

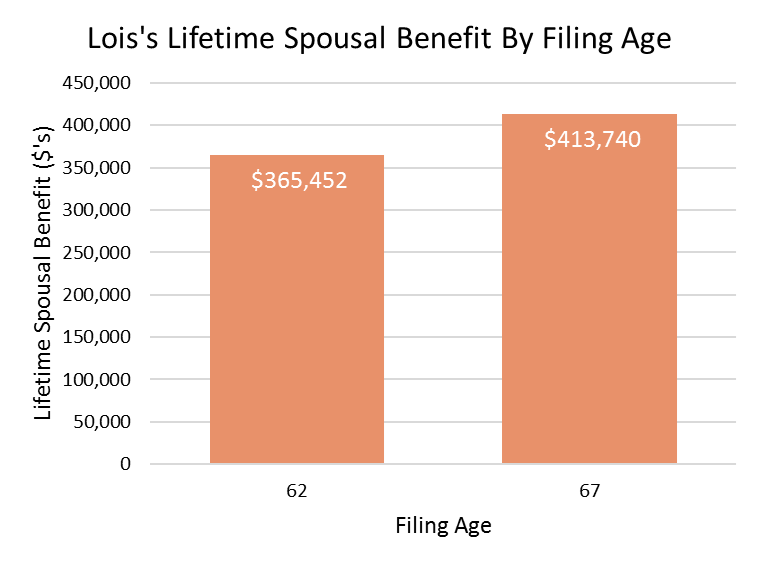

Lois’s unreduced (or maximum) spousal benefit equals one-half of Peter’s primary insurance amount. In this example, Lois will receive $1,250 (or $2,500/2) if she files at her full retirement age. If Lois files as early as possible at age 62 her benefits will be permanently reduced by 25% to $937.50. If Lois can afford to wait, she should do so, as the difference in lifetime benefits if Lois lives to age 100 is significant. (As in my previous article I am using a 1% real discount rate to calculate lifetime benefits).

If Lois can afford to wait until age 67, she increases her lifetime benefits by $50k or about 13%. This could make a big difference to Lois in retirement. While not everyone can afford to delay Social Security, for those who can waiting until full retirement age can have a significant impact on their living standard.

How Timing Impacts Survivor Benefits

In my previous article, I showed how survivor benefits are always larger than spousal benefits. That is because spousal benefits are capped at 50% of an ex-spouse’s primary insurance amount whereas survivor benefits are 100% of an ex-spouse’s actual retirement benefit.

Survivor benefits, like spousal benefits, may be reduced due to early filing. In fact, timing can affect a person’s potential lifetime survivor benefit in two important ways.

First, because an eligible survivor receives the deceased ex-spouse’s actual benefit, when a deceased ex-spouse filed for retirement benefits has a large impact. I’ll return to the example of Peter and Lois to illustrate. If Peter’s primary insurance amount is $2,500 per month, then his retirement benefit can range from a low of $1,750 (file at 62) to a high of $3,100 (file at 70). If Peter predeceases Lois, she steps into Peter’s shoes and assumes whatever amount he was receiving. Of course, Lois may have no control over when Peter claims his benefit, but if they in communication it is in Lois’s best interest to encourage Peter to delay filing for retirement benefits. Ex-spouses who are not on speaking terms are at a clear disadvantage.

The second timing element to be aware of is that while a qualifying ex-spouse can receive survivor benefits as early as 60, Social Security will permanently reduce them for anyone who files prior to full retirement age. The monthly reduction differs depending on a person’s year of birth, but for someone born after 1961 benefits would be reduced by 30% by filing at 60 instead of 67. The specifics of the reduction are complicated but Social Security explains them here.

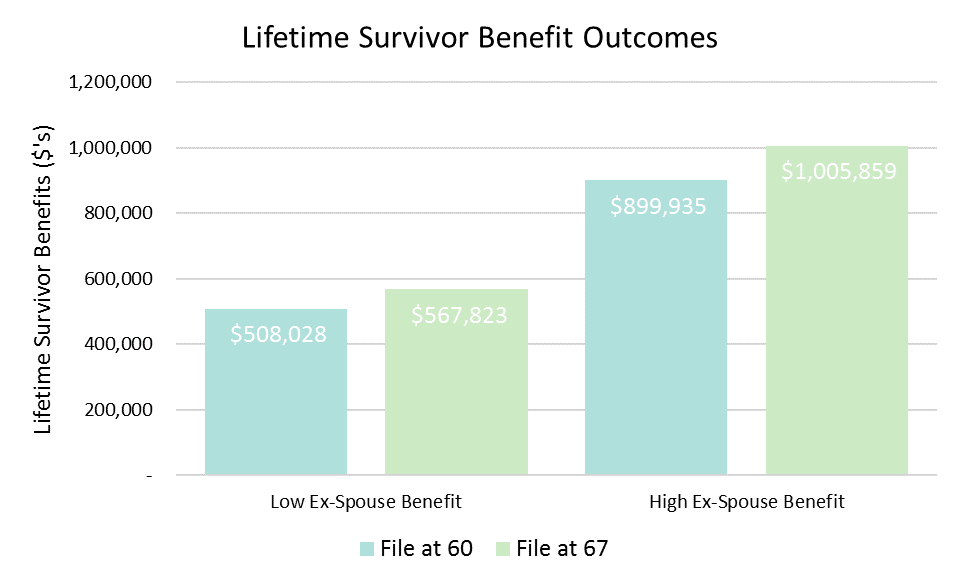

A divorced individual’s lifetime survivor benefit depends primarily on the amount of their ex-spouse’s retirement benefit when they died and when the divorced individual files. In Lois’s case, her lifetime benefit varies based on whether Peter’s retirement benefit was “low” ($1,750) or “high” ($3,100) and whether she files at 60 or waits until 67 to receive her unreduced benefit.

The most important factor for survivors like Lois is the amount of their ex-spouse’s benefit when they died. This is the difference between the same-colored bars, which is almost 100%. By contrast, whether Lois files early (age 60) versus later (age 67) can increase lifetime benefits by only as much as about 10%.

Implications for Divorced Spouses

Divorce is expensive. When couples separate, costs increase and resources (typically) decrease. Social Security has the potential to alleviate some of the financial hardship. This is particularly important in marriages where there was a large difference in earnings.

The following summary may help divorcing and divorced couples make more intelligent Social Security decisions:

- Someone who has worked their entire life at an upper-middle class salary or higher may be eligible for a Social Security retirement benefit of about $1 million over their lifetime.

- An eligible divorced person who never worked would receive a spousal benefit equal to one-half of their ex-spouse’s primary insurance amount. This benefit is not affected by when an ex-spouse files for benefits, but it is reduced if the divorce individual files prior to their full retirement age.

- Upon an ex-spouse’s death, a divorced individual can receive a survivor benefit as high as their deceased ex-spouse’s retirement benefit. This benefit will be reduced if the survivor files prior to full retirement age.

- Survivor benefits can be larger than spousal benefits, but recipients have less control over the amount they receive because they cannot predict when an ex-spouse dies and they may have no say when an ex-spouse files for retirement benefits.

- If ex-spouses are on speaking terms, they should try to coordinate filing for Social Security. This is especially important for the lower-earning or nonworking spouse, who is more likely to experience a significant change in their living standard in retirement due to different filing strategies.

- Ideally, couples going through a divorce will incorporate questions about Social Security into their planning. For example, ensuring ex-spouses have sufficient funds to delay filing for Social Security will likely benefit both people.

Thoughtful Social Security planning between divorcing couples can be a positive-sum game in an otherwise difficult and financially stressful process. Incorporating some of the above strategies can have long-term, meaningful impacts and may protect parties that have historically been the most financially harmed by divorce.

Photo by Didier Weemaels on Unsplash

Graphs by Frank Napolitano, Sensible Financial