This is Part 6, of 7-part series, read the other parts here: Part 1, Part 2, Part 3, Part 4, Part 5, Part 6, Part 7.

In a previous article, I explained the who, what, and when of Medicare Part D, Medicare’s prescription drug program for seniors. I devote this article to describing the “how” – that is, how to go about choosing among the myriad Part D plans available in your geographic area. Knowing how to choose a plan is important because you (or someone you designate) will need to re-evaluate your plan regularly to ensure that it still meets your needs and remains affordable.

The number of stand-alone Part D plans on the market is staggering. For example, a quick Google search reveals that there are 23 plans in my home state of Massachusetts alone. Apparently, when Congress passed the law pertaining to Part D, insurance companies saw it as a real money making opportunity and jumped into the market with both feet. Choosing carefully can really pay off, as your out-of-pocket costs can vary widely from one plan to another.

So how do you choose the right plan? For starters, here is how NOT to choose a plan (some common mistakes people make):

- DO NOT choose a plan just because your spouse chose the same plan. He or she may not take the same medications you do.

- DO NOT choose a plan just because it has the lowest premium. Often co-pays and co-insurance amounts for your medications, not the plan’s monthly premium, make the biggest difference in annual costs.

- DO NOT fall for pitches by sales agents that approach you. They are paid to sell the plans they advocate, not to help you choose the best plan for you. The same goes for choosing a plan based on glitzy marketing material mailed to your home.

The best drug plan for you is the one that has the lowest total out-of-pocket costs (premiums, deductibles, and co-pays or co-insurance, combined) for the medications that you currently take, without placing too many restrictions on getting those drugs. An example of a restriction might be a prior authorization required for a certain medication, or quantity limits imposed by the plan.

Don’t be concerned about medications you might need in the future. You can change plans every year if you want to. In fact, you may have to change because your chosen plan’s formulary (list of covered drugs) changes periodically, potentially resulting in an increase in the cost of some of your medications, or even their complete removal from the plan’s formulary. You should review your drug plan once per year to ensure that it still meets your needs, and that the cost is still reasonable. Otherwise, you may end up paying much more than necessary, or you could find yourself without coverage for certain medications you take. If you find that your plan no longer meets your needs, you can change plans during Medicare’s open enrollment period each year (typically October 15th to December 7th).1

When choosing a drug plan, you should consider other “personal preference” selection criteria, such as:

- The plan has a favorable customer satisfaction rating (yes, Medicare rates these plans using a 5-star rating, 5 being the best)

- The plan has in-network pharmacies that are located conveniently for you

- The plan has “preferred” pharmacies in your area that will save you money on the medications you take

- The plan has a mail order purchase option (if that is important to you)

- The plan allows you to fill your prescriptions at out-of-state pharmacies if you are traveling (again, if that is important to you)

One other important tip: if you need very expensive drugs for a serious health condition, try to choose a plan that has co-pays (a fixed dollar amount) instead of co-insurance (a percentage) for the medications you take, as co-insurance can increase your out-of-pocket expenses significantly, especially for the drugs in the highest price tier (tier 4).

There are two ways to choose a Medicare Prescription Drug plan: find one yourself or hire a professional Medicare consultant to find one for you.

Introducing Medicare’s Plan Finder

If you decide to do it yourself, the Medicare.gov web site has a helpful tool for finding a prescription drug plan called Plan Finder. Plan Finder takes you step-by-step through the process of entering medications you take and other personal information. It then provides a list of prescription drug plans in your geographic area that fit your criteria. If used correctly, it can be quite helpful in selecting the right plan for you at the lowest possible cost. (Truth be told, the tool is so helpful that even the professional Medicare consultants use it.)

I do not recommend having a friend or family member use the Medicare Plan Finder on your behalf unless they are detail oriented. Any incorrect inputs (e.g., the wrong form of the drug, or wrong dosage or frequency of refilling a drug) can yield wildly inaccurate results.

Compile a list of your prescriptions

Before you get started with Plan Finder, you should compile an accurate list of all your prescription medications. (Exclude over-the-counter medications and vitamins and supplements; they are not covered by Medicare.) It may also be helpful to think through your “personal preferences” for the criteria I listed in the previous section. For each prescription medication you take, you should have the following information on hand:

- The exact name of the drug, including any abbreviations that indicate the form in which you take it (e.g., ER for Extended Release, SR for sustained release, TAB for tablet, etc.)

- The exact per-unit dosage. As an example, if you take two 50 mg tablets each day, the per-unit dosage is 50 mg, not 100 mg. (Trust me, getting this right makes a difference in the results you get.)

- The quantity you receive when you refill the prescription. For instance, if you take two pills a day, and you refill the prescription every month, the quantity would be 60 (2 pills times 30 days)

- The frequency with which you refill the prescription (e.g., every month, every 2 months, etc.)

- Whether you get your prescription from a retail pharmacy or through mail order

Plan Finder Step 1: Enter preliminary information

Open an Internet browser on your computer, and go to www.medicare.gov.

Click on the green button with white lettering that says, “Find health & drug plans”.

If you are not yet enrolled in Medicare, or you are but do not want to provide any personally identifiable information, use the “General Search” box, and enter your zip code.

If you are currently enrolled in Medicare and do not mind providing some personal information, scroll down to the “Personalized Search” box and enter your zip code, Medicare member number, last name, date of birth, and Medicare Plan A effective date.

Click “Find Plans”. Then, answer a couple of preliminary questions and click “Continue to Plan Results”. If you are already enrolled in a drug plan, select your plan from the list presented and click “Continue”.

Plan Finder Step 2: Enter your prescriptions

Start entering each prescription you take by typing its name in the search box and clicking “Find my drug”. Plan Finder will present a list of possibilities that include both the drug’s name and the dosage. Select the correct one by clicking “Add Drug” next to its name. Then select the quantity, the frequency with which you refill the drug, and whether you buy this drug through a retail pharmacy or through mail order (you are presented with choices for each). Then click “Add drug and dosage” (meaning add it to the list of drugs you take).

Repeat the above actions for each prescription medication you take.

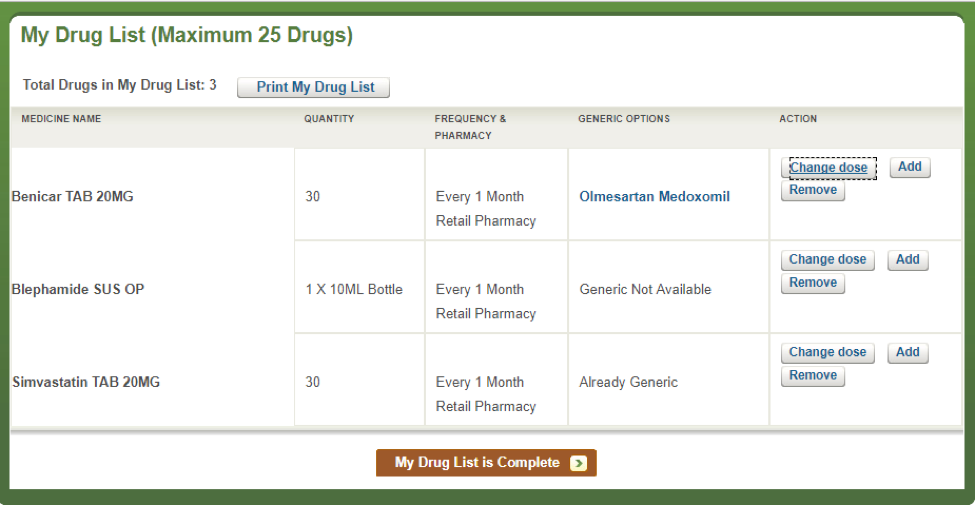

Here is what it might look like once you’ve entered all your prescriptions (this list is just an example; your prescriptions will be different):

It is very important that you enter the exact medication you currently take, even if there is a generic equivalent in the selection list (unless the drug you take is already the generic version, as in the case of Simvastatin above).

When you are finished entering all your prescriptions, click “My Drug List is Complete”.

Plan Finder Step 3: Select your pharmacies

Select a pharmacy in your area from the choices presented. (You can select more than one if you want.) If your current pharmacy is not listed, you can search for it. If for some reason you can’t find it, select any pharmacy in the list. It doesn’t really matter at this point in the process. You can revisit this later.

When you are finished, click “Continue to Plan Results”.

Plan Finder Step 4: Refine your plan results

Once you complete all the data entry steps, the application will present a “plan results” page that has a detailed list of the recommended drug plans in order from least to most total out-of-pocket costs. You will be able to refine your search to reduce the number of available drug plans. For instance, you can filter for only 5-star plans; or plans that have no restrictions for obtaining your drugs; or plans that have nationwide coverage (for the ardent traveler).

When you have finished with your selection criteria, click “Update Plan Results”, and then “Continue to Plan Results”.

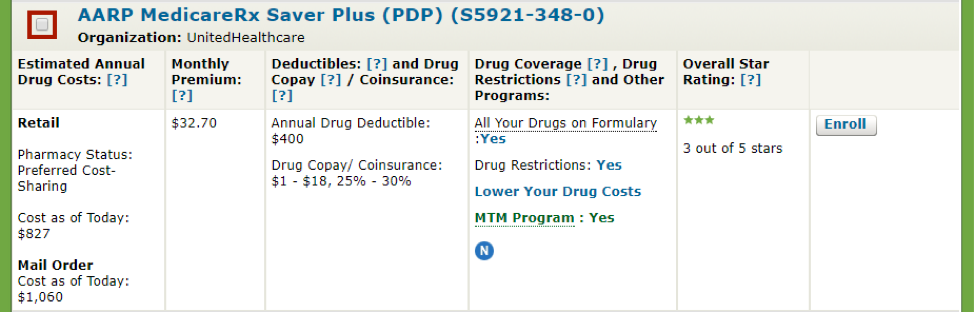

The application will display a list of prescription drug plans in your area that meet your criteria. If the list comes up empty, it simply means that no drug plans met all of your criteria. You will need to go to the previous page and modify your criteria. Here is a sample list of drug plans that carry the three medications listed above (the list of plans has been truncated due to space limitations in this article):2

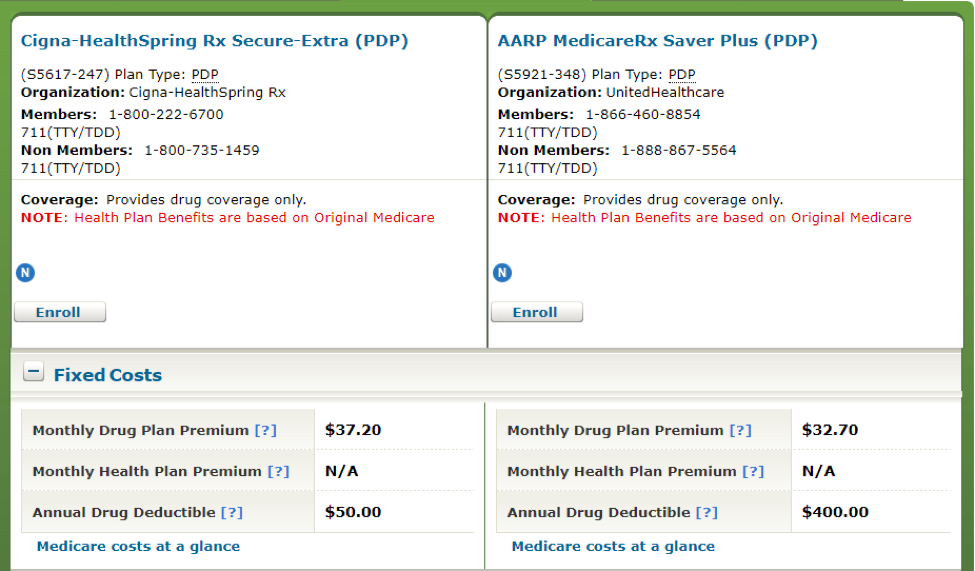

The two prescription drug plans shown above – AARP MedicareRx Saver Plus and Cigna-HealthSpring Rx Secure-Extra – both cover all three prescription drugs entered in Step 2. Each plan has different monthly premiums, deductibles, and co-pays/co-insurance amounts. They also both have some drug restrictions, although it is not clear from this display what those are.

To compare among plans and see a breakdown of the various costs of each, as well as their restrictions, check the red-bordered box next to each plan, and click “Compare Plans” at the bottom of the page.

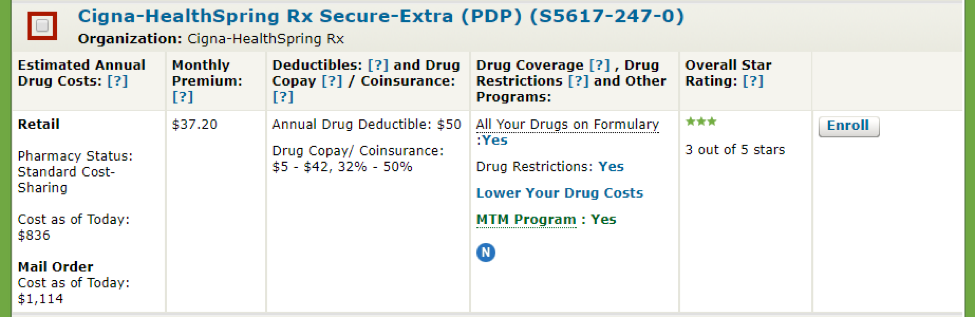

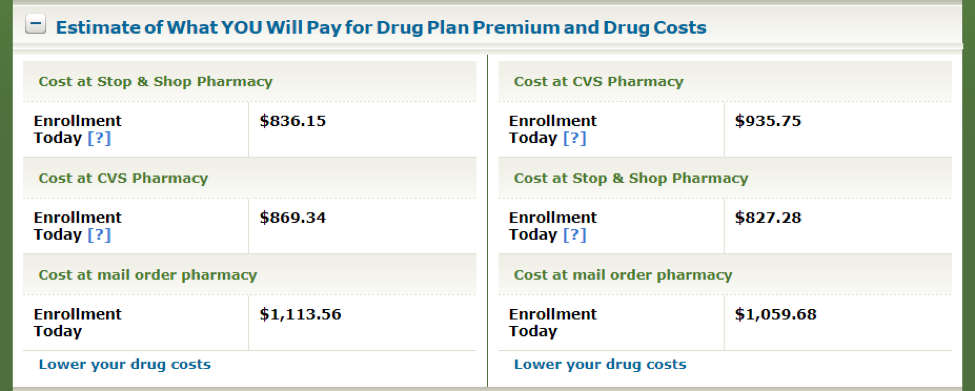

Plan Finder compares both your fixed costs (just premiums and deductibles) and your total out-of-pocket costs (including premiums, deductibles, and co-pays/co-insurance) for each plan, at each pharmacy selected, as shown above. (In this example, two local pharmacies, Stop & Shop and CVS, were selected in step 3 of the Plan Finder program.)

In terms of fixed costs, the AARP plan has a lower monthly premium, whereas the Cigna Health-Spring plan has a lower annual deductible. However, total out-of-pocket costs appear to be lowest if you enroll in the AARP plan and buy your medications at Stop & Shop. Moreover, it costs less in both plans to buy your drugs at the retail pharmacy instead of through mail order (go figure!). At the bottom of this screen, there is also an option to find out how to lower your drug costs, either through special Medicare-sponsored programs for low-income individuals, or by finding generic equivalents to some of the drugs you entered earlier in the program. (Of course, you would want to consult with your doctor before deciding on a different medication.)

It is worth noting that the “What you will Pay” figures in the above table are prorated from the beginning of the month following the month you use Plan Finder through the end of the calendar year. Unless you use Plan Finder in December, the displayed total dollar figures will not represent a full 12 months of costs. To find out what you would pay “all in” on a monthly basis, each month of the year, you can simply scroll down the web page to this table:

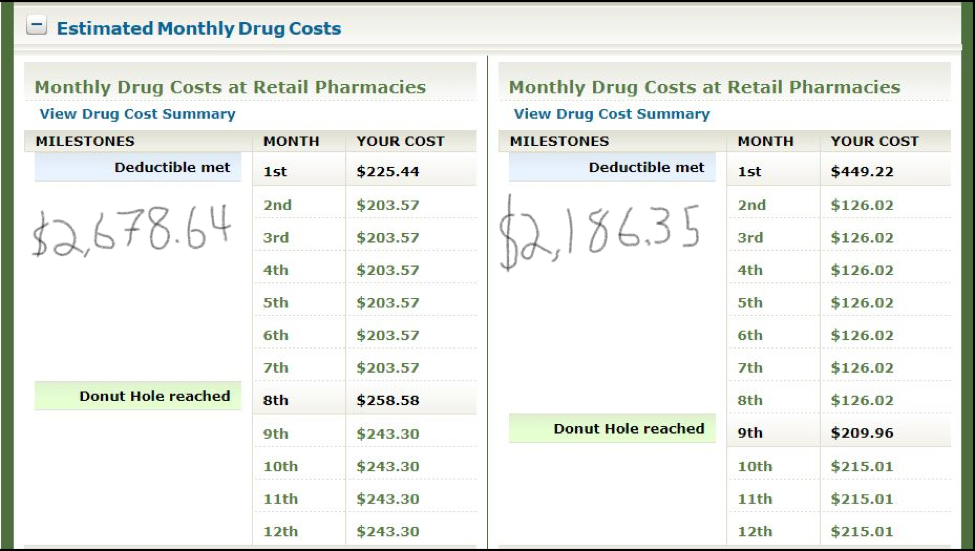

It doesn’t take a mathematician to figure out that the AARP plan (above, right) has substantially lower annual total out-of-pocket costs than the Cigna-Heathspring plan. (For some reason, Plan Finder doesn’t total the monthly costs for you, so the scratchy handwritten annual totals are mine.) This table also shows you the month in which you satisfy both the drug plan’s deductible and the “donut hole” pricing phase. Although not explicitly called out, you enter the last of the Medicare Part D pricing phases, catastrophic coverage, in September (the 9th month).

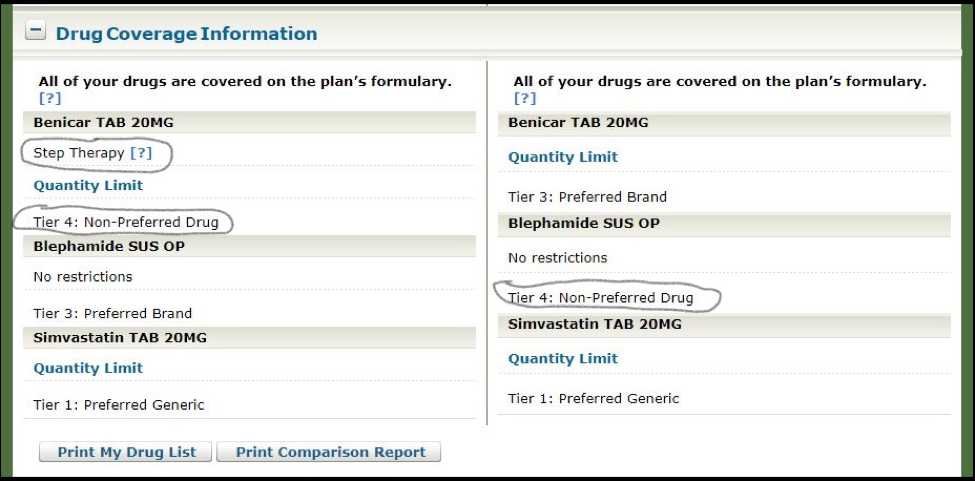

Before making a final decision on a drug plan and pharmacy, you should scroll down the page to the Drug Coverage Information section and check each plan for any restrictions it places on getting your medications. As you can see below, both plans in our example do have restrictions for some of the drugs:

The Cigna-Healthspring plan (above, left) requires Step Therapy for the Benicar drug. Step Therapy means that before the plan will cover that drug, the patient must first try another drug in that class – most likely a drug in a lower (less expensive) tier, possibly even a generic. (In some cases, you can petition the plan to make an exception.) Also, the AARP plan has placed Blephamide in Tier 4: Non-preferred drug, and the Cigna-Healthspring plan has done the same with Benicar. In this case, it is worth checking whether a similar drug may be available in a preferred tier, and then consulting with your physician. Finally, both plans have quantity limits on two of the drugs, although this shouldn’t present a problem if the quantities meet your needs (simply click on the link to find out).

After taking into account all of the above information, it would seem that the AARP plan / Stop & Shop Pharmacy combination is the preferred one in our example comparison, due to the lowest total out-of-pocket costs and fewest restrictions. However, if you drill down further in Plan Finder, you may be able to find similar, less expensive medications with even fewer restrictions; and/or another (perhaps slightly less conveniently located) pharmacy that offers additional cost savings. Also, keep in mind that filtering for only 5-star drug plans does not guarantee that they will be the lowest cost. Medicare rates its drug plans on numerous criteria, out-of-pocket costs being only one of them.

Medicare’s Plan Finder is a nifty tool to help you choose the least expensive prescription drug plan that covers the medications you take. It is not that difficult to use if you are detail oriented and are comfortable using the Internet. Some of the information obtained from this application would not be available if you simply called each drug plan sponsor and spoke with a phone representative. You should use it once per year to make sure your Medicare prescription drug plan continues to be the best available option for you, in terms of drug coverage, total out-of-pocket costs, and restrictions.

If, however, you do not wish to tackle this yourself, you can have a Medicare professional do it for you free of charge. The State Health Insurance Assistance Program (SHIP) has offices in each state of the country that offer this service. You can find a professional in your area by going to the Seniors Resource Guide at www.seniorsresourceguide.com/directories/National/SHIP/ and calling the phone number listed for the resource in your state.

In my next article (the last in the Medicare series), I will discuss Medicare Advantage plans (Medicare Part C), an alternative to traditional Medicare (A, B, supplemental, and D). What they are, how they differ from traditional Medicare, and why someone might choose such a plan instead of going the more traditional route.

Footnotes

1 In special circumstances, Medicare may give you an opportunity to switch to another drug plan outside of the open enrollment window. For example, if you permanently move out of your plan’s service area; if you qualify for extra help paying for prescription drugs; if the plan stops offering drug coverage; if you enter, live in, or leave a nursing home; or if the plan is a high performing plan and has received a 5-star overall plan rating from Medicare.

2 Sensible Financial does not endorse any Medicare Part D prescription drug plan.

Rick Fine is a Principal and CERTIFIED FINANCIAL PLANNERTM at Sensible Financial. Got a question for Rick about Medicare Part D? Ask in the comments section below. To speak with someone from our dedicated team about how we can help you plan for your financial future, click here!