The CARES Act says you don’t have to take an RMD this year. Should you?

Taxes

The CARES Act: How Will It Affect Individuals and Families?

The CARES Act has provisions that may affect you and your family. In this article, we outline the recent stimulus-related bills and their implications.

Should You Hire an Accountant to Do Your Taxes?

Whether your taxes are simple or complex, it might be wise to hire an accountant to do your taxes and get the most out of your money.

The new year is in full swing. Know your limits and get ready to file!

[Learn more…]

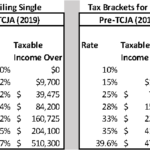

How Will Proposed Tax Reform Affect Me?

[Learn more…]

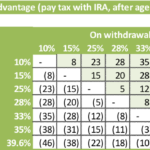

Year-end Tax Planning: Should You Do a Roth Conversion?

[Learn more…]

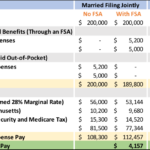

Flexible Spending Accounts: A Useful Employee Benefit That Can Reduce Your Taxes

[Learn more…]