In my last newsletter article, I looked at how to save for medical expenses using a health savings account (HSA). In this companion article, I’ll focus on another type of savings account called a flexible spending account. These plans are designed to help employees save for certain qualified expenses using pre-tax dollars. Although you may be able to reduce your taxes by contributing, it is important to understand the rules for the plan so that you do not lose unused funds at the end of the plan year.

In my last newsletter article, I looked at how to save for medical expenses using a health savings account (HSA). In this companion article, I’ll focus on another type of savings account called a flexible spending account. These plans are designed to help employees save for certain qualified expenses using pre-tax dollars. Although you may be able to reduce your taxes by contributing, it is important to understand the rules for the plan so that you do not lose unused funds at the end of the plan year.

What is an FSA?

Flexible spending accounts (FSAs) are tax-advantaged accounts offered by employers through “cafeteria plans.” These plans have nothing to do with food. Rather, they provide participants an opportunity to pay certain expenses with untaxed income. Participants in these plans can choose benefits from a menu of choices to fit their needs.

Who’s Eligible?

Each employer decides eligibility criteria for its FSA plan. You may have to dust off your employer benefits package or check with your Human Resources department/representative to see if your employer offers an FSA. Unfortunately, FSAs are not available to you if you are self-employed and certain limitations may apply for highly-compensated or “key” employees. Unlike an HSA, FSAs do not require participation in a high deductible health plan.

How Do FSAs Work?

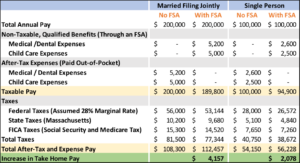

There are several types of FSAs available through a cafeteria plan, each offering the ability to save and pay for qualified expenses with pre-tax dollars. Employers may offer multiple types of FSAs to employees. I’ll focus on the two most common types of FSAs – those covering medical and dependent care expenses. The concept is relatively straightforward. First, you decide how much money to contribute and inform your employer. Your employer will then deduct that amount from each paycheck. Contributions to an FSA are not considered wages for Federal tax purposes, and are generally not subject to Federal Insurance Contributions Act (FICA) taxes either. Many states also exclude FSA contributions from income. Paying for eligible expenses on a pre-tax basis allows you to save more money by lowering your tax liability. In the example below, the married couple contributes $10,200 and the individual contributes $5,100. In both cases, the contributions to the FSA accounts allows them to save about 40% of the amount they contributed in taxes.

Employees have a few opportunities to enroll in their company FSA: within 30 days of hire, at a qualifying life event, during the initial enrollment period (when the plan is first established), or during the plan’s open enrollment (window of time during the plan year when you can make elections for the upcoming year). During enrollment, you designate how much you will contribute for the upcoming year. Once you decide, your FSA election can only be changed during the following year open enrollment or upon certain qualifying events like a change in marital status or number of dependents. If your employer offers multiple types of FSAs, you may be eligible to max out contributions to each (see amounts below).

Timing is important when it comes to eligible expenses. With a few exceptions (see special provisions below), you lose any unused funds at the end of each plan year. You can only claim reimbursement for eligible expenses incurred during the plan year, regardless of when you receive or pay the bill. This means that the date of service must fall within the plan year. Lastly, you cannot double dip, meaning you cannot claim reimbursement from your FSA if you are reimbursed under any other plan or program such as an insurance policy.

Health FSAs

Health FSAs are used to pay for qualified medical expenses, as specified in the employer’s plan. Examples include prescription drugs, co-pays and deductibles, eyeglasses/contact lenses, chiropractic care, non-cosmetic dental procedures, orthodontia, acupuncture, and psychiatric care. For 2017, employees can contribute up to $2,600 per year and employers may make additional contributions above this limit.[2] Because this limit applies at the employee level, a married couple could contribute as much as $5,200 in 2017 if each spouse is eligible to contribute through their respective employer.[3]

Dependent Care FSAs

Dependent care FSAs are used to pay for eligible dependent expenses while the guardian is at work. This includes childcare (for children under the age of 13) or for care provided to a child of any age who may be physically or mentally incapable of self-care. Adult day care also is an eligible expense for senior citizens who are dependents of the employee and live in the same home.

The maximum contribution for 2017 is $5,000 per family, or $2,500 per spouse if married and filing separately. If married, both spouses must earn income in order to exclude dependent care FSA contributions from taxable income. However, there are exceptions to this rule if the non-earning spouse is a full-time student or is disabled.[4]

Distributions

Distributions from an FSA can be slightly onerous. You must track eligible expenses and submit them for reimbursement. For additional reporting and distribution details, see IRS publication 969.

Special Provisions

Employers may offer provisions, described below, regarding the treatment of unused funds in your FSA at the end of the plan year.

1). Run-out Period – Refers to the period after the plan year ends during which you can still file a claim for reimbursement. This is essentially the cut-off for filing claims for the previous plan year.

2). Grace Period – Allows employees 2.5 months after the end of the plan year to incur eligible expenses. This differs from the run-out period in that it extends the plan year itself and gives you more time to incur expenses. Expenses incurred during the grace period must be claimed before the run-out period ends.

3). Carryover – Allows up to $500 of unused amounts remaining at the end of a plan year in a health FSA to be paid or reimbursed to plan participants for qualified medical expenses incurred during the following plan year. You can still contribute up to the plan maximum in years that you have carryover funds.

An FSA may offer a run-out period and either a carryover option or grace period, but not both. Unlike a health FSA, dependent care FSAs cannot offer a carryover provision. Employers who offer both a health and dependent care FSA may have different provisions between the plans. Therefore, it is important to check your plan summary to know which, if any, apply to you.

Why We Like FSAs

An FSA can be a nice tool for those who are eligible and have the cash flow to support contributions. Compared to HSAs, employers may offer FSAs with broader definitions for eligible expenses. If you have some level of predictable health and dependent care expenses, taking advantage of an employer’s FSA can help reduce your tax liability. The higher your marginal tax bracket, the more you can save.

FSA Caveats

Funding an FSA offers certain tax benefits; however, there are a few factors to keep in mind:

1). You lose unused funds at the end of the plan year (subject to the special provisions described above). Predicting future eligible expenses is a very difficult task. We do not recommend maximizing contributions unless you are confident that during the plan year you will incur at least the corresponding amount in eligible expenses.

2). Ensure that you keep receipts and can show that spending from the account is going towards qualified expenses. Record keeping and submitting for reimbursement is your responsibility and failing to file a claim prior to the end of the plan year may cause you to miss out on benefits.

3). There are restrictions on contributing to an HSA as well as funding a health FSA. It may be possible to use certain limited-purpose FSA accounts in conjunction with an HSA. If both are available through your employer or your spouse’s employer, check with your accountant and or FSA provider to ensure that you are eligible to fund both accounts.[5]

In Conclusion

It’s important to align the plan benefits with the expenses you incur to ensure you don’t forfeit unused contributions at the end of the plan year. Funding the account with precisely the correct amount is an impossible task. If you’re interested in contributing to an FSA for the first time, try easing into the account by making smaller contributions in the first year, which you can adjust annually as you get a better grasp on your spending.

[1] Example assumes eligibility to make both health and dependent care FSA contributions.

[2] https://www.irs.gov/publications/p969/ar02.html#en_US_2016_publink1000204174

[3] https://www.healthcare.gov/have-job-based-coverage/flexible-spending-accounts/

[4] https://www.irs.gov/pub/irs-pdf/p503.pdf

[5] https://www.irs.gov/pub/irs-drop/rr-04-45.pdf

Josh Trubow is a Financial Advisor and CERTIFIED FINANCIAL PLANNERTM at Sensible Financial. To speak with Josh or another member of our team about your financial future, contact us today.