A brief tax guide and update for 2019

As you might have heard in the news recently, the Tax Cuts and Jobs Act (TCJA) was passed at the end of 2017 and many taxpayers are now filing their first return under the new tax regime. The TCJA was enacted with four goals: tax relief for middle-income families, simplification for individuals, economic growth, and repatriation of overseas income. The TCJA updates will revert to the previous tax code after 2025 if a new tax bill is not passed. With the new tax law going into effect for 2018, it’s worthwhile to review the major changes and updates you’ll experience as you file your taxes this year.

Changes because of the TCJA

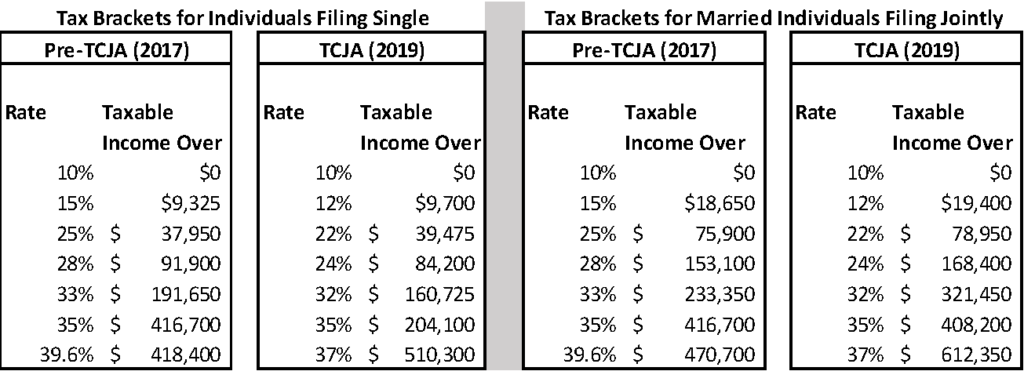

Tax Brackets

The TCJA maintains seven tax brackets with marginal rates from 10% to 37%. Income within each bracket is taxed at its corresponding marginal rate. For example, if you are married and file jointly with $200k in taxable income, i.e., gross income after all adjustments, you fall into the 24% marginal tax bracket. This does not mean you pay 24% tax on all your income. Rather, part of your income is taxed at 10%, part at 12%, part at 22% and the remainder at 24%. In effect, this means the couple will have an effective, or average, tax rate of 18%–much lower than the 24% marginal rate. Some of the tax rates remained the same and others were reduced as part of the TCJA. The pre-TCJA and 2019 tables are illustrated below.

Standard Deduction

Tax filers get the benefit of choosing between the higher of the standard deduction and the sum of their itemized deductions each year. The larger of the two gets subtracted from income and helps lower your tax liability. As part of the TCJA, the standard deduction was roughly doubled from $6,350 to $12,000 for single filers and from $12,700 to $24,000 for those married filing jointly.

Itemized Deductions

The TCJA modified and limited the amount of some itemized deductions. The deduction for state and local taxes (referred to as SALT) is now capped at $10,000. This modification has the largest effect on high income families that live in states with high income and local (real estate) taxes. Prior to the TCJA, high income earners had their itemized and miscellaneous deductions partially offset by PEASE limitations (named after Congressman Donald Pease). These PEASE limitations limited the amount you could deduct, based on earnings above a threshold. The TCJA eliminates the PEASE limitations (perhaps because it’s now redundant with the other limitations to SALT). Mortgage interest is still allowed as an itemized deduction, but you are now only allowed to deduct interest on new mortgages of $750k or less. The previous limit was $1M, however those who had mortgages prior to December 15, 2017 are still allowed to deduct their interest up to the previous $1M maximum.

Many miscellaneous itemized deductions are also suspended as part of the TCJA, as you could previously deduct certain expenses that exceeded 2% of AGI, including unreimbursed employee expenses, tax preparation fees, and investment expenses. Between limited itemized deductions and a larger standard deduction, fewer people are likely to itemize. The changes to the law may reduce the tax benefit of charitable giving. Your financial advisor can discuss strategies that are available to “bunch” multiple years of charitable donations into one year, which can make itemizing beneficial and help minimize your tax burden.

Personal Exemptions and Tax Credits

Prior to TCJA, tax filers could exclude $4,050 for themselves, their spouse, and any claimed dependents. The TCJA suspends these personal exemptions but simultaneously expands the child tax credits. Previously, families with income under $110k received a $1,000 tax credit for qualified children under the age of 17. The TCJA increases the credit to $2,000 and raises the income limit to $400k for those filing jointly. This tax credit applies irrespective of whether you take the standard deduction or itemize your deductions.

Alternative Minimum Tax (AMT)

The alternative minimum tax is a parallel tax system that may apply to certain higher earners with large itemized deductions. Taxpayers calculate their tax liability under each tax system and pay the higher of the two. As the TCJA reduced the number of people taking the itemized deduction, it also reduces the number of people subject to the AMT.

Estate Tax Exemption

The Federal estate tax is a tax applied to the fair market value of the assets you control at the time of your death, plus any gifts made during your lifetime above the annual gifting limit. Prior to the TCJA, the Federal estate tax applied to estates in excess of $5.49M. The TCJA increased the amount exempt from tax so that only estates in excess of $11.18M (2018) and 11.4M (2019) owe any tax Federal estate tax. Individual states may also impose their own estate tax. Changes to state estate tax rules are not covered in this article.

Changes for 2019

If you’re still reading, you deserve a gold star and some positive tax karma! There’s only a bit more to go and I will keep it brief.

Standard deduction

In 2019, the standard deduction is $12,000 for single filers and $24,400 for those who are married filing jointly. You receive an additional standard deduction of $1,650 if you are single and over age 65 or blind. Joint filers receive an additional $1,300 per person over 65 or blind.

Traditional and Roth IRAs

Contributions limits for traditional IRAs increase from $5,500 to $6k per person for 2019. Taxpayers over age 50 can make a catch-up contribution of an additional $1k per year. Roth IRA contributions are allowed for income under $122k (single) or $193k (joint filers). Income above these limits is either prohibited or subject to a phase-out.

Employer 401(k) and 403(b) plans

Maximum elective deferrals to these plans has increased from $18,500 (2018) to $19,000.

SIMPLE IRA

Maximum elective deferrals to these plans has increased from $12,500 (2018) to $13,000.

SEP IRA

Maximum elective deferrals to these plans has increased from $55,000 (2018) to $56,000. Maximum contributions are based on a percentage of self-employment earnings. Consult your accountant to determine maximum contributions each year.

Health Savings Account (HSA) Contribution Limits

Maximum contributions to an HSA are $3,500 for single plans and $7,000 for a family. The catch-up available for individuals over age 55 remains unchanged.

Annual Gifting Limits

Gifting limits remain unchanged from 2018. Taxpayers can gift $15k per person before they need to file a gift tax return.

Estate Tax Exemption

The estate tax exemption amount increases from $11.2 million per person to $11.4 million per person.

Wrapping up

While Congress passed the TCJA in 2017, we are now dealing with the first filing of returns under the new tax regime.You may find that your tax withholdings or estimated payments need updates based on the results of filing this year.Our financial plans incorporate these changes in the tax code. As always, if you have specific questions as they relate to your plan, please contact your Sensible Financial advisor.