Implementing sensible strategies to deal with IRMAA and Medicare can save you money. We offer a few ideas to help you negotiate both.

Should You Hire an Accountant to Do Your Taxes?

Whether your taxes are simple or complex, it might be wise to hire an accountant to do your taxes and get the most out of your money.

What’s the difference between Restricted Stock Units (RSUs) & Restricted Stock Awards (RSAs)?

Both RSAs and RSUs are employer plans designed to reward and retain employees by offering additional compensation in the form of company stock. This article will help you understand the key differences between the plans and learn about potential tax saving strategies.

The new year is in full swing. Know your limits and get ready to file!

[Learn more…]

Employee Stock Purchase Plans (ESPPs): Understanding and maximizing a great employer benefit you may be missing out on

[Learn more…]

A Sensible Approach to Scheduling

[Learn more…]

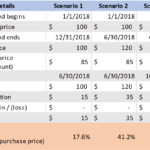

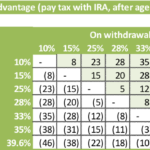

Year-end Tax Planning: Should You Do a Roth Conversion?

[Learn more…]