I hear clients say, “I’m not old, I don’t need to think about long-term care!” all the time. You may not be old yet, but if you’re lucky, you will be some day. Someone turning 65 today has an almost 70 percent chance of needing long-term care at some point in their remaining years. You might not like to think about your body or mind declining as you age, but it’s better to prepare for it than to ignore it.

Long-term care is the substantial human assistance one receives to help with activities of daily living, such as eating or dressing, over a prolonged period. For many older adults who anticipate needing long-term care in the future, a continuing care retirement community, or CCRC, is a viable living option. CCRCs offer independent living, assisted living, and skilled nursing care on one campus.

For more detailed information about CCRCs, watch my webinar “What Are CCRCs and Are They for Me?”

What is a CCRC?

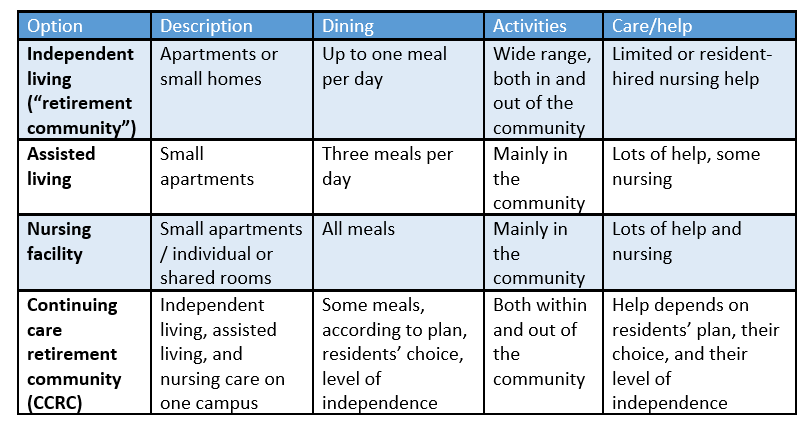

There are four types of congregate (community) living options for older adults.

A CCRC offers the widest variety of care levels. You can move into an independent living apartment at a CCRC while you’re still relatively healthy. If you need long-term care later, you can move next door to the assisted living or nursing facility.

Unlike other senior living options, some CCRCs offer Life Care contracts. With a Life Care contract, you pay the CCRC the same amount each year, even if you move into a more advanced care part of the community.

Is a CCRC right for me?

Community living isn’t for everybody. When advising Sensible Financial clients about community living, I suggest that they ask themselves five questions.

- How might my physical, mental, and emotional needs change as I age? For example, you might develop dementia, have a stroke, or grieve the loss of your spouse.

- Could my current home support these changing needs in my remaining years? Steep stairs leading into your home will be hard to navigate if you lose mobility. Would it be possible to add a wheelchair ramp or stair lift? If you need a live-in health aid, will there be enough space?

- Do you have a family history of needing long-term care? If your parents or grandparents needed to live in a nursing home or assisted living facility, you’re more likely to need long-term care too.

- Is it realistic to expect your children to care for you, or your friends and neighbors to remain close by? If your friends are all moving to the CCRC across town, you might want to join them. If your kids work full time, are raising a family, or live out of state, they might not be able to take care of you. And of course, you might not have children or relatives you can ask for help.

- How would I fare in a congregate living arrangement? A retirement community is, by its nature, social. If the idea of living close to others and going to a dining room full of people does not appeal, a CCRC might not be for you.

If a CCRC is sounding good so far, you might have more questions.

What is a continuing care retirement community like?

A CCRC offers services you normally do yourself, like cooking and cleaning. There are lots of clubs and committees to join. There’s always somebody around to talk to, but you can retreat to your living personal space if you want privacy. And, CCRCs offer physical, social, and cultural activities, to support your physical and mental health.

CCRCs often offer these amenities:

- Chef-prepared meals

- Utilities

- Housekeeping, maintenance, and repairs

- Household appliances

- Gardening, landscaping, and snow removal

- Concierge services

- Use of pool and gym, including classes

- On-site entertainment

- Use of the activity and meeting rooms

- Shuttle service

Each CCRC is different, so if a particular amenity is important to you, be sure to visit and ask about it.

Since a CCRC is a community, the social aspect of living there is a great defense against loneliness. Older adults often face loneliness as they lose mobility, and their friends and neighbors die or move away. Being lonely could lead to depression, but loneliness also contributes to health problems and even premature death. Many CCRCs have lively social offerings, with activities like these:

- Book clubs

- Art classes

- Off-campus shopping and fine dining

- Trivia nights and games

- On-campus concerts

- Tai Chi, yoga, and dance

- Computer training

- Resident committees

- Movies

- Lecture series

- Symphony, theatre, and museum trips

Considerations for CCRC living

CCRCs aren’t for everyone. Depending on who you are, these aspects of CCRCs might be a disadvantage.

- CCRCs can be pricey. You may invest a good chunk of your home equity for your apartment, although your estate may get a refund for part of the cost when you die.

- Community living has rules. If you like to play loud music late at night and grill on your balcony, you may be disappointed.

- Less private space. A single-family home might be 2000-4000 square feet, but the private space in a CCRC apartment might be 800-1600 square feet.

- Waiting lists. It can take months or even years for new applicants to get into a CCRC, so it’s better to start your search well in advance.

- A higher minimum age. Most retirement communities are 55+, whereas CCRCs have a minimum move-in age of 62.

- You must be reasonably healthy at move-in. If you have major debilitating health issues when you move in, the CCRC may charge you extra fees for your care. Some won’t even accept you.

- CCRCs must contend with recent trends. COVID-19, inflation, and staffing shortages have affected CCRCs’ pricing and services.

How to identify a CCRC I might like

Still interested? To find a CCRC, start with research. Pick a region where you’d like to live, and search online resources like mylifesite.net, longtermcare.gov, or aginglifecare.org. You can also seek advice from a Geriatric Care Manager or Life Care Manager.

Once you’ve picked three or four CCRC candidates, take a tour. Bring your spouse, a friend, or loved one along as a second pair of eyes. Interview the sales/marketing director, the finance director, and some residents (preferably without the salesperson present!) and ask for materials like marketing brochures, sample contracts, annual reports, a calendar of events, and a price list.

Finally, sample the CCRC experience by attending some on-campus events, eating in the dining room, and scheduling an overnight visit. You might find you don’t want to leave!

How do I decide?

Moving to a CCRC is a financial decision, but it’s also an emotional one. It’s scary to think about aging, and hard to imagine leaving your home for congregate living. Some of my clients have taken years to decide.

Take your time but start researching before you think you need to. CCRC waiting lists can be lengthy. Plus, if you wait too long, you might develop a condition that disqualifies you from applying. CCRCs are expensive, too, so you might need time to gather the resources.

Even if a CCRC is not your cup of tea right now (or ever!), having a long-term care plan will help you age with dignity. Talking to a Life Care Manager or financial advisor is a great place to start.

If you need information about moving to a CCRC or planning for long-term care, Sensible Financial is here to advise you. Request an appointment with one of our experts and we can figure it out together.

Photo by Claudia Love on Unsplash