Early retirement and the concepts of high savings rates, deliberate frugality and reducing one’s working hours continue to seep into the mainstream. Blogs like Mr. Money Mustache, Early Retirement Extreme, and the FIRE (financial independence, retire early) movement have become a topic of frequent conversation in the media and among many in their 30s, 40s and 50s. A Reddit forum devoted to the FIRE movement has over 440,000 subscribers!

Financial independence and early retirement are by no means new ideas. Your Money or Your Life, written by Vicki Robin and Joe Dominguez in 1992, is the so-called “bible” of the FIRE movement. The basic philosophy is to “make every money choice more conscious” by recognizing that “you pay for your money with your time.”

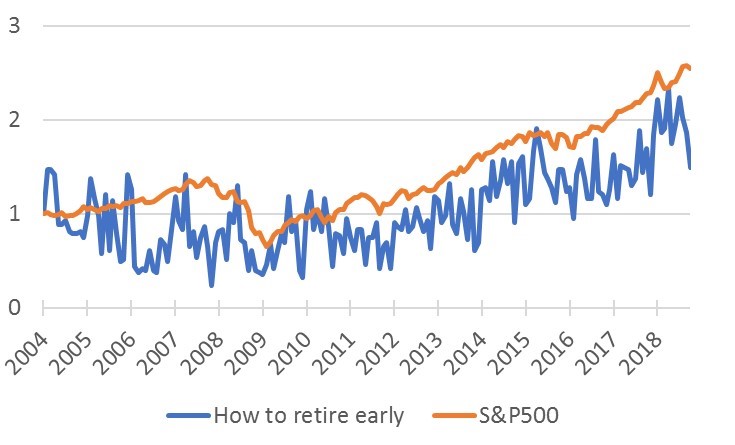

The concept of early retirement continues to gain momentum, in step with the prolonged growth of the U.S. stock market. For example, Google searches in the U.S. for “how to retire early” and the S&P 500 index have each more than doubled since the bottom of the Great Recession in 2009 (see below).

Figure 1. Monthly Google searches for “How to retire early” in the U.S. and the S&P 500: Index, January 2004 = 1

Sources: Google Trends; Yahoo Finance

Beyond being a thought-provoking concept, what might this mean for you and your financial plan? If you plan on retiring, whether early or not, several important takeaways from lifecycle financial planning can help you better prepare financially.

Specifically, your retirement age impacts three key factors in your financial plan: your lifetime living standard, life insurance requirement and risk capacity.[1] In a series of articles, I’ll discuss how your retirement age (whether it’s 40 or 80!) impacts each of these factors and how this relates to your financial plan. It’s important to note that having a fulfilling and healthy retirement (especially if it’s long!) relies on much more than just financial preparedness—however, I won’t cover these topics here. In this article, I’ll focus on how your retirement age impacts your lifetime living standard and what this means for your financial plan, especially if you’re looking to retire early.

Your living standard and retirement age are directly related

The fundamental challenge in lifecycle financial planning is that you earn for fewer years than you spend. The challenge is to set aside sufficient funds while you’re earning to maintain your living standard throughout the years when you’re no longer earning (i.e., retired) but still spending. Conceptually, your living standard (i.e., outlays on discretionary spending like food, clothing, travel, leisure and entertainment) is directly related to your retirement age. Fewer years of earnings means fewer resources to support your lifetime spending, and vice versa. The earlier you retire, the lower the lifetime living standard you can afford to maintain.[2]

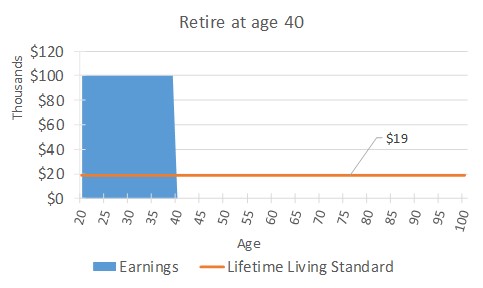

Consider the case of Willy Worker, a single 20-year-old, earning $100k a year.[3] Figure 2 illustrates that if he retires at 40 rather than 65, Willy’s lifetime living standard is much lower ($19k vs $42k per year). Retiring at 40 means he’ll have $2M of lifetime earnings instead of $4.5M if he retired at 65. Fewer resources to support a longer retirement means a lower level of affordable spending every year.

Figure 2. Fewer years of earnings means a lower lifetime living standard ($19k vs $42k)

Want to retire as early as possible? Get comfortable with a lower living standard

Now that we’ve established the direct relationship between your living standard and retirement age, let’s put this in the context of your financial plan. First, consider the following questions:

- What living standard can I maintain if I plan to retire at a specific age?

- When can I retire if I plan to maintain a specific living standard?

These are two sides of the same coin. Think of them as two distinct financial plans. The first is solving for the highest living standard you can maintain given your desire to retire at a specific age. The second is solving for the earliest you can retire given your desire to maintain a specific living standard.

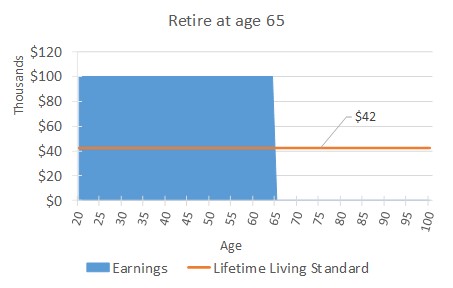

The orange line in Figure 3 shows the lifetime living standard that Willy can afford, now through the end of retirement, if he chooses to retire at different ages. This is an extension of Figure 1. Choosing to retire between ages 40 and 65 means Willy’s lifetime living standard will range from $19k to $42k per year. The blue bars in Figure 3 show the amount of assets at retirement that Willy will need to afford the associated living standard. Choosing to retire between ages 40 and 65 means Willy’s assets at retirement will range from about $1.14M to $1.52M.

This figure can tell us a lot about the implications of his retirement age—whether he’s planning to retire at a specific age (question 1) or specific living standard (question 2).

- The earlier he chooses to retire, the less he can afford to spend on his living standard (see orange line) and the fewer assets he’ll have at retirement (see blue bars).

- The less he chooses to spend on his living standard, the earlier he can afford to retire (see orange line) and the fewer assets he’ll need at retirement (see blue bars).[4]

Again, these are two sides of the same coin. If Willy plans to retire early, he must live on less because he’ll have fewer assets, but if Willy plans to live on less, he can retire early on fewer assets. If you’re seeking to retire as early as possible, you should focus on reducing your living standard to your minimum acceptable level now.

Figure 3. Two sides of the same coin: (1) Choosing to retire early means you’ll have a lower living standard, (2) Choosing to have a lower living standard means you can retire early.

Want to maintain a specific living standard in retirement? Focus on growing your assets

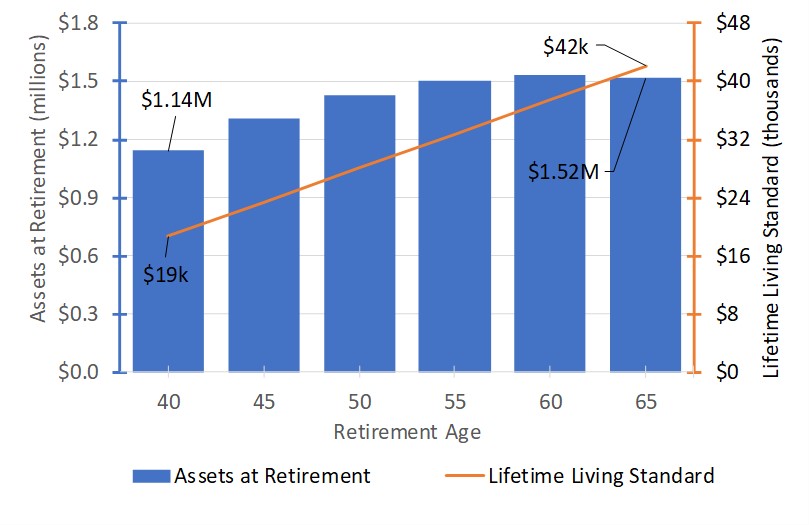

An alternative approach to early retirement is to focus on growing your assets to a certain level. For example, another way of looking at question 2 is to consider how much Willy needs at retirement to maintain a specific living standard throughout the rest of his life.[5]

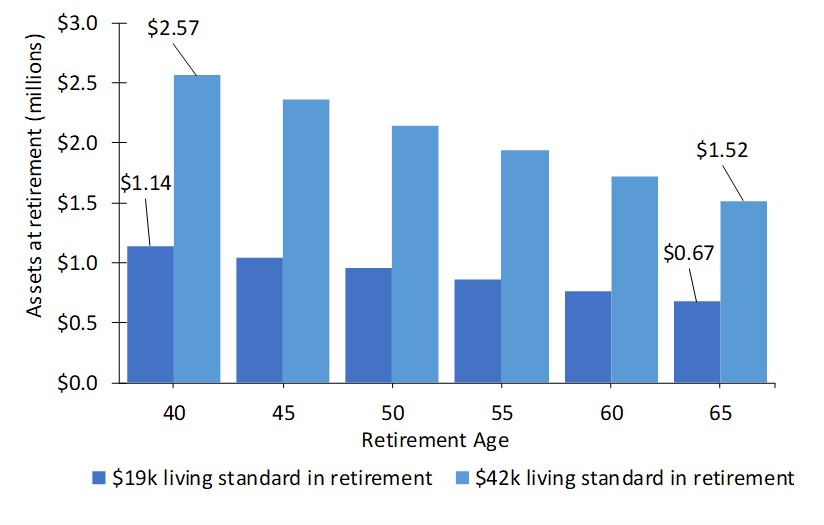

Figure 4 illustrates that the earlier Willy retires the more assets he’ll need to maintain the same living standard throughout retirement, and vice-versa. To maintain a living standard of $19k in retirement he would need about $1.14M to retire at 40 versus $674k to retire at 65. To maintain a living standard of $42k in retirement he would need $2.57M to retire at 40 versus $1.52M to retire at 65. Retiring early requires more assets, no matter the living standard you plan to maintain, because you’ll have more years of spending with no earnings.[6] If you’re seeking to retire as early as possible, this means you should focus on increasing your financial assets as rapidly as possible by saving aggressively now.[7]

Figure 4. Retiring early requires more assets, no matter the living standard you plan to maintain.

Conclusion

One size does not fit all when it comes to how early you can afford to retire or how many assets you’ll need. The answer depends on your living standard. All those articles that say you need $X million by age Y do not apply to you (unless by coincidence)!

Lifecycle financial planning tells us two important things about your retirement age:

- The earlier you retire, the lower the lifetime living standard you can afford to maintain, and

- The earlier you retire, the more assets you’ll need to maintain your living standard in retirement

If you are seeking early retirement, this means reducing your living standard to the absolute minimum you can accept and rapidly growing your financial assets by saving aggressively. This seems like an extraordinarily tall order. Many supporters of the FIRE movement talk about increasing one’s after-tax savings rate to “the hallowed 70 percent!” For most people, this is both unattainable and undesirable. However, for those looking to strike a balance (maybe retiring in their 50s, for example) the trade-off of maintaining a lower living standard may be worthwhile. A comprehensive financial plan, that examines multiple scenarios around your retirement age, can help to make these trade-offs crystal clear.

[1] Your lifetime living standard is how much you can afford to spend on discretionary spending every year for the rest of your life. Your life insurance requirement is how much life insurance coverage you need every year to maintain the living standard of your survivors. Your risk capacity is how much financial risk you can afford to take with your investments without materially impacting your living standard.

[2] This assumes annual earnings are fixed. If you could instead take a more remunerative job, you could retire earlier and maintain the same (or higher) lifetime living standard.

[3] For simplicity, I assume Willy has no current savings, lives through age 100, receives no Social Security, the rate of return on financial assets and inflation are 0%, and his only liabilities besides taxes are discretionary spending to support his living standard.

[4] Technically, at some future working age assets at retirement will begin to decline even as the living standard increases (e.g., assets at age 65 are slightly less than at age 60 in Figure 3). This is driven by the fact that the later you retire the fewer years of retirement you need to fund. However, the working age where assets at retirement begin to decline is very unlikely to be before any reasonable early retirement age.

[5] Smoothing your living standard in retirement is not the same as smoothing your living standard over your lifetime. This example focuses on how many assets are necessary to retire. How you spend and save before retirement is not addressed.

[6] With excellent market returns since the Great Recession, many people have larger savings than they otherwise would have had. This means they can theoretically support an earlier retirement. Therefore, it’s no surprise to see a strong positive correlation between market returns and an interest in “how to retire early” (see Figure 1).

[7] Rapidly growing your financial assets does not mean taking extraordinary risks with your investments. In fact, retiring early means you’ll have less capacity to take on investment risk. Only if you’re willing to work several more years (or decades) if future market returns are poor should you consider taking more risk with your investments.