The government is spending a lot of money it doesn’t have. Should we be worried about inflation? How do debts and deficits affect inflation?

Federal Reserve

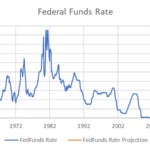

Evidence says the Fed is not “out of control”

[Learn more…]

What does it mean to say that the Federal Reserve Bank (the Fed) is raising interest rates?

[Learn more…]

What do the recent changes in interest rates mean for your portfolio?

[Learn more…]

Update on Market Reaction to Evolving Federal Reserve Policy

[Learn more…]