The stock market has declined a lot in the last two days, and the President has implied that it’s the Federal Reserve’s (the Fed’s) fault: the Fed is “so tight” (that is, the Fed is raising interest rates too fast and / or too much), and it is “out of control.”

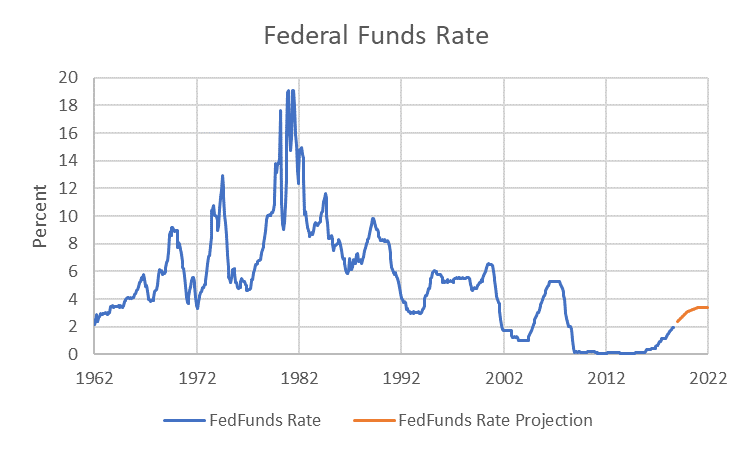

The Federal Reserve is increasing the interest rate it can directly affect. Known as the Federal Funds rate, it’s the rate at which banks lend to each other.

The chart shows the Federal Funds rate every month since 1962 (in blue), and the Federal Reserve’s own projections about how they plan to increase the rate (in orange). Let’s see what the data say:

- The rate is currently very low, much lower than it has been over much of its history since 1962

- The rate is increasing, but more slowly than in almost any of the Fed’s previous “tightenings” or periods of rate increases.

Look at

- The late 1960s

- The early 1970s

- The late 1970s

- The late 1990s

- The early 1990s

- The early 2000s

All had more rapid increases (steeper slopes) than the ones we are experiencing now.

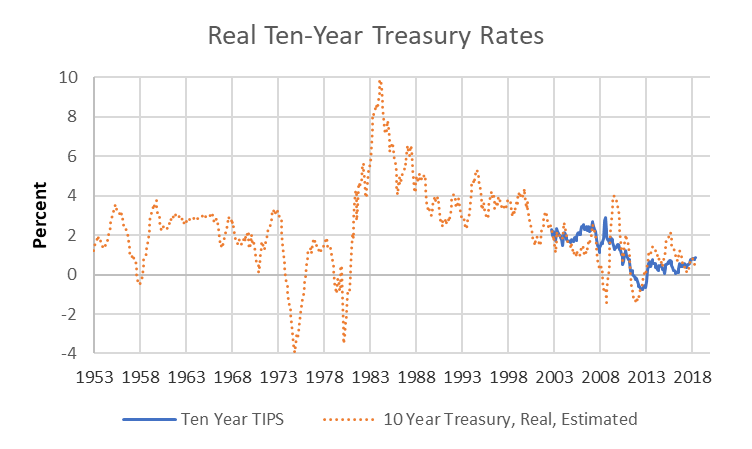

The President might also be concerned that “real” interest rates (interest rates net of inflation) are too high.

The real 10-year Treasury rate tells investors the safe rate of return for the next ten years, and is a good representative of longer-term interest rates. Since 2003, we have a very accurate measure of real 10-year Treasury interest rates. We can simply look at the interest rate on 10-year TIPS (Treasury Inflation Protected Securities – blue line on chart below).

The current real rate is low, not the lowest since 2003, but certainly lower than the rate before the Financial Crisis and the Great Recession.

We don’t have 10-Year TIPS rates before 2003 (or at least, the Federal Reserve data store doesn’t provide them), but we can produce rough estimates by subtracting a one-year rolling average inflation rate from the 10-Year Treasury rate.

The graph illustrates how rough the estimates are (compare the orange dotted line to the blue solid line). Nevertheless, it’s clear that the current 10-Year real rate is very low by historical standards.

Having interest rates that accurately reflect market realities is important for the economy. Interest rates are prices. If they are too low, managers and investors will make investments they shouldn’t. If rates are too high, they won’t make investments they should. In a booming economy, interest rates should be high enough to guide decision-makers to choose only the best investments, the ones that will produce high returns. The Fed is striving to move interest rates in that direction.

Like any politician, the President wants credit for everything good, and wants to find a culprit for everything bad. If the economy can’t prosper with higher interest rates than we have now, it’s not as strong as the President asserts, and the Fed clearly believes. Both may be wrong, but the Fed isn’t “out of control.”