Let’s discuss President Trump’s policy changes and how they might affect the economy, your financial plan, and investments.

Economy

The Novel Coronavirus or COVID-19: How and when will life return to normal?

[Learn more…]

Trade Deficits And Tariffs And Trade Wars, Oh My!

[Learn more…]

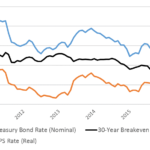

Inflation Assumption Updates And Your Financial Plan

[Learn more…]

Is Passive Investing Bad for the Economy?

[Learn more…]

Greek Crisis Avoided — For Now

[Learn more…]

Peering Over the Fiscal Cliff

[Learn more…]