This article originally appeared on Forbes.com.

On November 1, the IRS announced cost of living increases to IRA and employer plan contribution limits for 2019. The IRA annual limit increased from $5,500 to $6,000; the employer plan limit (applicable to 401(k)s, 403(b)s, most 457 plans and the Federal Government’s Thrift Savings Plan or TSP) increased from $18,500 to $19,000. Those are just the headlines.

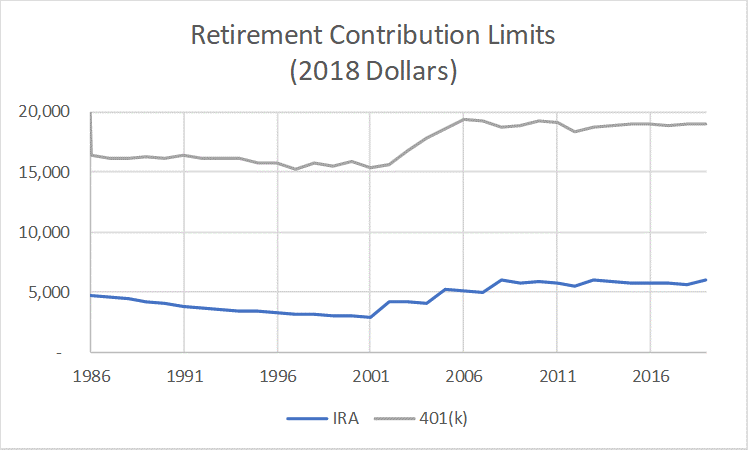

Together, Congress and the IRS have presided over large changes in retirement contribution limits. In 2018 dollars, the IRA contribution has been as small as $2,917 in 2001 up to about $6,000 since 2008. The employer plan limit has been as low as $15,249 in 1997 and as high as $19,000 since 2006.

Regardless of inflation, employees of firms offering retirement plans have a much larger tax deferred savings opportunity. Each year, they can shelter from tax 3 times as much (3 times!) as workers whose best tax-sheltered retirement savings option is their IRA.

How does this affect your retirement savings plan? How should you respond?

Consider the source(s).

The IRS is following Congressional instructions (Economic Growth and Tax Relief Reconciliation Act of 2001, or EGTRRA) to maintain the purchasing power of both contribution limits.

That is, the IRS is making the changes the Congress told them to make, ensuring that the limits keep up with inflation.

Last time I looked, neither the Congress nor the IRS was a financial planner, or a financial advisor of any kind. They don’t know you or your financial situation, and they’re only vaguely interested in your financial success.

The IRS is in the business of collecting all the taxes they can. These increased contribution limits just make their job a little bit harder – there will be less income to tax. Members of Congress are in the business of being re-elected. The link between your retirement savings and their election prospects is tenuous at best.

It doesn’t take much analysis to see that these changes don’t provide much guidance about what you should do. Let’s do some “supposing.”

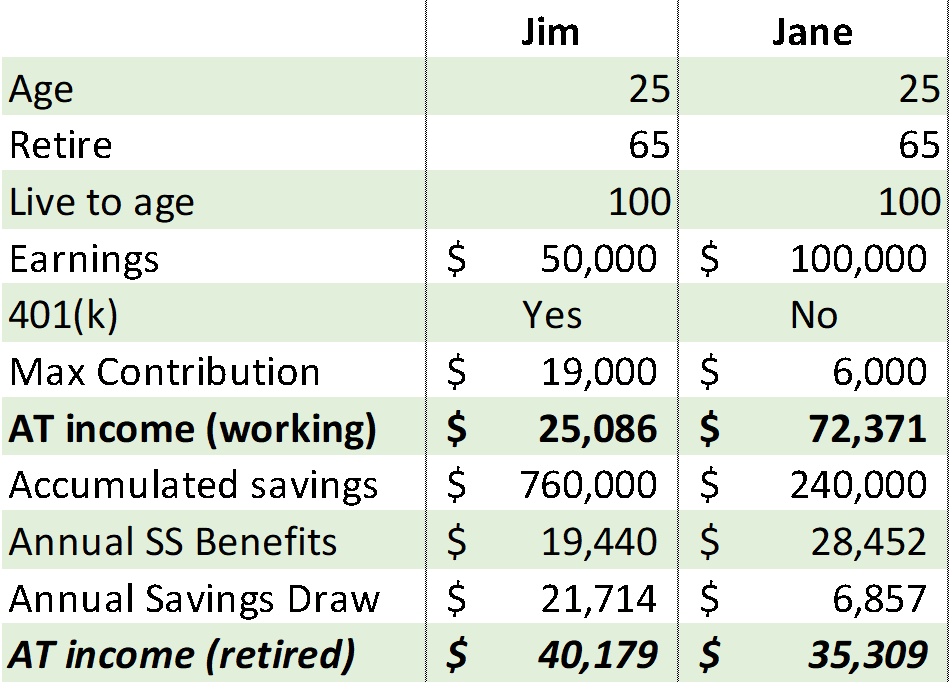

Suppose Jim works for an employer offering a 401(k) plan, and earns $50,000 per year, pre-tax. Should he “max out” his contributions? Let’s see, $19,000 is almost 40% of $50,000 – what do you think?

Some very rough analysis (see table) shows that if Jim saves $19,000 a year and retires at 65, he would have $25,086 in after-tax income before retiring versus $40,179 in retirement. Similarly, if Jane earns $100,000 a year with a non-401(k) employer and limits her retirement savings to the IRA maximum of $6,000 per year, she would have $72,371 in after-tax income before retiring versus $35,309 in retirement.

Neither one is likely to be happy with their choice. Jim scrimps and saves throughout his working life to have 60% more income after retirement. Jane can live the high life while working but her spendable income drops by half after she retires. In practice, Jim should save less than his allowable maximum, and Jane a good deal more.

Summarizing, the contribution limit increases change what you can do, not what you should do.

If saving based on the contribution limits is not good strategy, what is? Should you save more? Less?

Unfortunately, there is no simple answer. [Actually, there is one simple answer, just not for the questions immediately above. If your employer matches your contributions, be sure to contribute enough to get the full match.] If you want to retire comfortably when you choose to, thinking carefully about your retirement savings, both tax advantaged and taxable, is the only way to go. Factors that will influence the right answer for you include (at least): when you hope to retire, your annual income, your income history, how much you’ve saved so far and whether you own your home.

You will need to save a higher percentage of your income:

- To retire earlier, because your savings must cover more years of retirement.

- If your earnings are higher, because Social Security benefits will replace a smaller proportion of your income.

- If you haven’t saved much yet, because you are making up for lost time.

- If you rent rather than own, because home owners’ home equity is like prepaid rent – a “hidden” component of retirement savings.

“How much should I save for retirement?” is a very personal question. The answer is almost certainly not the IRA or employer plan contribution limit.

Forbes has full details on the 2019 limits for 401(k)s and more here.

Note: Both IRA and retirement plan contribution limits varied even more widely before the Tax Reform Act (TRA) of 1986.