Charitable giving truly is the gift that keeps on giving. In addition to the positive feelings you get from giving to a needy charity, a charitable gift can reduce your taxes. In this article I’ll show you how planned giving, which takes into account how your income (and therefore tax brackets) change over time, can let you donate the same amount to charity while maximizing the charitable gift deduction. (Another, often related, strategy to maximize charitable giving is to donate highly appreciated securities, instead of cash. For more on that, click here.)

Qualified charitable gifts reduce taxable income by the amount of the gift (up to certain limits outlined in IRS Publication 526), provided you itemize your deductions. The tax savings equals the value of the gift multiplied by your tax bracket. For example, if you are in the 35% marginal tax bracket and make a charitable gift of $10,000, the tax benefit would be $3,500 ($10,000 x 35%). You’ll notice that the higher your tax bracket, the greater the benefit of charitable giving.

Below I’ll show you how changing the timing of charitable giving can lead to greater tax savings if changes in your income imply different marginal tax brackets in different years. For purposes of my analysis I’ll assume that tax brackets remain constant over time. I’ll also ignore the time value of money. Sensible Financial does not give tax advice, so you should consult your CPA or qualified tax accountant for a detailed assessment of your charitable giving strategy.

Annual Charitable Giving

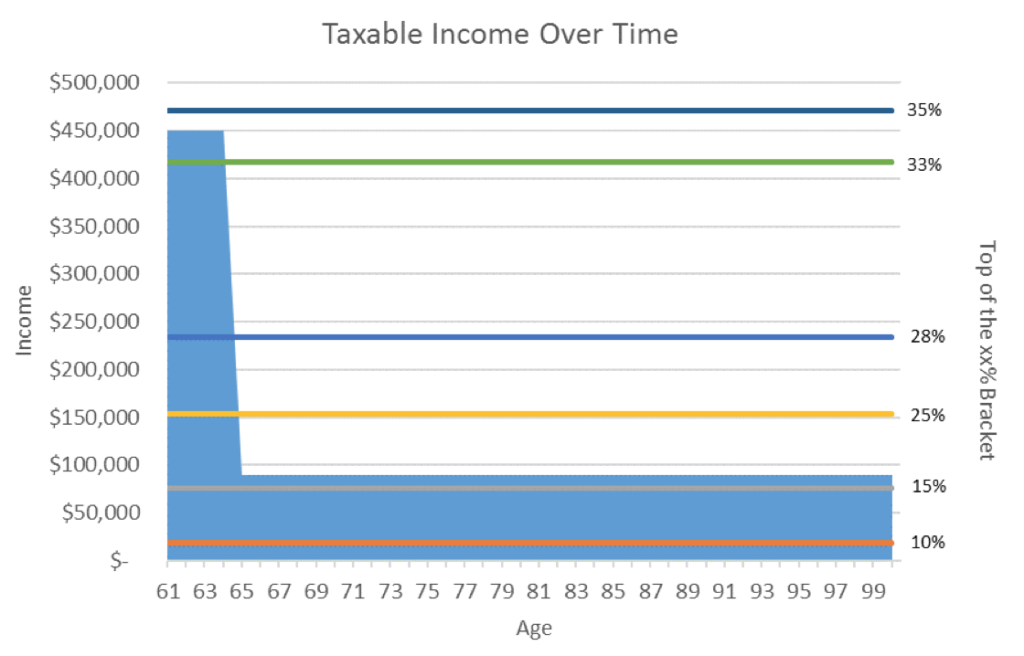

Many people make equal dollar gifts to the same charities every year. If your income and your marginal tax brackets vary over time, the tax benefits of your annual gifts may change as well. Let’s look at an example: a married couple is currently in a high marginal tax bracket (still working) and will be in a low marginal tax bracket in the future (once they retire). The chart below shows the pattern of income they anticipate as well as the break points between different Federal marginal tax rates.

The couple plans to make $10,000 of charitable gifts every year for the next 40 years ($400,000 in total). For the next four years they will be in the 35% marginal tax bracket, so the tax benefit of each annual gift is $3,500 ($10,000 x 35%). Once the couple reaches age 65, they will be in the 25% marginal tax bracket and the tax benefit of that same $10,000 gift will only be $2,500 ($10,000 x 25%). Following the strategy of gifting $10,000 per year for life, the couple would realize $104,000 in tax savings from their charitable deductions.

| Age | Donation | Tax Savings |

|---|---|---|

| 61 | $10,000 | $3,500 |

| 62 | $10,000 | $3,500 |

| 63 | $10,000 | $3,500 |

| 64 | $10,000 | $3,500 |

| 65 | $10,000 | $2,500 |

| 66 | $10,000 | $2,500 |

| 67 | $10,000 | $2,500 |

| 68 | $10,000 | $2,500 |

| 69 | $10,000 | $2,500 |

| 70 | $10,000 | $2,500 |

| 100 | $10,000 | $2,500 |

| Total | $104,000 |

Strategic Charitable Giving

Alternatively, the couple could maximize the tax benefit of their charitable giving by “frontloading” their gifts in the years in which they are in their highest marginal tax bracket. Instead of gifting $10,000 annually for 40 years, they could gift $100,000 annually for four years. Using this method, the couple would realize $134,664 in tax savings from charitable gifts over their lives.

| Age | Donation | Tax Savings |

|---|---|---|

| 61 | $100,000 | $33,666 |

| 62 | $100,000 | $33,666 |

| 63 | $100,000 | $33,666 |

| 64 | $100,000 | $33,666 |

| 65 | - | - |

| 66 | - | - |

| 67 | - | - |

| 68 | - | - |

| 69 | - | - |

| 70 | - | - |

| 100 | - | - |

| Total | $134,664 |

The benefit of timing your charitable gifts will be greater when there is a significant difference between current and future marginal tax brackets. In the above example, the couple saved an additional $30,664 in taxes simply by changing the timing of their gifts.

One issue with the frontloading strategy is that some people prefer to support the same charities each year on an ongoing basis. For those who like the idea of regular giving but still want to take advantage of making gifts while in a high lifetime tax bracket, a donor advised fund may be a solution.

A Note on Donor Advised Funds

A donor advised fund is an account set up at a qualified public charity, e.g. Fidelity Charitable Gift Fund. Contributions made to a donor advised fund are treated as tax deductible charitable gifts in the year of the contribution and, as such, are irrevocable. Monies in a donor advised fund remain in the account until you make “grants” to your chosen qualified public charities. Importantly, you are not required to make grants to charities from the account in the same year that you contribute to the donor advised fund. This allows you to separate the tax deduction element from the gift element of your charitable donation.

Using a donor advised fund would allow for the couple in our example to both front-load the $400,000 in gifts in four years (maximizing the tax benefit) and make $10,000 charitable grants from the account each year over their lifetimes. [1]

Summary

Consider your current and future marginal tax brackets when making charitable gifts. Strategizing the timing of your charitable gifts can allow you to receive a greater tax benefit over your lifetime or allow for you to gift more!

[1] The value of assets in the Donor Advised Fund will fluctuate depending on how they are invested and on the returns to those investments. Thus, in our example, the couple’s favorite charity may receive either more or less than $400,000 if the investments perform well or poorly.

Laura Williams is a Junior Financial Advisor at Sensible Financial. Got a question for Laura about planned charitable giving? Ask in the comments section below! To speak with someone on our dedicated team about how Sensible Financial can help you plan for your financial future, click here!