Planning to retire soon? Celebrating a milestone birthday? It might be time to think about older adult living options.

People’s capabilities and needs change as they get older. The best housing choices accommodate those changes. What’s best for you depends on the support you’ll need and the amount of decision-making and care management you delegate to others.

My colleague Laura Williams and I presented a four-part webinar series on the many older adult living options available today. If you missed it, you can still watch the webinars.

When choosing retirement housing, planning is vital. You can’t predict the future, but preparation will enable you and your loved ones to cope with whatever life brings.

Your housing needs change as you age

When you were younger, your housing priorities focused on proximity to work or schools. As you age, those priorities shift.

Along with the location, the type of housing you seek changes. Climbing stairs, reaching objects on high shelves, and home maintenance may become more challenging over time. As an older adult, you might want:

- One-floor living

- Comfortable weather year round

- Easy access to your favorite activities

- Proximity to medical care

- Space for an aide, family member, or friend to stay with you

- Room for visitors

- Meal services

Moving becomes more physically and emotionally demanding as you get older. Managing renovations also gets harder. Your best bet is a housing plan that preserves flexibility as you age. It could also be something like a continuing care retirement community (CCRC).

You might never need assisted living or nursing care, but it’s safer to plan as if you will. If you do need long-term care, having a plan makes it easier for you to live the way you prefer. It also puts less strain on your family and helps you stay healthier longer.

What questions should you ask yourself?

Physical

- Do you have or anticipate physical limitations or disabilities?

- Do you have or anticipate health issues you will need help with?

Social and family

- Where do your children live and how much can you rely on them?

- Where do your friends live?

- What activities are important to you?

Financial

- What can you afford?

- What do you want to leave to your children?

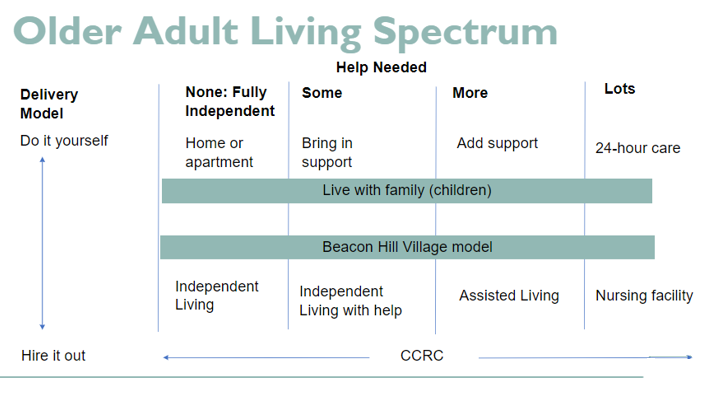

This chart represents a spectrum of living options based on the amount of care an older adult needs. The aspects of the spectrum are:

- What level of support do you need? As you age, you may need increasing levels of help with daily living.

- Who supports you? If you have assets, you can choose to have a family member or friend assist you, hire a personal care assistant (PCA), or move somewhere that offers support.

- How much do you want to do yourself? On one end of the spectrum, you can DIY your older adult living situation. In the middle, you could choose to live with family members for support or connect with a community using the Beacon Hill Village model. At the far end, you can hire someone else to coordinate your care, like a life care manager.

Older adult living options

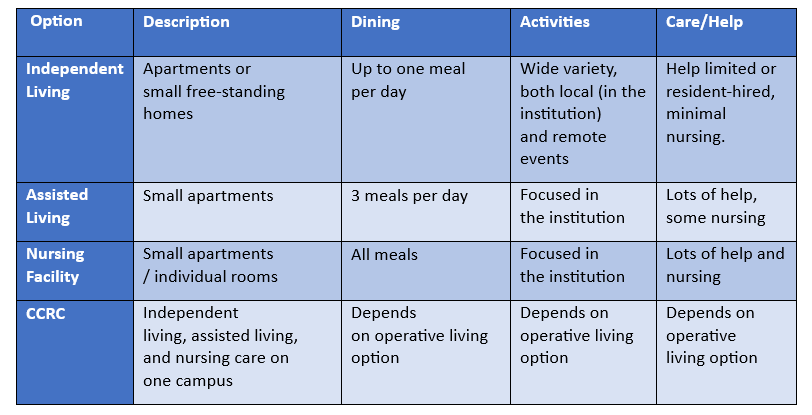

Independent living, assisted living, nursing facilities, and CCRCs offer different care and living experiences.

Doing it yourself

If you build your own older adult living option, you get exactly what you want. The challenge is arranging it all yourself, which can take research and time. As your needs change, you may find yourself constantly redesigning your solution.

Advantages of DIYing your own older adult housing solution

- Living in a custom built (by you) situation

- Having great flexibility

- Depending on your needs, it may be expensive

Disadvantages of DIYing

- Changing to suit your ever-changing health situation

- Socializing demands more effort

- Forcing partner/family to become your caregiver

Doing it all yourself lets you customize your housing and care to suit your needs, but it can backfire if you’re not prepared. As people age, their mental flexibility and resilience often decline. It’s normal, but it can cause problems if you don’t realize it’s happening. It becomes harder to make big decisions, deal with your finances, and get things done. With preparation, this situation can end with your family, partner, or friends taking over or hiring a PCA (personal care assistant).

There is wisdom in humility. By acknowledging that you may become unable to manage your own care, you make it possible to plan for more contingencies and age with dignity. Know ahead of time who you’ll turn to for help with care management. Remember, even if you’re DIYing, you can always consult with an expert to design the best solution for your needs.

Who could help manage your care?

- Children

- Other relatives or friends

- Professionals

- Care managers

- Elder law attorneys

- Professional fiduciaries

- Daily money managers

Hiring out for older adult living

If you’re concerned about managing your own care, you may prefer to live in a CCRC. By choosing a CCRC, you delegate your care and its management to experts. You join a community with a built-in social network and activities. A CCRC is designed to ease transitions between different levels of care, so you can stay in the same location even if you suddenly need skilled nursing. However, you need to choose wisely – it can be hard and expensive to withdraw from a CCRC.

Advantages of choosing a CCRC

- You delegate management to experts

- The management and staff have experience with older adults

- The community has social activities built in

- Designed for transitions, CCRCs are the most shock-resistant option

Disadvantages to CCRCs

- You choose the CCRC, but from a limited menu

- If you dislike your choice, you may be stuck there

- Moving to a CCRC disrupts your routine and involves moving to a new place

If you decide to “hire out” your housing, it’s best to begin planning well before you move. Consult with an expert, like a life care manager. They can assess your needs and teach you about communities and resources near you. If you choose CCRC living, decide carefully. Visit your top choices before committing. A poor choice can be costly and hard to correct. In some instances, your decision may be irreversible.

What should I know before choosing an older adult living option?

The future is unpredictable. Nevertheless, there are maps and guides to help you navigate it. You can anticipate issues you may face, consult with professionals, and choose the best housing solution for you. Research and thoughtful planning will enable you to cope gracefully with any challenge.