- New rules eliminate the ability of spouses who do not reach 62 by January 1, 2016 to file for spousal benefits while letting their own retirement benefits grow.

- April 29, 2016 is the deadline to reach age 66 and “File and Suspend” in order to let your retirement benefits grow while your spouse takes spousal benefits.

- Divorced persons who do not reach 62 by January 1, 2016 will also be unable to take spousal benefits on their ex-spouse’s record while letting their own benefits grow.

- There are no changes in the rules for widows and widowers.

- Rules for parents with dependent or disabled children are complex, and require careful analysis.

- If you are already receiving Social Security benefits, the new rules do not affect you.

On November 2nd, President Obama signed into law the Bipartisan Budget Bill of 2015 that eliminates two attractive Social Security filing strategies for anyone born in 1954 or later. For those born before 1954 and not yet taking Social Security benefits, some options are still available, but these are limited, and the window of opportunity is closing fast. The strategies being phased out are portions of File & Suspend and Restricted Application. Both of these provisions allow beneficiaries to collect partial benefits while accruing maximum benefits in the future.

What are File & Suspend and Restricted Application under the previous law?

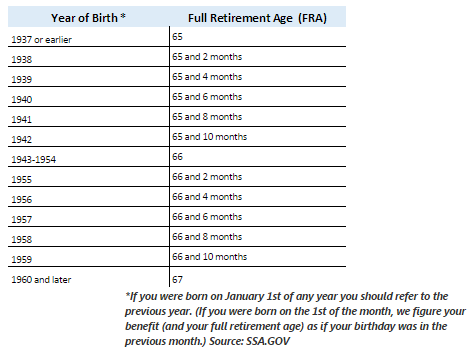

File & Suspend (sometimes called “Claim and Suspend”)

For one spouse – usually the lower earning spouse — to claim “spousal” benefits (that is, benefits based on the other spouse’s earnings record), the other spouse – usually the higher earning spouse — has to have filed for their own “retirement” benefits (that is, benefits based on their own earnings record). Once the higher earning spouse reaches Full Retirement Age, or FRA (between ages 65 and 67, depending on date of birth)[i], they can file for retirement benefits and then suspend them at the same time. This action enables the lower earning spouse to file for spousal benefits while allowing the spouse who Files & Suspends to defer taking their own retirement benefits until they turn 70. During the suspension period, the spouse who Filed & Suspended will earn Delayed Retirement Credits (DRCs), raising their eventual monthly retirement benefit in real terms by 8 percent per year.[ii]

One other little-known File & Suspend provision allows an individual who has previously Filed & Suspended to request a reinstatement of all benefits that have accrued (but have not yet been paid) during the period of suspension. You might do this if, for example, you learn that your life expectancy has been greatly shortened due to a serious illness that arose during the period of suspension. If you reinstated, you would receive a lump sum of the accrued past benefits since the date of suspension. By asking to have previously suspended benefits repaid in a lump sum, you would forego the Delayed Retirement Credit (DRC) increases that you had been accruing. But this might not matter if you don’t expect to live that long.

Restricted Application

When a spouse claims spousal benefits at their FRA, they do so by filing a Restricted Application. This permits them to receive spousal benefits without triggering a simultaneous claim for their own retirement benefits. They can collect spousal benefits for several years and then switch to their own retirement benefit at age 70, including any DRCs they’ve accrued by deferring it.[iii] It is important to file a Restricted Application because if the spouse’s own retirement benefit is larger or could eventually be larger than the spousal benefit, the Restricted Application allows his or her retirement benefit to be delayed, thus allowing it to grow by 8% per year until age 70.

File & Suspend and Restricted Application go hand-in-hand. When one spouse Files & Suspends at FRA so that the other spouse can file for spousal benefits, that other spouse must file a Restricted Application so that he or she will only receive spousal benefits at first, while allowing his or her retirement benefits to grow by 8% per year up to age 70. Without the restricted application, that spouse would receive the larger of the two benefits right away, and their retirement benefits would not grow at 8% per year until age 70.

What has changed, and why?

While the use of these two provisions – File & Suspend and Restricted Application – in order to receive spousal benefits while accruing retirement benefits was legal, the move was regarded by some as a loophole because it allowed married couples to receive additional cash while waiting for their retirement benefits to grow. For high-earning couples, the move could increase lifetime retirement benefits by as much as $60,000. While this is not currently a significant drain on the Social Security system (relatively few married couples have implemented this strategy to date because most didn’t know it was allowed), it was expected to gain momentum given that “the secret was out”. Had the provision not been phased out, it would have cost the Federal government billions of dollars as more and more baby boomer couples retire over the next decade and beyond.

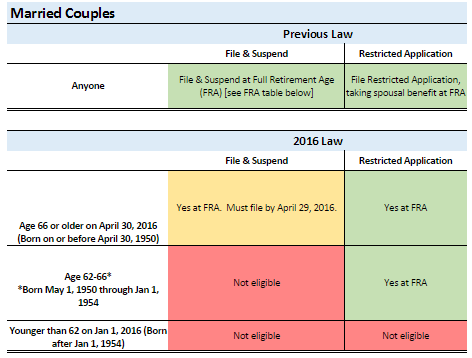

Under the new law, Social Security recipients born after January 1, 1954 will no longer be able to start with spousal benefits before switching to their own retirement benefits. They will only receive the larger of the two benefits starting from the time they file. After April 29, 2016, people will be able to claim spousal benefits only if their spouse is actually receiving Social Security retirement benefits. In other words, an individual may still File & Suspend (thus allowing his or her own delayed retirement benefits to grow by 8% per year until age 70), but not in order to allow their spouse to collect spousal benefits.

In addition (also starting April 30, 2016), someone who files and suspends at Full Retirement Age may not then seek a reinstatement of benefits that accrued during the period of suspension, should they determine later on that they are unlikely to reach their average life expectancy. They can resume their suspended benefits, but they would be able to receive benefits only effective with the month after the month the request for resumption of benefits has been received by SSA, and from that point forward. (This restriction applies to both single and married individuals.)

Congress approved the changes on November 2, 2015 and technically they go into effect on May 2, 2016, exactly six months after the passage of the law. However, April 30th and May 1st both fall on a weekend, when the Social Security Administration is closed. So, practically speaking, the law takes effect after Friday, April 29th.

What hasn’t changed?

A wage earner who is eligible to receive Social Security retirement benefits can still start receiving retirement benefits as early as age 62 (though in most cases, we would recommend waiting, as starting benefits at 62 would greatly reduce one’s benefit).

After Full Retirement Age, there is an 8% increase in benefits for each year one delays starting retirement benefits until age 70. For people currently aged 65 who are in relatively good health (i.e., they will likely reach their average life expectancy – currently approximately age 85 for men and age 87 for women), it is usually to their advantage to wait until 70 to start receiving their retirement benefits; their lifetime benefits are likely to be greatest.

Who will not be affected by these changes?

- If both spouses are already receiving Social Security benefits, they will not be affected by the new law.

- If a spouse has already Filed & Suspended their retirement benefits, and the other spouse is receiving spousal benefits, the new rules will not apply to them, either.

- A Social Security-eligible spouse who will have reached the age of 66 on or before April 29, 2016 can file and immediately suspend their retirement benefits, so that their spouse can file a Restricted Application in order to collect spousal benefits at FRA. It is important to note that the Restricted Application spouse must reach age 62 at or before the end of 2015, in order to be eligible to file a Restricted Application, but they wouldn’t actually file the application until they reach FRA. (Someone filing prior to FRA is required to take his/her own retirement benefit first before any spousal benefit will be paid. If the person’s own FRA benefit amount exceeds 50% of the spouse’s FRA amount, then there are no spousal benefits due. The person collects solely based on his/her own work record and, because he/she would be collecting prior to FRA, the amount would be reduced.)

Who is most affected by the changes to File & Suspend and Restricted Application?

Married couples for whom the lower earning spouse obtains age 62 after December 31, 2015 are out of luck. Moreover, even if the lower earning spouse is age 62 by December 31st, if the higher earning spouse reaches the age of 66 after April 29, 2016, the couple will not be grandfathered into the old law. More specifically, here is what happens if they miss these age milestones:

- After April 29, 2016, for a lower wage earner spouse to receive spousal benefits, the higher wage earner must be receiving their retirement benefits at the same time. In other words, the higher wage earner would need to “File” so that the lower wage earner can receive spousal benefits, but they would not be allowed to “Suspend”. Both spouses would receive their respective benefits simultaneously.

- If the lower earning spouse’s own retirement benefit is smaller than the spousal benefit, he or she can receive the (lower) retirement benefit before the higher wage earner starts his or her retirement benefit. The lower earning spouse can then receive the larger benefit (the spousal benefit) once the primary wage earner starts receiving his or her own retirement benefit (again, by Filing, but not Suspending). If the lower earner has started collecting his/her own retirement benefit prior to FRA, he/she will never receive the full 50% of the higher earner’s FRA amount. Once the higher earner starts to collect, the lower earner will be due additional money, but it will just be added on to the reduced benefit the lower earner is already receiving. The reduction continues to impact the payment.

- If the lower earning spouse’s retirement benefit is larger than his or her spousal benefit, that spouse will receive the retirement benefit (the larger of the two) when filing. And vice versa.

Putting it all together for married couples

The following table visually summarizes the changes to File & Suspend and Restricted Application as it pertains to married couples:

Other filing scenarios

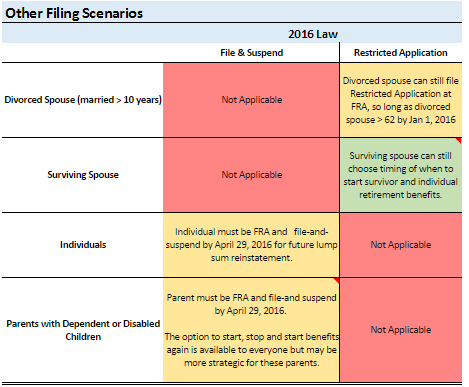

The majority of people affected by the new Social Security provisions in the Bipartisan Budget Bill of 2015 are two-wage earner married couples who do not reach a certain age by the timeframes outlined above. There are, however, other filing scenarios that may apply to you:

- Surviving spouses and surviving ex-spouses are not affected by the changes because File & Suspend and Restricted Application don’t apply to them. In the event that a surviving spouse or surviving ex-spouse (who was married at least 10 years, and who has remained unmarried until age 60) apply for “widow’s benefits” (a.k.a. Survivor Benefits), they can always receive the higher of 100% of the deceased spouse’s or ex-spouse’s retirement benefit, or their own retirement benefit. However, they have a choice about when to claim benefits. They can opt to receive a lower benefit prior to FRA and then switch over to the higher amount at that point or later. Still, they collect on one amount or the other at a time; not on both full amounts at once. The new budget legislation does not change these rules.

- For divorced individuals, the File & Suspend rule does not apply and never did. As for Restricted Application: if you are divorced and entitled to a benefit based on your ex-spouse’s earnings (i.e., you were married to that louse for at least 10 years and are currently unmarried), you can file a Restricted Application to receive spousal benefits while deferring your retirement benefits until 70, but only if you reach age 62 by the end of 2015. (Your ex-spouse need not have filed for retirement benefits yet.) Otherwise, you must receive the higher of your retirement benefit or the (ex-)spousal benefit at the time you file for benefits. In other words, you cannot file a Restricted Application.

- Individuals (whether married or single) who want to File & Suspend at FRA in order to have the option later on to request reinstatement of previous benefits (should they become seriously ill during the suspension period) must reach FRA and File & Suspend on or before April 29, 2016.

- A parent with dependent or disabled children must be FRA and File & Suspend by April 29, 2016 in order for those children to continue receiving a benefit while the parent has asked to have his/her payments suspended. The rules pertaining to this scenario are complex. If this applies to you, please contact your financial advisor to determine the best filing strategy.

Putting it all together for these other filing scenarios

In closing

The passage of the Bipartisan Budget Act of 2015 aims to close what the Federal government considers “loopholes” in the Social Security program. To be fair to people who are approaching filing age, the new legislation provides a 6-month “window” in which Social Security-eligible individuals, couples, surviving spouses / ex-spouses, and parents of dependent or disabled children who meet certain age milestones can be “grandfathered” into the old law.

If you meet the age criteria outlined above for the six-month transition period, you should carefully consider whether or not Filing & Suspending or filing a Restricted Application makes sense for you. Sensible Financial® stands ready to assist you in navigating the complex waters of Social Security so that you can maximize your lifetime benefits.

[i]Use the following table to determine your (and your spouse’s) Full Retirement Age (FRA)

[ii] Kotlikoff, Moeller, and Solman; Get What’s Yours, page 131; Simon & Schuster, 2015

[iii] Kotlikoff, Moeller, and Solman; Get What’s Yours, page 131; Simon & Schuster, 2015