Towards the end of 2021, President Biden and Congress tried to pass the Build Back Better (BBB) legislation. Many expected it to pass, but an agreement was not reached. Both the House and Senate versions of the bill included language that would end the ability to convert after-tax dollars in an IRA or 401(k) to a Roth IRA or Roth 401(k). After-tax contributions can be made to a Traditional IRA or 401(k) and are different from Roth contributions. After-tax dollars are not taxed upon withdrawal, but the growth of the after-tax dollars is taxed as ordinary income. To avoid tax on investment growth, it’s necessary to convert after-tax dollars to Roth dollars. For now, after-tax conversions are still allowed. In this article, I discuss why those who are inclined to make after-tax contributions and conversions should consider doing them early in the year.

What are Backdoor Roth and Mega Backdoor Roth contributions?

“Backdoor Roth” refers to an indirect method of getting additional after-tax dollars into a Roth 401(k) or Roth IRA. Direct contributions to Roth IRAs are prohibited for joint filers earning more than $214k or single filers earning more than $144k in 2022. Mega Backdoor Roth contributions allow those with significant saving capacity to get additional contributions into an employer 401(k) plan.

Let’s use an example: Jack and Jill are a married couple filing jointly and earn a combined $300,000 in W-2 wages and each have access to a 401(k) through their employer. Their Modified Adjusted Gross Income is more than the amount eligible to make direct Roth IRA contributions this year. They can each fund their 401(k) with pre-tax or Roth contributions as employees. Jack’s employer also allows after-tax 401(k) contributions and conversions. Jack and Jill do not have any other retirement plans outside of their 401(k).

Backdoor Roth contributions

Using the couple above as the example, Jack and Jill can each contribute $20,500 to their respective 401(k) plans in 2022. Jack and Jill have the capacity to save even more than they are putting in their 401(k) but cannot contribute directly to a Roth IRA because their income is too high. Jack and Jill can contribute $6,000 into Traditional IRAs. Because their income is too high, they are ineligible to take a tax-deduction for these IRA contributions. However, they can contribute their $6,000 to a Traditional IRA, and then immediately transfer (“convert”) the Traditional IRA dollars to a Roth IRA. Because no tax-deduction was taken for the IRA contributions, they are converting after-tax contributions and no taxes are due. This series of contributions and conversions is referred to as a Backdoor Roth contribution. Jack and Jill were able to get $6k each into a Roth IRA, even though their income was too high to directly contribute. Keep in mind that the tax-free transaction described above was possible because neither Jack nor Jill had pre-tax dollars in any IRA accounts before doing these transactions. If they had pre-tax dollars in any IRA account, their respective conversion of the after-tax “Backdoor Roth” would be partially taxable.

Mega Backdoor Roth

Jack and Jill might be able to put more money into their 401(k) using a Mega Backdoor Roth. They can if their employer allows after-tax employee contributions and in-plan conversions of the after-tax money into a Roth 401(k). Jack, for example, would first contribute $20,500 to his 401(k) as an employee (he could contribute either pre-tax or Roth dollars). He also contributes after-tax funds which do not reduce taxable income. He then converts his after-tax 401(k) dollars into Roth 401(k) dollars. Doing so is not a taxable event and he can withdraw future growth on those contributions tax-free in retirement. Many 401(k) custodians who allow after-tax contributions and conversions will have an option to automatically convert after-tax dollars (Fidelity is one example). Doing the Mega Backdoor Roth allows Jack to contribute up to $61k, including employer matching, to his 401(k) in 2022. Without a Mega Backdoor Roth option, Jack would save his extra funds to a brokerage account which pays tax on dividends and capital gains.

This is described in additional detail in this previously published Mega Backdoor Roth article.

Act early in 2022

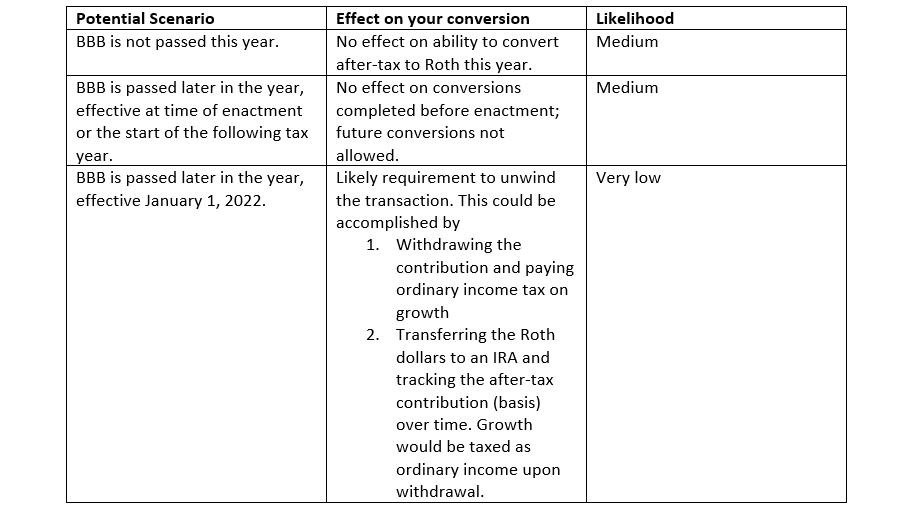

There is uncertainty whether BBB will pass this year or in the future. Below, I outline several potential scenarios and the effect they could have on a conversion of after-tax dollars.

Converting after-tax money earlier in the year gives you the highest probability of a recognized conversion. If the BBB legislation is enacted, waiting could result in the inability to convert the after-tax money. The risk of acting early is that a previous conversion could be retroactively disallowed and additional steps to unwind the transaction may be necessary. Even in this third scenario, the result is that you are likely no worse off than if you had saved the money to a taxable brokerage account or only funded a non-deductible IRA and had to track basis over time.

Please reach out to your advisor if you have questions about making Backdoor Roth contributions, or if you would like to discuss the timing of such contributions.

Sensible Financial does not provide tax advice. This article is not intended to provide and should not be taken as advice and is not specific to any individual taxpayer.

Photo by Cara Fuller on Unsplash