An Option for Turbocharging Your After-tax Retirement Savings

The IRS sets contribution “limits” on how much employees and employers can contribute annually to a retirement plan. For 2021, the elective deferral amount you are likely familiar with is $19,500 for a 401(k) ($26,000 for age 50+). Less known is the fact that the IRS allows total contributions up to $58,000 ($64,500 for age 50+). With certain 401(k) plan provisions, employees may be able to substantially increase retirement savings and allow for even more tax-free growth of savings. In this article, I will describe how a mega backdoor Roth works, the benefits and risks, and for whom this strategy is suited.

Important disclaimer – this article is for educational purposes only and should not be considered tax advice. Please consult your tax professional and plan administrator to understand your options and the tax implications of the decisions you may make.

Types of retirement plan contributions

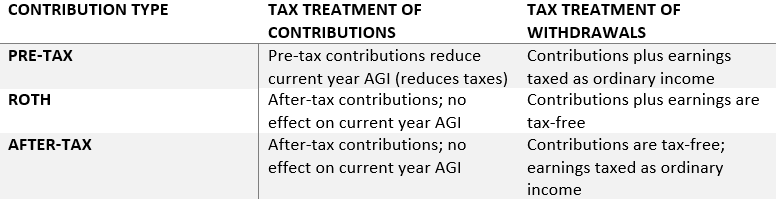

As an employee, you are faced with the choice of what type of 401(k) contributions to make. Depending on your employer retirement plan, you may have the option of making one or more of the following contribution types – pre-tax, Roth, or after-tax.

Pre-tax

These are traditionally the most common type of retirement contributions. Employees contribute pre-tax dollars and withdrawals are taxed as ordinary income. Earnings on pre-tax contributions accumulate tax-deferred. Unlike a Traditional IRA, there are no income limits on who can contribute to a pre-tax 401(k).

Roth

Employees contribute using after-tax dollars and future withdrawals are tax-free. Earnings on Roth contributions are also tax-free. Unlike a Roth IRA, there are no income limits on who can contribute to a Roth 401(k).

After-tax

These contributions are similar to Roth contributions in that they are made with after-tax dollars. Your contributions can be withdrawn tax-free in retirement. However, earnings on after-tax contributions are taxed as ordinary income when withdrawn.

What is a Mega Backdoor Roth and who is eligible?

Additional contributions

A mega backdoor Roth allows you to increase total retirement plan savings to up to $58,000 (or $64,500 if 50+) by making up to $38,500 in after-tax contributions in addition to your $19,500 (or $26,000 if 50+) elective deferral.

To take advantage of the IRS’s maximum savings limit, employees must contribute $19,500 as an elective deferral (either pre-tax or Roth contributions) and the employer must allow after-tax contributions.

Assuming your employer allows it, and you have saving capacity, making after-tax contributions to the 401(k) can provide additional opportunities for tax-deferred growth. The sum of the employee elective deferral, the employer matching contribution, and any after-tax contributions cannot exceed the $58,000 limit.

Rolling over or converting for tax-free growth

Tax-deferred growth on your after-tax contributions is beneficial, but what if there were a way to get tax-free growth instead? Well, there is, thanks to an IRS ruling from 2014. Plans that allow in-service distributions or in-plan conversions offer a way to get tax-free growth on after-tax contributions. Here is how the two options work.

In-service distributions, if available, allow distributions from a 401(k) prior to age 59 ½. The significance of this feature is that if the plan administrator tracks pre-tax and after-tax balances separately, you may be able to do a rollover of the after-tax portion of your account into a Roth IRA without paying tax. This allows after-tax contributions to grow tax-free within a Roth IRA as opposed to tax-deferred within the after-tax portion of a 401(k).

In-plan conversions are another way to accomplish the same thing. With an in-plan conversion, you convert after-tax contributions into the Roth portion of your 401(k), without rolling the funds out of the plan. Some plans even allow automating the conversions so that after-tax contributions are made, then immediately converted to Roth before any growth occurs. Immediately converting your after-tax contributions to Roth helps ensures that all future growth is tax-free.

Please see the risk section below, as these approaches can be very complicated and there is potential that you may owe tax on a portion of the distribution or conversion, depending on your current contribution sources and plan rules.

What are the benefits of the mega backdoor Roth?

The benefit to plans that allow after-tax contributions is that you can save above the maximum elective deferral amounts. This may allow for up to $38,500 of additional retirement savings per year, which would grow tax-deferred, or potentially tax-free if in-plan conversions or in-service distributions are possible. Combining additional after-tax saving with in-service distributions or in-plan conversions allows you to fully realize the benefits of the mega backdoor Roth.

These additional savings opportunities may allow you to turbo charge your retirement savings and may be advantageous compared to saving excess contributions to a brokerage account.

What are the risks?

Although there are significant benefits to being able to make after-tax contributions and having the earnings grow tax-free, there are also risks involved. Prior to engaging in these strategies, it is important to consult both your tax professional and plan administrator.

Depending on the types of contributions and earnings within the plan, you may owe taxes when you try to move the after-tax portion of the account to your Roth 401(k) or IRA. These rules can be very complex and specific to how the plan tracks the various balances.

Contributing additional after-tax savings to a 401(k) provides tax-deferred growth, but earnings will eventually be taxable as ordinary income upon withdrawal. After-tax brokerage account saving may provide a more beneficial tax-deferred (by buying and holding) opportunity as future capital gains are taxed at preferred rates. Without the in-service distribution or in-plan conversion provisions, you may want to forgo the after-tax contributions.

Finally, your employer’s 401(k) plan must meet nondiscrimination testing. This means that the plan must benefit all employees and cannot be too heavily focused among the ownership and highly compensated employees. If the plan is deemed to be too top heavy (60% of assets held by key employees), a portion of your after-tax contributions could be returned to help the plan comply with the testing rules.

Assuming plan eligibility, who should consider this Mega Backdoor Roth?

You may be a prime candidate for this strategy if you are already maxing out your elective deferral (at $19,500 or $26,000 if 50+) to either the pre-tax or Roth 401(k) and you are looking for additional tax-advantaged opportunities to save for retirement. Earners with higher income tend to be the ones with the capacity to save beyond the elective deferral limits.

If you are saving large sums of money each year in a savings or brokerage account after maxing out your elective deferrals, you should consider checking with your employer to see if after-tax contributions are available and whether you are permitted to make in-service distribution or in-plan conversions.

For help thinking about your saving capacity and how these strategies fit into your overall plan, please consult your financial advisor. Finally, please consult your tax professional and plan administrator to confirm your options and how they apply to your specific situation.

Photo by CHUTTERSNAP on Unsplash