In this article I will cover estate taxes and how trusts can reduce them. I will use examples to show what the estate tax is, how it is calculated, and how trusts fit into the picture. Please note, nothing in this article should be construed as legal or tax advice and is for informational purposes only. Always consult a qualified professional when making creating or making changes to an estate plan.

What is the estate tax?

There are many forms of taxes in life. FICA taxes, income taxes, sales taxes, and property taxes. The estate tax is perhaps the most misunderstood. This is not surprising. Most people have very little experience with the estate tax, and it may only come up with the death of a family member. Also, due to changes in the law (starting with the “Bush tax cuts” in 2001 through the Tax Cut and Jobs Act of 2017) very few Americans today have an estate tax issue.

Nevertheless, there are at least two reasons to spend time on this subject. One, the provisions of the Tax Cut and Jobs Act (“TCJA”), which created today’s estate tax exemption, is set to expire in 2026. At that point, the current approximately $13 million exemption would revert to its pre-TCJA levels, or about $5 million. Two, twelve states and the District of Columbia have their own state estate taxes. (You can find out more information about those state estate tax regimes here). The state exemption is lower (often much lower) than the federal amount. As of this writing, the state-level estate tax exemption in MA and OR is only $1 million.

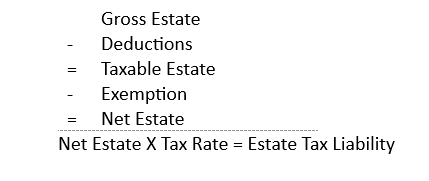

The estate tax is levied on a person’s estate (the sum of an individual’s real and financial assets) upon death. To calculate the estate tax, start with the gross estate (all property, excluding debt) and apply several adjustments. The first category of adjustments is deductions. This is a broad category that includes items such as funeral expenses, debts, transfers to a surviving spouse and charitable donations. The second category is the estate tax exemption. The exemption is to estate tax what the standard deduction is to income tax. Everyone gets to shield some amount of their estate based on the exemption amount in effect when they die. As of 2023, the federal estate tax exemption is $12.9 million. Reducing the gross estate by deductions and the exemption leaves us with a net estate to which some tax rate is applied. Or my oversimplified estate tax formula:

How To Reduce Estate Taxes

Estate planning may focus on maximizing deductions, the estate tax exemption or both. One common deduction is the charitable giving deduction. Adding the correct language to a will, trust and/or beneficiary designations reduces a taxable estate by the amount donated. Another (very) common way for married individuals to reduce an estate is by using the marital deduction. This deduction allows one spouse to transfer an unlimited amount of assets to a surviving spouse upon death. I’ll illustrate both deductions with an example.

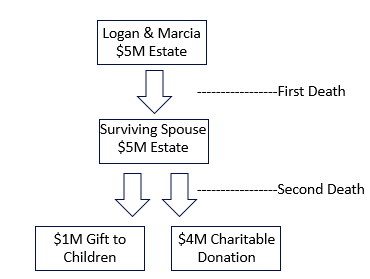

Logan and Marcia recently updated their estate plan. Their goals are to avoid paying any estate taxes, and to leave as much as possible to their children. Their attorney helps them draft a very simple estate plan with two provisions.

- Provision One: Whoever passes away first, transfer all property to the surviving spouse.

- Provision Two: Upon the surviving spouse’s death, transfer an amount equal to the estate tax exemption to our children and donate any remaining amount to our preferred charity.

The first provision takes full advantage of the marital deduction on the first spouse’s death to avoid any estate tax. The second provision ensures that as much money as possible passes to their children estate tax free, by fully utilizing the surviving spouse’s estate tax exemption, and then donating the rest to charity. Using a flow chart and some numbers makes it easier to understand how the plan works. Note – to make the math easier I assumed a $1 million estate tax exemption.

As planned, neither of their estates owes any estate tax. When the first spouse dies, everything passes to the surviving spouse tax free due to the marital deduction. When the surviving spouse dies, they make the largest possible tax-free gift to their children by using up the estate tax exemption ($1 million) and then donating the remainder of their estate ($4 million) to charity. This plan works, but it can be improved. Logan and Marcia could have given twice as much to their children without incurring any estate tax. This is where a trust helps.

What is a trust?

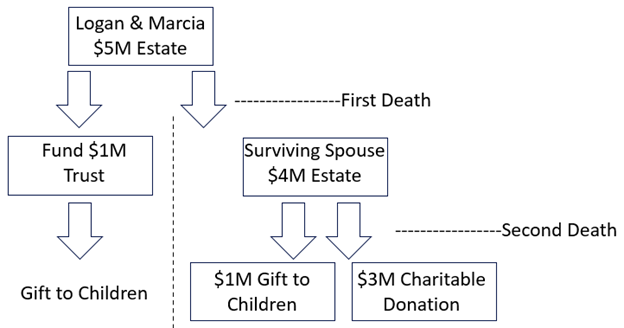

A trust is a legal relationship that involves three people: a grantor (person who funds the trust), trustee (person who manages trust) and a beneficiary (person who receives benefits from trust). A special type of trust known as an irrevocable trust is created when a grantor funds a trust and gives up control of the assets. A designated trustee manages the trust assets for the same beneficiary. Irrevocable trusts are used in estate planning because when you give up control of an asset, it is excluded from your gross estate upon death. (There are additional benefits to irrevocable trusts that are beyond the scope of this article). Let’s return to Logan and Marcia.

Their original estate plan did not take full advantage of their combined estate tax exemptions. They gifted $1M to their children when the second spouse passed, but they could have given twice as much if they utilized both spouse’s exemptions. One way to do this is to fund an irrevocable trust with the estate tax exemption amount at the first spouse’s death. The surviving spouse is often an income beneficiary for life and, in certain cases, can even access principal. This arrangement keeps the assets out of the surviving spouse’s estate, but also provides financial support. Upon the surviving spouse’s death, the irrevocable trust is outside of their estate and passes tax-free to their children. The second spouse gifts their exemption amount to the next generation. In Logan and Marcia’s plan, they gift any remaining amount to charity. This is what their updated estate plan looks like:

In Conclusion

Hopefully my simple example clarified how an estate plan that effectively utilizes trusts can reduce estate taxes. In the real world, these plans are much more complicated and depend on lots of different factors. If you are concerned you might have an estate tax issue or if you would simply like to better understand your situation, speak with your advisor and we are happy to discuss your financial plan with your attorney.

To learn more about estate planning, please see my earlier article, The Basics of Estate Planning as well as my webinars, The Basics of Estate Planning, Charitable Giving and Your Estate Plan, and my upcoming webinar, The Basics of Estate Planning Part 2: Saving on Estate Taxes with Trusts.

Photo by OPPO Find X5 Pro on Unsplash