Suppose a financial advisor told you about a financial product that would enable you to invest in the stock market without ever having to worry about poor investment returns, or losing your principal. Yes, that’s right. Invest in stock and bond mutual funds inside of this product, and, even if they tank, you won’t lose your principal. In fact, prior to drawing down the assets in retirement, your money is guaranteed to increase each year regardless of how your investments perform. Your investments do well? Great, your account balance increases. Your investments do poorly? No problem, your pot of money still increases.

Suppose a financial advisor told you about a financial product that would enable you to invest in the stock market without ever having to worry about poor investment returns, or losing your principal. Yes, that’s right. Invest in stock and bond mutual funds inside of this product, and, even if they tank, you won’t lose your principal. In fact, prior to drawing down the assets in retirement, your money is guaranteed to increase each year regardless of how your investments perform. Your investments do well? Great, your account balance increases. Your investments do poorly? No problem, your pot of money still increases.

Not completely sold yet? What if the advisor threw in a bonus incentive? When you eventually start drawing down the assets, you will never have to worry about running through your money prematurely. Even if you exhaust your assets before the end of retirement, you will continue receiving the same amount of income each month for as long as you live.

Still not ready to sign on the dotted line? If you decide at any time that this product is not for you, you can withdraw your money, even if you have already started drawing monthly income from the account. Not only that, you can arrange for the remaining account balance to pass to a beneficiary of your choice if you should die prior to depleting your account.

Almost there? At this point, one can imagine that the advisor might throw in a set of Japanese Ginsu knives, to seal the deal.

Too good to be true, you say? Well, the advisor is probably trying to sell you an Annuity with Guaranteed Minimum Withdrawal Benefits, or a GMWB annuity

Here’s how it works

First, a very brief refresher on annuities: An annuity is a contract you enter into with an insurance company that allows you (the “annuitant”) to deposit money (“the principal”) and defer taxes on the growth until you start receiving the money as income. An annuity has an accumulation phase and an income phase. The income could be received by pulling money out of the annuity on a regular or semi-regular basis, or by trading the entire asset for a lifetime stream of income. The tax treatment during the income phase depends on how you receive the money, as well as whether or not the principal has already been taxed prior to being deposited into the account. A “fixed” annuity guarantees a fixed growth rate each year while the money is still accumulating. A “variable” annuity is one in which the value of the account depends on underlying investments in the form of mutual funds (or “sub-accounts” in annuity parlance). A variable annuity’s account value is anything but guaranteed because it is based on stock (and bond) market performance.

A GMWB annuity has features shared by both a typical fixed and a typical variable annuity, plus some additional features common to neither. After depositing money into an account, the annuitant allocates the principal among a variety of pre-selected mutual funds. The annuity company maintains two separate account balances: the actual account balance, which reflects the investment performance of the mutual funds; and the “benefit base”, which will eventually be used to calculate how much money the annuitant can withdraw each month when he or she starts receiving income.

The benefit base works according to the following formula: If investment returns exceed a minimum guaranteed (i.e., fixed) annual growth rate — usually between 4% and 7%, depending on the contract – the benefit base will increase by the actual investment rate of return for that year. If investment returns lag the minimum guaranteed growth rate, the benefit base will increase by that guaranteed growth rate. At no time during the accumulation phase will the benefit base decrease (assuming you don’t take any withdrawals during this phase); it can only go up, even if the actual account balance tanks due to poorly-performing investments.

Therein lies the first guarantee: No matter how your investments perform, your benefit base (but not your account balance) is guaranteed to increase each year, at least by the minimum guaranteed rate. This, in turn, will increase the amount of money you can withdraw each month during the income phase.

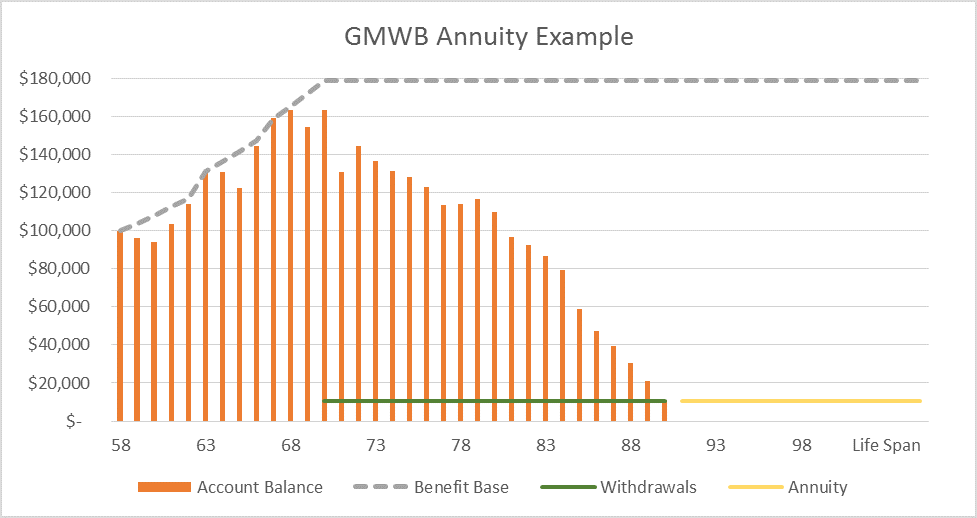

Here is how it looks, graphically:

In the above example, a 58-year-old enters into a GMWB annuity contract, deposits $100,000 into an annuity brokerage account, and invests the money. The account balance (shown in orange) fluctuates from year to year based on the performance of the underlying investments. The Benefit Base (shown by the grey dotted line) increases each year at the higher of the account balance growth rate or a contractual minimum guaranteed percentage (4% in this example). You can see that even though the investment returns falter on occasion, the benefit base keeps on increasing. And when the year’s performance exceeds 4%, the benefit base increases by the percentage rate of return on investments for that year.

At age 70 (in this example), the annuitant starts drawing money from the account. The monthly draws (the green line, shown in the chart as annual draws due to page space limitations) are a contractual percentage (6% in this example) calculated off the benefit base, not the actual account balance. However, it is the account balance that is drawn down each month. The account balance fluctuates each year during the income phase based on a combination of investment performance and the monthly draws. In this example, the account balance never exceeds the benefit base once withdrawals start at age 70, but if it did, the benefit base would increase to match the account balance, and the resulting withdrawals would increase as well, because they are calculated off the benefit base. In other words, the withdrawal percentage remains the same – it’s contractually based – but the actual dollar amount withdrawn each month increases if the benefit base increases.

Now, here’s the second guarantee: Should the account balance ever go to zero (in the above example, it is depleted by age 90), the insurer is on the hook to provide a monthly income stream (shown in yellow on the chart) that will continue for the life of the annuitant. The amount of income will be equal to the most recent withdrawal amount just before the balance was exhausted. The income stream will continue as long as the annuitant lives.

The third guarantee pertains to the account balance during both the accumulation and income phases. If the annuitant should die at any time before the account balance goes to zero, the beneficiaries will receive the higher of the remaining account balance or some other amount specified in the contract (the terms vary from contract to contract). Once the account is depleted, the beneficiaries would get nothing at the death of the annuitant.

Safety from a volatile stock market – guaranteed! An ever-increasing benefit base, resulting in higher monthly income – guaranteed! A death benefit for your loved ones, should you die prematurely – guaranteed! And the ability to cancel the product at any time and take the remaining account balance with you! What’s not to like?!

So, should you scrap your current portfolio in favor of a GMWB annuity (and the Ginsu knives)? Well, maybe you should wait until you read my answer in next month’s newsletter.