In last month’s newsletter, I described a product called a Guaranteed Minimum Withdrawal Benefit (GMWB) annuity, and I gave an example of how it works. A GMWB annuity is one of several types of products that more broadly fall under the name, Guaranteed Minimum Living Benefits. Each type of product in this category works in a slightly different way. However, they all share the common objective of providing a guaranteed amount of income during retirement. GMWB annuities are underwritten by insurance companies and sold by commissioned agents or brokers.

In last month’s newsletter, I described a product called a Guaranteed Minimum Withdrawal Benefit (GMWB) annuity, and I gave an example of how it works. A GMWB annuity is one of several types of products that more broadly fall under the name, Guaranteed Minimum Living Benefits. Each type of product in this category works in a slightly different way. However, they all share the common objective of providing a guaranteed amount of income during retirement. GMWB annuities are underwritten by insurance companies and sold by commissioned agents or brokers.

The GMWB concept is very attractive to nervous investors, as well as to people who are concerned about outliving their assets: deposit some of your hard-earned money in a GMWB annuity account; invest it in stock and bond “sub-accounts” (the annuity version of mutual funds); and watch it (hopefully) grow. The insurance company will maintain two account balances: the actual account balance, which is a direct reflection of how the sub-accounts perform over time; and an alternate account balance (think “alternate reality”) called a Benefit Base. The benefit base will grow each year at a pre-determined minimum guaranteed growth rate, or it will increase to match the actual account value if the value is higher than the benefit base in a given year. During the “accumulation” phase, the benefit base will never decrease as long as you don’t withdraw money prematurely.

When you eventually start drawing down the asset during the “draw-down” or “income” phase, the insurance company will multiply a predetermined withdrawal rate times the benefit base to determine the dollar amount you are permitted to withdraw each month from the account. The monthly withdrawal amount will remain constant for the duration of the contract. If you happen to run through the money before the end of retirement, the company is on the hook to provide you a monthly income (a life annuity) equal to your previous monthly draws, for as long as you live. If you die before exhausting the asset, you can leave the remaining account balance to your beneficiaries.

In summary, a GMWB annuity provides a guaranteed income stream for life and a death benefit for your loved ones should you die prematurely before exhausting the assets. You can also cancel the product at any time and take the remaining account balance with you!

So, what’s not to like?!

Well, plenty. The main problem with these guaranteed living benefit products is that they are very expensive. A typical GMWB annuity contract will get you coming and going with fees.

- First, let’s consider the Mortality, Expense, and Administrative (ME&A) fee, which can run 1% to 1.5% per year, on average.

- Then, there are the Guaranteed Minimum Withdrawal Benefit and Guaranteed Death Benefit fees. You want to be protected from a downturn in the market and make sure your heirs receive something if you die prematurely? You have to pay for it. These fees are usually between 1% and 2% per year (though some companies offer a “free” basic death benefit).

- Finally, the fees on the underlying investments are usually between 0.2% and 2.0%. Our experience has been that they tend to average 1% for a typical portfolio.

All in, annuitants typically pay between 3% and 4.5% annually for the privilege of holding a GMWB annuity contract. They don’t get a bill for these charges; the fees come right out of the account. Most annuitants do not even know how much they are being charged. As a result of all these fees, it is uncommon for the account balance to influence the growth of the benefit base (beyond the guaranteed minimum annual growth rate). Moreover, the fees continue throughout the draw-down period, as long as there is a non-zero account balance. For some perspective, consider an investment portfolio that earns, on average, a 5% annual return before fees. If you hold one of these annuities, and it charges 4% per year in fees, then your average net annual return on investment is only 1%. Basically, the company is siphoning off 80% of your return in fees each year!! (Advanced math. Don’t try this at home.)

If that weren’t enough, some companies impose hefty surrender charges (perhaps as much as 8% or 9%) if you purchase the product and then decide to cancel it. The surrender charge schedule can last as long as 7 or 8 years, with the charges gradually decreasing to zero. Whether you keep the contract or surrender it, the insurer and the agent who sold it to you will get their money.

Hold on a sec, you might say. Yes, the GMWB product has high expenses, but let’s not forget that the benefit base increases automatically even if the returns on investment are not so great. Well, that’s true. However, the contractual withdrawal rate is often low enough that the account balance rarely goes to zero. So, you are less likely to receive the life annuity the insurance company is on the hook for if the account is fully depleted.

A less expensive alternative that will secure a lifetime income stream

If what you really want is a lifetime stream of income that will continue as long as you live, a Deferred Income Annuity (DIA) may be a better alternative than a GMWB annuity. A DIA purchased with money in retirement accounts goes under the name of Qualified Longevity Annuity Contract, or QLAC for short. A DIA or longevity annuity works as follows: you give an insurance company a non-refundable amount of money (the “Principal”), and in return, the company promises to pay you a monthly income later in life, for as long as you live. You get to choose the payment start date, not to exceed age 85. (But you buy the contract now.) The main difference between a DIA and a GMWB annuity is that with a DIA you lose control of the asset as soon as you enter into the contract, so it is no longer available to be drawn down. You just receive a lifetime income stream at an agreed-upon start date.

Let’s explore an example in which the 58-year-old investor whom I introduced in my first article invests a portion of his $100,000 asset in a DIA instead of a GMWB annuity. And let’s assume that he wants a lifetime income stream of approximately $10,000 per year (~$833 per month) to start when he is 85. That is the age he is most concerned he could run out of money. Because the start date is so far out, he is able to purchase this contract for just under $18,000, less than one-fifth of the amount of money he would have used for the GMWB annuity for a similar income stream later in life. (A DIA is also less expensive than a GMWB annuity because it is a simpler product with fewer guarantees.)

After he buys the annuity, he has $82,000 remaining to invest in a more traditional way. So, let’s assume that he invests the 82 grand in a conservative mix of stocks and bonds (mostly bonds) that has an expected net return of 4% per year (after much lower expenses, say 1%). As in the previous article’s example, he wants to start drawing down his investment account at age 70, at a rate of approximately $10,000 per year.

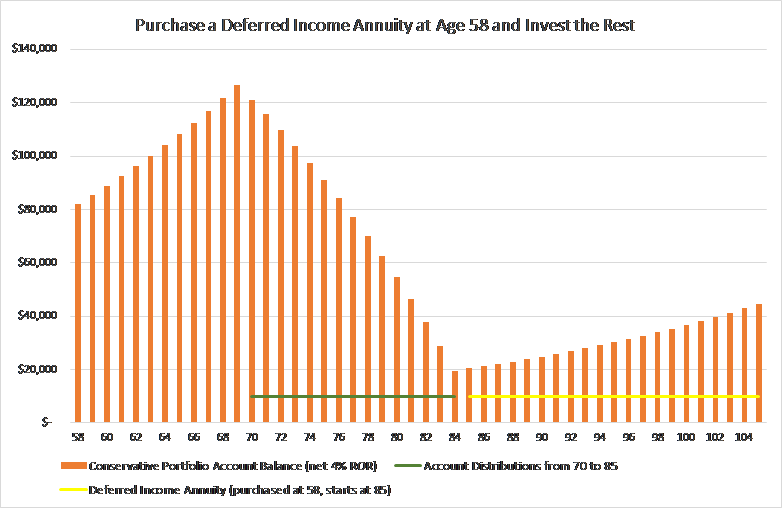

Here is how it looks, graphically:

At a modest 4% return, our investor is able to draw his $10,000 per year (shown here in green) starting at 70 and stretch out his investments (shown here in orange) until around the time his DIA kicks in at age 85 (shown in yellow). Once the annuity income starts up, he shuts off the asset draws and lets his investment account continue to grow. By the end of retirement, he would have built up a legacy that is worth almost half of his original $100,000 principal.

I should emphasize that this approach is not a sure bet. Even a conservative portfolio can lose value. Unlike with a GMWB annuity, there is no guarantee that the investor will have the income he desires every year from ages 70 to 84. However, since the portfolio is conservatively invested, that may be a risk the investor is willing to take.

What should you do if you already own a GMWB annuity?

These products are designed to appeal to investors. They sound great during the sales presentation, and the expenses are frequently hard to identify and understand. Many people have bought annuities with guaranteed benefits, and you may be one of them.

If you are, the first thing you should do is determine if you really want and need more guaranteed income. While this might seem like a no-brainer (who wouldn’t want guaranteed income?), some people have enough income from other predictable sources, such as pensions, rental income, and Social Security that they do not need additional guarantees. Some folks also have a high enough net worth that they could weather large fluctuations in the stock market without jeopardizing their current living standard. So, if you don’t really need the income guarantees offered by this type of product, you should strongly consider getting out of it immediately. (To borrow an expression from the game of Monopoly, “Do not pass go. Do not collect $200.”) Even if there are hefty surrender charges, it may be best to get out now, to avoid future expenses.

If you want the income guarantees and have been carrying the product for several years (i.e., you are out, or almost out, of the surrender charge period), then the decision whether or not to exit is not as straightforward. You may be close to retiring, and you’ve already paid a lot of money for the guarantees in the product (sunk costs are sunk). If the benefit base is large, and the account value is small, you might be eligible for lifetime income that is large relative to the assets you could withdraw if you cancel the contract. In other words, if the guaranteed withdrawal dollar amount is competitive with other commercial income annuities, it might be worth staying with the product.

How to win BIG with GMWB annuities

- Be sure future income is your objective.

- Enter into a GMWB contract, and then have your investments tank.

- Live a really long time.

Just make sure your crystal ball is in good working order before signing the contract.