Clients sometimes ask Sensible Financial, “We will need more income over the next few years. Should we change our portfolio to be an income portfolio?”. The suggestion is that perhaps there are different types of investments that should be used if income is required. It is a very reasonable question and relates to a style of investing called “growth and income investing”.

To understand growth and income investing, one needs to know that in general, investment returns come from two sources.

- Income: Typically, interest or dividends paid to owners of the investment

- Capital appreciation or depreciation: Changes in the value of the investment

Growth and income investors select some investments because they generate current income from interest or dividends, and others because they have good prospects for long-term capital appreciation (growth). These investors would select a mix of these investments based on their need for current income or long-term growth.

Total return investing

At Sensible Financial, we recommend a different approach, known as total return investing. With that approach, the investor selects investments based on risk-adjusted expected return, irrespective of whether the return is likely to come from interest and dividends or from capital appreciation. Required withdrawals from the portfolio are accomplished from either dividends and interest and/or from selling shares.

Growth and income investing

Growth and income is a simple and appealing idea, which involves living off the income and not touching principal. However, the approach suffers from practical problems. For one, few investors have large enough portfolios that they can (or wish to) live only off the income. In retirement, they will either need to use some of the principal or reach for securities with especially high income. This raises a problem for those (like Sensible Financial) that believe the investment markets are efficient. The “invisible hand” of the market allocates capital across investments in a way that maximizes the market’s view of total risk-adjusted returns. Deviations from that allocation, by definition, either reduce return or increase risk relative to the market portfolio.

Investors that require a lot of income might over-allocate to income-producing investment categories. These include real estate, high-yield “junk” bonds, longer-duration bonds, emerging market bonds, or dividend-paying stocks. By doing so they would be less diversified than the market portfolio, under-allocating their investments to other areas and reducing their expected risk-adjusted return.

A second flaw in the growth and income approach is the preference for income from dividends or interest. Within retirement accounts such as IRAs or 401(k)s, all income is taxed in the same way. However, outside of these tax-advantaged accounts, capital gains are taxed differently (usually at a lower rate) than ordinary income such as some dividends or interest. It can be more tax-efficient to source cash for withdrawals by selling an appreciated security than by receiving interest or certain dividends. That means paying capital gains tax only on the appreciation rather than paying ordinary income tax on the entire amount.

Income investing vs. the lifetime balance sheet

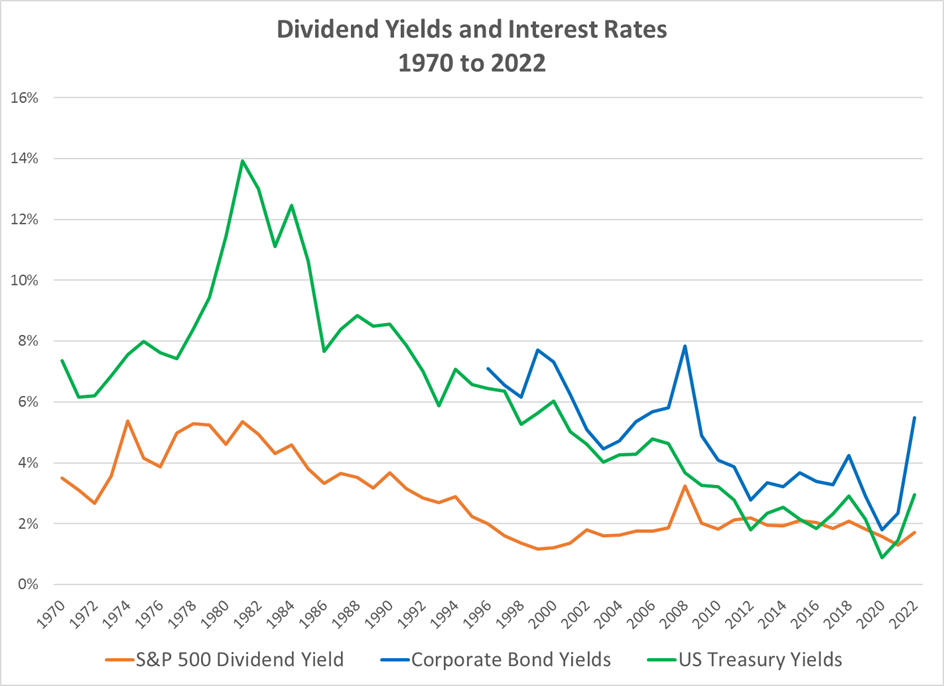

A further challenge with income investing is that income is only a portion of a security’s total return. Strictly following an income investing approach would lead one to reduce spending when interest rates are low and increase spending when interest rates are high. Advisors at Sensible Financial find that people like to maintain smooth living standards over time. They base their living standard on their lifetime balance sheet (or lifetime budget), rather than changing their household budget every time there is a change in interest rates. In fact, strictly following an income approach to budgeting can lead to some surprising outcomes. There have been periods when dividends and interest rates have declined (for instance, 1980 to 2020 – see chart below), while total returns have been very strong. This can lead to reductions in spending, even while a portfolio is growing. In 2022, interest rates rose but asset values declined. These investors would have enjoyed greater spending freedom but would have been withdrawing at a relatively high rate from their portfolios. Decoupling spending from income, and instead using a sustainable rate based on total returns and one’s lifetime balance sheet would likely smooth the ride.

Sensible Financial’s advisors follow a total return approach, investing without regard to yields and sourcing cash for withdrawals from whichever source is available — interest, dividends, or security sales.

By contrast, we believe it makes sense to look at things like income and potential for capital appreciation when deciding which investments to place in which types of accounts (sometimes called “asset location”). However, that is a topic for another article.

Please contact your advisor if you wish to discuss this topic further.

Photo by imso gabriel on Unsplash