Budgeting is something that few people enjoy. Simply hearing the word may cause you to imagine clipping coupons or, worse, being out of a job. Many people believe that if you have enough resources, budgeting is a choice rather than a necessity. In what follows, I’ll explain why everyone already has a budget (whether they’ve made the conscious choice to have one or not) and illustrate how you can utilize this budget as a valuable financial planning tool.

You already have a budget

Fundamentally, you can’t spend over your lifetime more than you have in resources. This simple, yet informative, observation highlights the fact that your lifetime spending must exactly equal your lifetime resources. This means that everyone has a budget, whether you know it or not. It’s your lifetime budget.

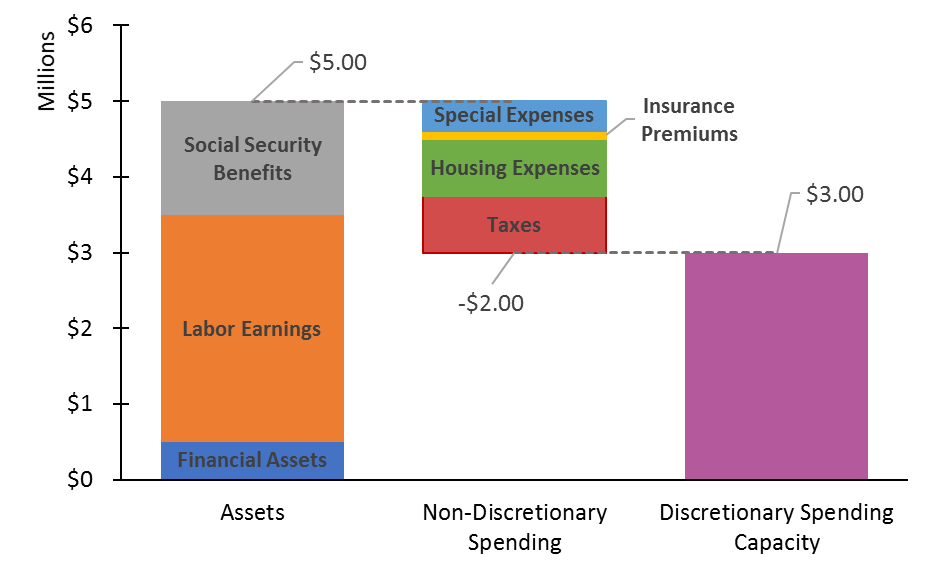

Consider the hypothetical lifetime balance sheet of Wanda Worker.[1] On the asset side of her balance sheet, Wanda has $500k of financial assets (her current savings), $3m of future labor earnings, and $1.5m of future Social Security benefits.[2] Adding up her lifetime assets means that Wanda will have $5m to spend over the remaining years of her life.

On the liability (or spending) side of her balance sheet, Wanda has both non-discretionary and discretionary spending. Non-discretionary (or “off-the-top”) spending includes taxes, housing expenses, outstanding liabilities or debt, insurance premiums and any other planned (or “special”) expenses. Wanda is obligated to pay taxes, her mortgage and utilities, to repay any loans, and is committed to paying insurance premiums and other planned expenditures such as graduate school tuition and weddings for her children, major home renovations, and new car purchases.

Whatever lifetime assets Wanda has left over after covering these off-the-top expenses will be available to support her lifetime discretionary spending. Discretionary spending supports her living standard, such as outlays on food, clothing, travel, leisure and entertainment. If we assume Wanda has $2m of future non-discretionary spending (say, $750k for taxes, $750k for housing, $100k for insurance and $400k for other special expenses), her lifetime capacity for discretionary spending is $3m (i.e., $5m minus $2m).

Figure 1 provides a graphical representation of Wanda’s lifetime balance sheet. From left to right, you have Wanda’s lifetime assets ($5m), her non-discretionary spending ($2m) and her resulting capacity for discretionary spending ($3m). This means Wanda can spend no more than $3m to support her living standard over the remaining years of her life.[3] [4] If this sounds like a budget, it is! It’s Wanda’s lifetime budget.

Figure 1. Wanda’s lifetime balance sheet. The difference between her lifetime assets and non-discretionary spending is her lifetime budget (or capacity) for discretionary spending.

How to live within your lifetime budget

You can learn a lot by thinking through your lifetime balance sheet. Importantly, you can develop a good sense of how much you’ll have in lifetime financial resources to support your living standard. For example, if your goal is to smooth your annual discretionary spending from now through the end of retirement, you can use your lifetime balance sheet to estimate your maximum annual budget for discretionary spending.[5] A single person, with no dependents, can divide their lifetime budget (or capacity) for discretionary spending by the remaining years of their life.[6] For example, if Wanda is single and expecting to live another 50 years, a rough estimate of her annual budget for discretionary spending is $60k ($3m divided by 50 years).[7]

This can be extremely helpful in developing an annual spending and saving plan. Specifically, you can assess whether you can afford your current discretionary spending from a lifetime perspective. For example, if Wanda is currently spending $100k a year on discretionary spending, we can say that she can’t support this level of spending through the end of her retirement (unless, unfortunately, the end of her retirement comes sooner than expected). In fact, for every year she spends $100k, she’ll have to reduce her future lifetime spending by a total of $40k (i.e., $100k mins $60k).

To sustainably support this higher level of spending ($100k a year) Wanda would need to increase her lifetime income and/or adjust her non-discretionary spending, if possible. She could retire later, switch to a more remunerative career if possible, or access home equity later in life.[8] Any of these would increase the lifetime assets on her balance sheet, increasing her capacity for lifetime discretionary spending. Wanda might also be able to reduce her non-discretionary spending. She could commit fewer resources to graduate school tuition, weddings, home renovations, and/or car purchases. These would decrease the lifetime liabilities on her balance sheet, increasing her capacity for lifetime discretionary spending.

Lifetime budgeting is about prioritizing

As Wanda Worker’s situation highlights, your lifetime balance sheet illustrates the impact on your living standard of various financial decisions you make over the course of your life.[9] If you want to retire early and maintain your current living standard, your lifetime budget can tell you if you’ll need to take that higher paying job or hold off on purchasing that vacation home. If you want to switch to a less remunerative job, your lifetime budget can tell you how many additional years you may need to work or how much less you’ll have to spend on college tuition and home renovations. If you want to increase your charitable giving, send your children to private school, or provide financial support to a family member, your lifetime budget can tell you how much additional saving you’ll need to do or if you’ll need to tap home equity later in life.

This may not seem like budgeting at all. You might think of budgeting as strictly a method for monitoring your cashflow. This is indeed an important component of your budget (and one I plan to address in future articles). However, focusing solely on cashflow may cause you to miss the forest for the trees. Your lifetime budget offers you a thirty-thousand-foot view of your financial life. It allows you to put the big financial decisions in your life (e.g., those around work and family) in the context of your capacity for discretionary spending. From a lifetime perspective, this means budgeting is about prioritizing, not simply monitoring cashflow.

Think of it this way. Your lifetime budget tells you how much you can afford to spend on your living standard given the broad financial plans you outline for your future. How you then choose to spend that money is up to you. This is where having annual discretionary spending and saving targets (a budget in the more classical sense) can help to keep you on track. For example, if you consistently over- or underspend your target you may need to adjust the broad financial plans implicit in your lifetime budget.

Conclusion

As I’ve just shown, you already have a budget—your lifetime budget. Simply put, you can’t spend over your lifetime more than you have in resources. This means budgeting is much more than simply tracking your spending. It’s about prioritizing the big financial decisions in your life.

Write down your priorities and life goals. Talk with your family and friends about them, and use them to sketch out a simple lifetime balance sheet. You might even create multiple balance sheets to help you illuminate the trade-offs underlying some important financial decisions you may make over your lifetime. Think of this process as designing a rough financial plan for the rest of your life. Yes, it will be wrong. No one can perfectly predict the future. But all financial plans are wrong. It’s the process of planning, prioritizing your life, and thinking about your lifetime budget that is essential. With a plan, you’ll have much more freedom when it comes to making the big financial decisions in your life.

To speak with an advisor about planning for your financial future, contact us!