Strategies for Maximizing Your Charitable Giving Tax Benefit

This is Part 2 in the charitable giving series. Part 1 described how charitable giving can reduce your tax liability by avoiding capital gains tax, increasing deductions, or lowering taxable income. This article will introduce strategies and vehicles that allow you to take advantage of these charitable giving tax benefits.

Avoiding capital gains tax: Vehicles that facilitate donations of highly appreciated assets

Donor Advised Funds

A Donor Advised Fund (DAF) is a special type of account established through a public charity. Taxpayers who contribute appreciated assets, such as stock, avoid capital gains on the donated asset and can take a charitable deduction at the time of the transfer to the DAF. After the initial contribution, the account owner(s) make charitable distributions, known as “grants”, from the DAF to their preferred charities.

Other vehicles for charitable giving

There are other vehicles that facilitate donations of highly appreciated assets such as Private Foundations, Charitable Remainder Trusts (CRT) and Charitable Lead Trusts (CLT). Private Foundations provide the added benefit (among others) of allowing donations to support individuals for specific purposes (such as to improve a skill or talent). CRTs and CLTs offer you the opportunity to receive income from the trust either immediately following the donation (CRT) or after a period of time (CLT). However, these vehicles are generally more complicated and expensive to operate than a Donor Advised Fund.

Many households are no longer able to itemize deductions after the Tax Cut and Jobs Act. However, it may be possible to reduce taxes by increasing itemized deductions through bunching contributions or reducing gross income through Qualified Charitable Distributions.

Increasing itemized deductions: bunching donations

Donor Advised Funds provide an additional tax planning opportunity. “Bunching” multiple years of donations into one tax year may allow you to itemize rather than take the standard deduction thus turning an otherwise nondeductible charitable gift into an itemized deduction. .

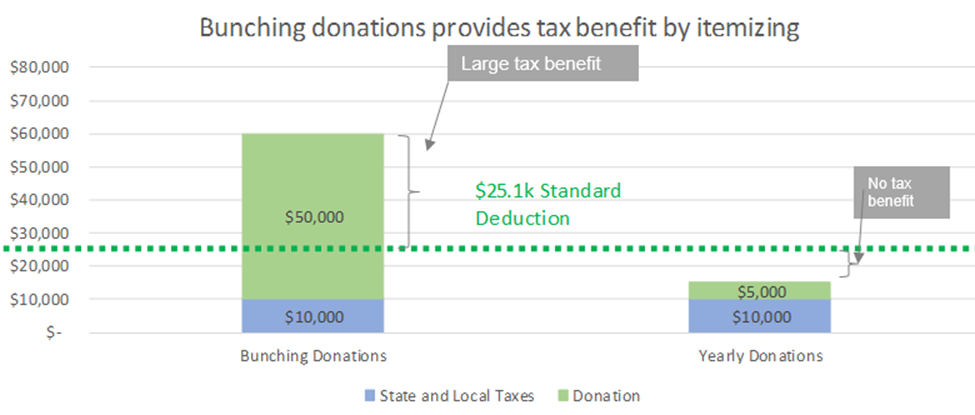

In my first article I described how you may not receive a tax benefit if you take the standard deduction and donate cash (depending on the size of your donation). For example, a married couple filing jointly who has $10k in other deductions and makes a $5k charitable donation would not reduce their tax bill. That is because total itemized deductions of $15k is less than their standard deduction, or about $25k in 2021.

However, if instead you “bunched” 10 years of gifts (or $50k) into one DAF contribution, the donation would increase your itemized deductions to $60k ($50k donation plus $10k in other itemized deductions) in the year of the Donor Advised Fund contribution. Therefore, bunching multiple years of donations into one year allows you to itemize (as itemized deductions exceed the standard deduction).

While donating $5k per year would not provide any tax benefit when gifted annually (see article one), bunching ten years of gifts does provide an additional tax deduction of about $35k ($60k in itemized deductions minus $25.1k you would receive if you took the standard deduction in 2021). You can read more about the benefits of “bunching” donations here.

You could choose to give multiple years of gifts directly to the charity and benefit from the bunching strategy. However, some may wish their charities to receive regular grants rather than one large donation every few years.

Donor Advised Funds not only allow you to benefit from the bunching strategy, but also to distribute the donation over time as desired. That is because you receive the tax deduction when you contribute to the Donor Advised Fund and then recommend grants to charities from your charitable account in subsequent years (with some time constraints which will be discussed in future articles).

Reducing taxable income: Qualified Charitable Distributions

If you are over 70 ½, the IRS allows you, within certain limits, to make distributions directly to charities from your Individual Retirement Account (IRA) without paying tax on the distribution. These are called Qualified Charitable Distributions (QCDs).

Unlike regular cash stock donations, QCDs not only reduce your taxes if you itemize, but also if you take the standard deduction. Distributions (to charity) that would have otherwise been taxable at ordinary income rates are excluded from your adjusted gross income. As discussed in article one, reducing gross income decreases taxable income and therefore tax liability.

In future articles, I will provide more detail on Donor Advised Funds and Qualified Charitable Distributions.

The information in this article is not intended as tax advice. Sensible Financial does not provide accounting or tax services. You should consult your tax professional before making any decisions.