Giving to a cause you care about feels good. By donating to a nonprofit, you might fund school supplies for needy children, help endangered species survive, or support survivors of a natural disaster. You probably know charitable giving can also reduce the amount of income tax you pay. But did you know charitable giving can be a beneficial part of your estate plan? Read on to learn how and why you might want to incorporate charitable giving in your estate plan.

Estate planning is a complex topic. If you’re interested in adding charitable giving to your estate plan, speak to your estate attorney about whether it makes sense for you.

Why would you incorporate charitable giving into your estate plan?

Incorporating charitable giving into your estate plan can help you in a few ways.

- Reduce estate taxes: Charitable giving can reduce the size of your taxable estate, so you pay less in taxes.

- Prevent premature depletion of assets: Saving large charitable gifts until after your death gives you a safety net for unexpected expenses.

- Lead to better planning outcomes: It’s best to consider all options when planning your estate. Being knowledgeable about charitable giving helps you make informed decisions.

Charitable giving strategies in your estate plan

Reducing your taxable estate

Let’s start with estate tax. Estate tax is a tax the government collects from the net value of a deceased person’s estate (all the property and money the person owned) after they die, but before their heirs inherit the estate. Estate tax exemptions are like exceptions. They determine who gets to pay less (or no) estate tax. For example, the federal estate tax exemption is $12.92 million per person. That means that if you die with less than $12.92 million in your estate, the federal government won’t take out any estate tax. Some states have their own estate taxes and exemptions. In Massachusetts, the per-person state estate tax exemption is $1 million.

If you want less of your estate to go to estate tax, you can make your taxable estate smaller. One way to do this is to set up charitable gifts through a will or trust. Other things that reduce your taxable estate include funeral expenses, debts, and transfers to a surviving spouse.

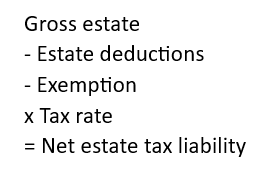

Estate taxes, like income taxes, are levied against the net value of the estate. In practice, it’s a complex calculation. But it’s simple to summarize.

To calculate the tax savings of a charitable gift, multiply the value of the gift by the tax rate.

Planning to balance lifetime resources and expenses

Sensible Financial thinks about financial planning as balancing your lifetime resources and expenses. We want to help people live within their means. With charitable giving, you have the option to give throughout your lifetime, or to give at the end of your life through an estate plan. Delaying some charitable giving until after you pass away has resource-balancing advantages.

- Spending at the “sustainable” level means assets last for life. At a sustainable level, you spend your assets down over time, so they last for your expected maximum lifespan.

- Higher spending can deplete assets prematurely. Pushing spending until after your death means you won’t run out while you’re alive.

- Less flexibility makes it harder to adapt to life’s surprises. If you give a lot to charity now, you can’t take those gifts back. You might deplete assets you’ll need later for unexpected expenses.

Taxes are complicated. Estate planning is complicated. Thinking carefully about your goals and working closely with your advisors is more likely to produce better outcomes.

Examples of charitable giving in an estate plan

If you choose to add charitable giving to your estate plan, there are a few ways to go about it.

- Name a charity in a will or living trust. This is the simplest option.

- Make a specific bequest

- Name a charity as a residuary beneficiary (the person or entity who gets everything left over after the rest of your will has been executed).

- Designate a charity as a beneficiary on a retirement account or life insurance. Naming a charity as a direct beneficiary of an account ensures they will receive the account value in the future. Contractual accounts like these typically bypass probate:

- IRAs

- Life insurance

- Transfer-on-death accounts

- Use a special trust to gift to charity. There are two types of irrevocable trusts you can use for this.

- With a charitable remainder trust, you receive income, on which you can claim an income tax deduction. The rest of the trust will go to your chosen charity when you pass away.

- With a charitable lead trust, it’s the other way around. The income goes to the charity you choose, and the rest goes to a non-charity beneficiary you choose, like one of your heirs.

Should charitable giving be part of your estate plan?

There are many potential benefits to incorporating charitable giving into your estate plan. Your giving strategies can range from the simple to the complex.

Don’t forget that charitable giving is just one part of your estate plan. Because estate planning is so complex, it’s important to work with professionals. Ideally, they should work with each other. If you have an estate lawyer and a financial advisor, make sure they’re communicating!

If you have questions about estate planning, Sensible Financial is here to help. Contact one of our experienced financial advisors.

Estate planning is a complex subject. If you’d like to read or watch more on the subject, please see the article, The Basics of Estate Planning or webinars, The Basics of Estate Planning, and The Basics of Estate Planning Part 2: Saving on Estate Taxes with Trusts all by Frank Napolitano. This article is based on Frank’s webinar, Charitable Giving and Your Estate Plan.

Photo by Jess Bailey on Unsplash