In my last article on banks and banking, I described the disconnect between the risk inherent in bank deposits and depositors’ perceptions of that risk.

In the case of SVB (Silicon Valley Bank), depositors started to withdraw deposits in search of higher deposit interest rates. SVB had to sell securities at a loss to repay those depositors. Many of SVB’s remaining depositors feared SVB wouldn’t be able to pay them back and “ran” (took their money out of the bank). SVB was in big trouble.

SVB’s liabilities were larger than its assets. If it sold all its assets, it wouldn’t have enough to return depositors’ money and pay off all its other loans. The Federal Deposit Insurance Corporation (FDIC) stepped in, closed SVB, and promised that all depositors (including those with uninsured deposits) would get all their money back.

Banks have failed many times before, and our country has created two basic solutions.

Two approaches to protect depositors from risk

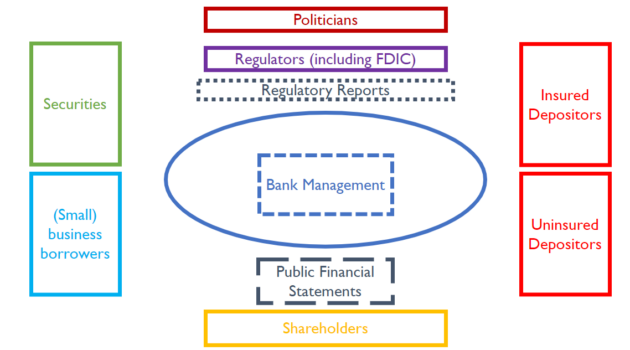

Deposit insurance

- Federal Deposit Insurance, funded by the banks themselves, promises that insured depositors will lose nothing if their bank fails.

- This is supposed to protect (small) depositors against loss.

- It is also expected to make bank runs and “contagion” (runs against one bank expanding to many banks) less likely.

- In addition, we (as a society) expect uninsured depositors to monitor their bank’s solvency and reduce their deposits if they become concerned. This is supposed to encourage banks to take less risk. Banks earn less profit if their deposits shrink.

Bank regulation

- Banks are subject to rules (Dodd-Frank is the latest version) designed to protect against insolvency.

- Several government organizations, including the Federal Reserve and the FDIC, supervise banks:

- Watching the banks closely to be sure they follow the rules.

- Insisting that risky banks change their behavior to become less risky.

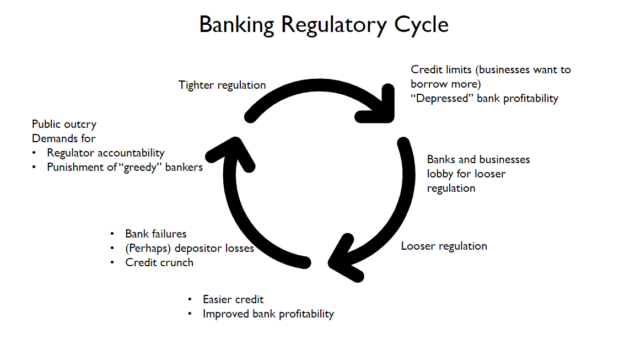

This diagram includes both approaches.

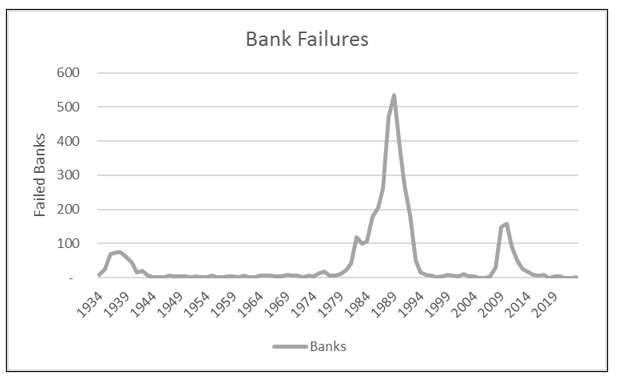

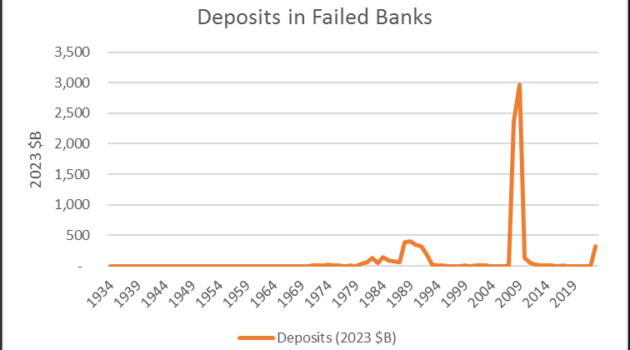

Our country has progressively improved both deposit insurance and regulation, since the Great Depression in the 1920s and 1930s. Nevertheless, bank failures continue. The graphs below show the history, including large numbers of failed banks and dollars of deposits affected by the Savings and Loan crisis of the late 1980s and the Great Financial Crisis of 2007-2009.

How can this be? What could possibly go wrong?

Our simple diagrams don’t capture the powerful incentives the participants face:

- Bank management and shareholders make more money if the bank is more profitable.

- The bank is more profitable if:

- Depositors receive lower interest rates (which they may accept if they believe the bank is safer or if the bank offers especially convenient services).

- Borrowers pay higher interest rates (which they must if they are riskier).

- Bank management and shareholders lobby politicians and strive to influence regulators for

- More deposit insurance – which reassures depositors and makes them willing to accept lower interest rates on their deposits.

- Weaker regulation – which allows banks to make riskier loans (and increases the risk of major losses and insolvency).

- Small business owners lobby politicians for access to capital.

- Tight regulation restricts capital access.

- Loose regulation makes loans easier to get.

- Taxpayers and citizens (not shown) complain to politicians if they must pay higher taxes to “bail out the banks” when they fail.

- Uninsured depositors cannot carry out their disciplinary function – they do not have access to timely, accurate information on bank solvency. (In the SVB case, the regulators had much better information than the uninsured depositors but took no action.)

The fundamental instability of banking, the regulatory and deposit insurance “solutions,” and the incentives they create produce a cycle of tightening and loosening regulation.

This arrangement has evident flaws. Maybe, however, it’s the best we can do if we want to avoid losses.

I tend to doubt that. The world has changed a lot since banking was invented.

I believe we could do much better if we focused on our primary objectives for the banking system and redesigned the system to accomplish those objectives using all the tools now at our disposal.

The solution begins with recognizing that bank lending (to small businesses, homeowners, etc.) is risky. Depositors should be able to choose what kinds of loans they want to fund and should knowingly bear the risks of those loans.

Banks could still offer demand deposits with minimal risk of default. We could simply require that banks offer money market mutual funds to their demand deposit customers.

Banks could raise money for (riskier) lending to businesses and consumers from other sources. Specifically, banks could lend their equity capital and then sell their loans for packaging into securities just as they do with car loans and mortgage loans today. The people and companies that buy those securities would know the risks they are taking.

We’d still see profits and losses in the financial sector, but the winners and losers would know the risks. No surprises. No bank runs.

Depositors would be taking a small amount of risk – the prices of their money market mutual funds might fall from $1.00 to $.99, say. Their risk of significant losses (say, more than 1%) would be vanishingly small.

We wouldn’t need deposit insurance, as depositors are bearing that small risk of loss.

Current borrowers would still be able to borrow, but lenders would be more aware of the risks they are taking to receive those higher interest rates.

I’m not holding my breath waiting for this solution to materialize. Larry Kotlikoff proposed this idea in his book Jimmy Stewart is Dead several years ago, and it is not in the policy conversation.

What can you do if the government can’t eliminate risk, no matter how hard it tries, no matter how earnestly it promises?

- Understand that life, financial products, and financial services are risky. The best regulation illuminates and clarifies risks but cannot eliminate them.

- Strive to understand the risks behind the financial products and services you use to limit and manage them effectively. For example, make sure your bank deposits are insured and that you understand the risks and potential rewards of your investment portfolio.

Banking is not the only example of the unintended consequences of trying to eliminate risk instead of recognizing and highlighting it. I will come back to the broader subject soon.

This article appeared originally in Forbes.com.

Photo by Stoica Ionela on Unsplash