In December, I wrote an article on Estate Planning Feedback from Our Clients, based on a client survey we undertook last year. This is the follow-up article where we share insights from that survey about how our clients work with accountants.

The role of accountants in financial planning

Accountants serve as important advisors, preparing tax returns and providing guidance on tax matters. Like financial planners (such as Sensible Financial) and estate attorneys, they handle confidential information from clients and offer advice for important financial matters.

The relationships can be very transactional – annual preparation of a tax return for a fee – but for some, the relationship is broader and more consultative. An accountant’s up-to-date technical knowledge is important, as are their organizational skills, and judgment. In some, but not all situations, interpersonal skills are also critical.

Who uses an accountant?

Our survey had 77 household responses that named a specific accountant – thank you if you were one of the contributors! Unlike the estate planning survey, we also had 18 responses of “we do our own taxes” or “TurboTax”.

That is one of the “ah-ha’s” from our survey: about 20% of respondents do their own taxes. This is notable because Sensible Financial clients typically hire professionals to save themselves time, access expertise that they may not have, and obtain peace of mind.

Among those who do work with an accountant, we learned that, similar to our estate planning findings, there are many accountants and firms represented. Of the 77 respondents who listed an accountant, 65 different names were mentioned, across almost as many firms. The accountant mentioned most frequently appeared seven times in the responses, and another accountant at his firm was mentioned twice.

It should be noted that this accountant is someone that we refer clients to, so it’s not surprising to see him well-represented in the responses. No other individual was listed by more than two households.

Services beyond tax preparation

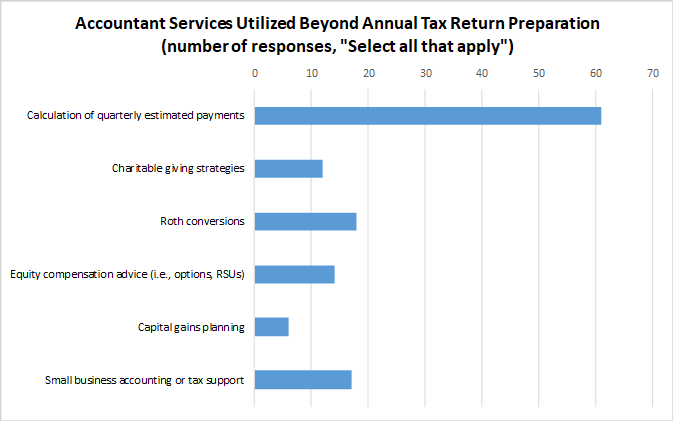

All respondents use their accounting firm for annual tax return preparation. Many of our clients also utilize other services from accountants, as shown in the following chart. From experience, we know that several of these areas are ones in which our clients also work with Sensible Financial in conjunction with their accountant.

Client satisfaction and areas for improvement

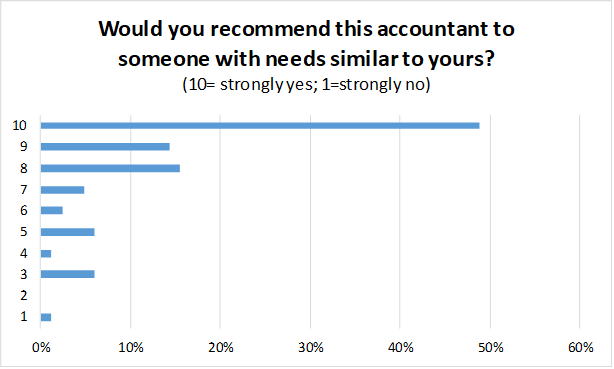

We asked clients, “Would you recommend this accountant to someone with needs similar to yours?”, on a scale of 1 (“strongly no”) to 10 (“strongly yes”). 79% of respondents who use an accountant provided a rating of 8, 9, or 10, while 8% provided a low rating of 1 to 4.

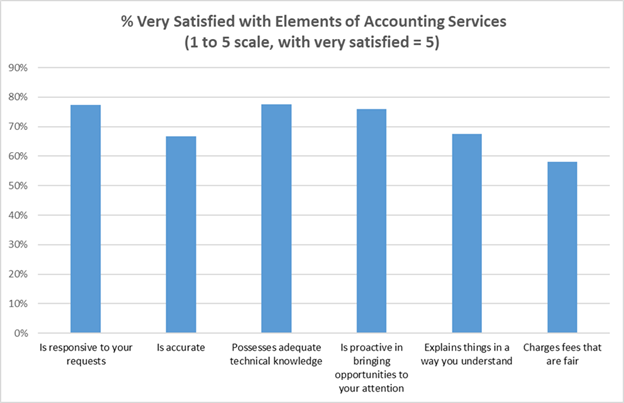

We also assessed client satisfaction with aspects of the service we consider important. Across most of those factors, 65% to 80% were “very satisfied”. Three dimensions stood out for lower ratings: “Is accurate”, “Explains things in a way you understand”, and “Charges fees that are fair”. Even when including “somewhat satisfied” responses, these categories did not reach 80% satisfaction. These seem like areas for improvement for some accountants.

What clients appreciate

It was a pleasure to read some of the nice comments about accountants:

- “___ has been very generous in helping us with IRS filing issues and was extremely effective in helping us to quickly reach resolution. His work has been accurate and timely.”

- “___ is very efficient and prompt in preparing our taxes.”

- “___ does a great job for us. He explains well and has a lot of experience.”

- “___ has great personality and is fun to work with.”

However, a few comments suggested dissatisfaction – timeliness, occasional errors, and one about an accountant who was receiving commissions on insurance products sold by a financial advisor they had referred to.

We also heard comments from clients who had switched firms, and that certainly can be done. There are benefits to staying with the same firm, as they get to know you and have access to all your old data, but some of our clients switched accountants and are happy that they did.

Choosing the right accountant

Overall, the survey shows that there are many qualified CPAs providing excellent service, from annual tax preparation to broader financial consulting. Working with a large, nationally known firm is not necessary for most people. Instead, what matters most is responsiveness, accuracy, and communication style.

We recommend that you collect recommendations from those you trust, and then select an accountant with whom you feel comfortable. If you have questions or wish to discuss your accounting needs, please contact your advisor.

Photo courtesy of Mikhail Nilov on Pexels