Estate planning attorneys play an important role, helping us prepare for the time when we are not able to manage our financial affairs, and ultimately, ensuring that our wishes are carried out when we have passed. They cover many sensitive and important topics. It is a role that demands technical knowledge, but also good people and administrative skills.

As financial planners and investment advisors, we work with these professionals from time to time, and our clients sometimes ask us for referrals. We do form impressions of estate planning attorneys based on our interactions with them, but our view is incomplete. We see them as they do certain parts of their work, and we see their written output, but we do not always see them from our clients’ perspective. To fill this gap, we conducted a survey of our clients to find out what they thought. This article reports on what we learned.

Many responses and many estate planning attorneys

We had 91 responses – if you contributed, thank you! One of the most striking things we saw in the survey data is how many different attorneys and firms our clients use. Across those 91 survey responses, there were 68 different firms represented. The firm that was most frequently mentioned works with only six households in the survey sample. Looking across our client base where, in most cases, we know who the estate planning attorney is, we see a similar story. There are many estate planning firms and practitioners out there. It is not one of those professions where only large firms can succeed.

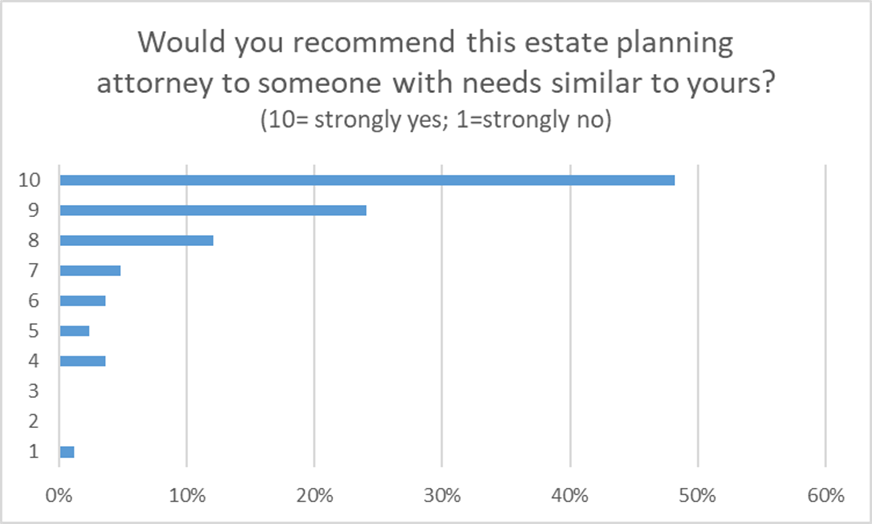

As for success, we do not have visibility into whether the firms are profitable, though they must be “profitable enough” since they stay in business (many clients report relationships of more than ten years). However, based on the survey, we can say something about a different aspect of success – client satisfaction – measured by one’s willingness to recommend. When asked, “Would you recommend this estate planning attorney to someone with needs similar to yours?”, 84% rated their willingness to recommend as an 8, 9, or 10, based on a one to ten scale with 10 meaning “strongly yes” and 1 meaning “strongly no”. Only four responses gave a 1 to 4 rating.

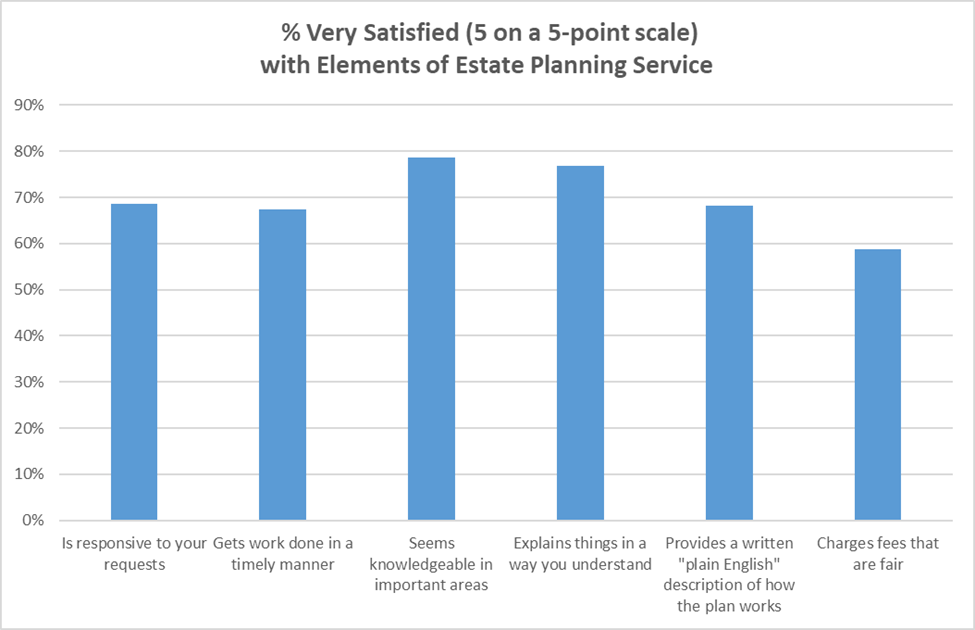

In addition to asking about willingness to recommend, we asked about satisfaction with things we see as important in an estate planning attorney. Overall, across most attributes, most clients are quite satisfied with their estate planning attorney, as the following chart illustrates.

In addition to the quantitative survey questions, we requested qualitative feedback on the attorneys. Most of the responses involved preferences for communication style, such as “explanations were too simplistic”, “rather brisk and formal”, or “good for those that prefer simplified step-by-step explanations”. These observations were very valuable, though they were widely varied – no generalized pattern emerged.

The value of long-term relationships

One type of qualitative comment does merit mention, where the attorney had retired or moved out of state. Typically, families need estate planning assistance episodically over many years, either for occasional updates or when something changes in their life situation. Starting with a new attorney can be costly and time-consuming. Thus, hoping for a very long-term relationship is reasonable. When selecting an attorney (especially if selecting a solo practitioner), one should think about that lawyer’s anticipated longevity in their role and inquire about succession plans.

In summary, the survey and our professional experience leads us to believe that there are many excellent estate planning attorneys available, including many that are solo practitioners or in small firms. A lot of what distinguishes them is their responsiveness, communication style, and “bedside manner”. When selecting an attorney, it can be helpful to get a referral from a trusted friend or advisor. It is also reasonable to request an introductory meeting with an attorney before committing to an engagement with them. This will allow you to assess their communication style and whether it feels like a comfortable relationship could develop. In that meeting you could ask about the types of clients they serve, their process, their fees, and the deliverables that you can expect. One deliverable we highly recommend is a plain English document that specifies how the estate plan works and how it should be implemented. This can include retitling of accounts and changes to beneficiary designations.

If you have questions or wish to discuss your estate planning needs, please contact your advisor.

Photo by Nguyen Dang Hoang Nhu on Unsplash