This is the first in a series of several articles analyzing investment performance over the first two decades of the 21st century.

This article originally appeared in Forbes.com.

We’re halfway through 2020. Instead of writing a top ten list or a best of the 2000s, I wanted to dig deeper and learn what I could from the past twenty years of investment history.

I looked at the last two decades of dividends to see what insights I could gather. The time period roughly coincides with Sensible Financial’s history, as we began work in April of 2002. I discovered some fascinating things.

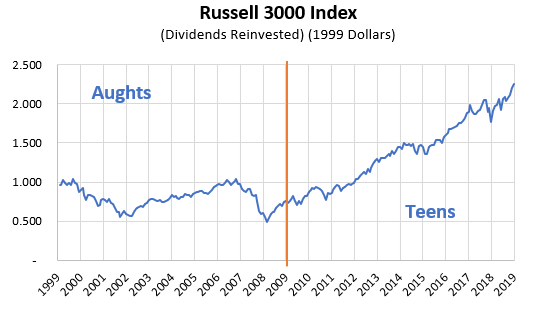

The Russell 3000 index in the chart illustrates the performance of the US stock market in the 2000s and 2010s. The 2000s (the aughts) saw two major US stock market declines – the bursting of the internet bubble from 2000 to 2002 and the Great Recession/Great Financial Crisis from 2007 to 2009. The 2010s (the teens) offered excellent stock returns, but in three of the ten years, the stock market declined and there were extended periods of flat returns as well as sharp dips in 2011 and 2018.

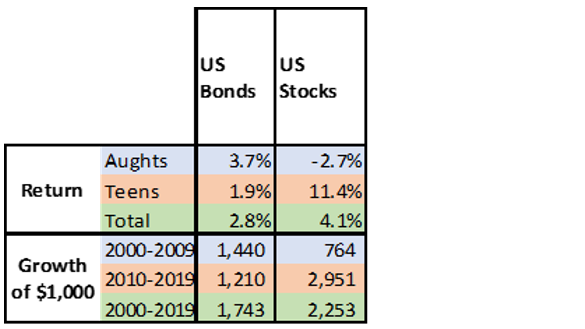

US Bonds upset US Stocks in the aughts

Bonds are the largest asset class alternative to stocks. In general, bonds are less risky than stocks, and we expect stocks to outperform bonds. That didn’t happen in the aughts. Two large stock market declines in close succession contributed to a “lost decade” for stocks. The geometric mean for US stocks (the Russell 3000) was -2.7% in the aughts. That is, if you had started with $1,000 on January 1, 2000 and earned -2.7% each year for ten years, at the end of 2009 you would have had the same $764 you would have gotten from investing in stocks over the same time. On the other hand, had you invested $1,000 in US Bonds at the beginning of the aughts, you would have earned a geometric mean return of 1.9%, and ended up with $1,440. Bonds outperformed stocks by almost double.

So, why not switch from stocks to bonds?

Because the teens would have been a tough decade for you. In the teens, stocks crushed bonds — geometric mean returns in stocks were 11.4% per year versus 1.9% in bonds. Starting with $1,000 in bonds at the beginning of 2010, you would have had $1,210 at the end of 2019, while the same investment in stocks would have produced $2,951!

Stocks beat Bonds from 2000 to 2019, but not by much

Looking at the whole 20 years, $1,000 invested in 2000 would have grown to $1,743 in bonds and $2,253 in stocks by the end of 2019. Over a 20-year period, the equity risk premium — the advantage of stocks relative to bonds — was a mere 1.3% per year (4.1% for stocks vs 2.8% for bonds). You might wonder if it was worth the agita.