TIPS (Treasury Inflation-Protected Securities) combine the lower risk traits of bonds with a buffer against inflation, making them an attractive option for retirement funding. They can provide predictable income at minimal risk. These Treasury bonds protect investors against surprise inflation. Their principal or face amount adjusts to maintain purchasing power in the event of inflation. That said, there are different methods of holding TIPS.

Is holding laddered individual TIPS bonds better than holding a TIPS index fund?

In most cases,

- Holding bond index funds is more efficient than holding individual bonds.

- However, ladders of individual TIPS bonds support accurate asset liability matching. TIPS index funds do not.

- TIPS index funds hold TIPS of many maturities.

- Selling TIPS index funds means selling TIPS bonds years before they mature.

- If interest rates differ from when the TIPS were issued, the TIPS price will differ from face value.

- This is the source of the asset liability mismatch.

- TIPS ladders can reduce the risk of funding retirement spending relative to TIPS index funds.

A natural question about TIPS is how to hold them. One can hold individual TIPS bonds or a TIPS mutual fund.

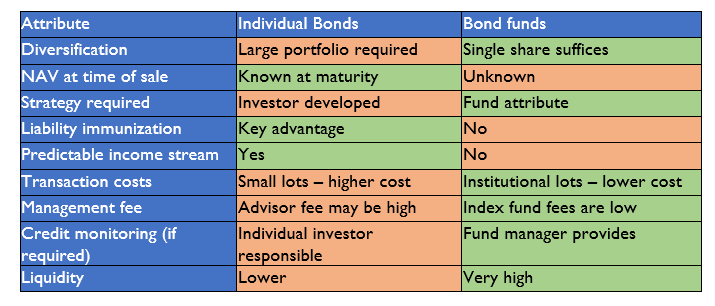

Whether to hold individual bonds or a bond mutual fund is an old question. There’s broad agreement about when individual bonds are best, and when a fund is best. The text box lists the pros (in green) and cons (in red). NAV stands for net asset value.

Clearly, if an investor wishes to hold the same bonds in the same proportions as the mutual fund holds, the mutual fund has the advantage. However, if an investor holds bonds in amounts matched to planned spending year by year (this approach is called laddering – with each year as a “rung” on the ladder), their bond holdings will almost certainly differ from the holdings of the mutual fund.

If we are thinking about a TIPS ladder (as opposed to, say, a portfolio of individual corporate or municipal bonds), most of the bond fund advantages are small or non-existent.

- Diversification for risk reduction has little impact – the bonds in the fund will be TIPS, too.

- Unlike corporate or municipal bonds, TIPS require minimal credit monitoring (the US government is a very low risk borrower).

- Since the ladder investor plans to hold these bonds to maturity, liquidity is a secondary consideration.

Example: TIPS Laddering vs Index fund

The US Treasury issues TIPS bonds in 30-year maturities. To keep things simple, we will assume that these bonds pay interest once a year on January 15th (In fact, TIPS pay interest semi-annually). Enhancing the model to recognize this complexity would not change the results.) Each year’s bond is issued on January 31st and matures on January 15th 30 years later. Thus, for example, TIPS issued on January 31, 2030 will mature January 15, 2060.

One of the key advantages of TIPS is protection against surprise inflation. However, we will assume that inflation is 0% throughout our example to highlight the advantages of laddering TIPS. Incorporating inflation would not change our conclusions but would make the example much more complicated.

It is 2030. Sally and Cindy intend to retire at the end of 2059, when they each turn 70. Each is planning to live through her 99th year, 2089. Each earns $60,000 per year. Each wants smooth spending for the rest of her life.

The only difference between Sally and Cindy is how they plan to fund their spending after they retire.

- Sally plans to build a TIPS ladder, buying bonds in 2030 that mature in 2060 to fund her 2060 spending, bonds in 2031 that mature in 2061 to fund her spending in that year, all the way up to 2059, when she’ll buy bonds that mature in 2089.

- Cindy plans to fund her retirement spending by buying TIPS index fund shares every year with her savings. The bonds in the TIPS index fund will be slightly different from year to year. For example, when Cindy buys the index fund in 2030, it will hold bonds maturing from 2031 to 2060. When she buys bonds in 2059, it will hold bonds maturing from 2060 to 2089.

The real interest rate, 1%, stays the same from 2030 through the end of 2059, when Sally retires. Thus, every TIPS bond that Sally buys for $1,000 will pay $10 of interest each year until it matures.

We also assume that the real interest rate has been 1% since 2001, when the first TIPS in the TIPS index fund Cindy buys in 2030 were issued. Thus, every TIPS bond in the index fund is also priced at $1,000 and will pay $10 of interest each year until it matures.

It turns out that, based on these assumptions, both Sally and Cindy can spend $34,445 per year, every year. Sally can buy individual TIPS in a ladder to accomplish this, while Cindy buys her TIPS index fund. Each can continue to spend that amount throughout her retirement if interest rates do not change from 2060 through 2089.

Holding differences

We also assume that the Treasury issues the same number of TIPS bonds each year. Then the index fund will hold all “live” TIPS (the ones that haven’t matured yet) in equal proportions. Because interest rates do not change while Sally and Cindy are working, the values of the TIPS do not change – they are always worth $1,000 apiece.

In 2030, Sally will buy bonds issued in 2030 to start her TIPS ladder. In each year from 2031 to 2059, Sally receives interest on the TIPS she holds, and buys bonds issued in that year. On the other hand, Cindy buys shares of the TIPS index fund in 2030. Just like Sally, in each year from 2031 to 2059, Cindy receives interest from her TIPS index fund, but she uses her savings to buy more TIPS index fund instead of individual TIPS.

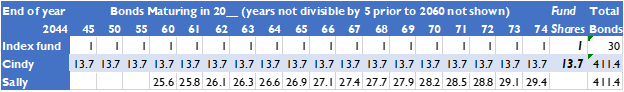

At the end of 2044, here are their holdings, showing only the years divisible by 5 before 2060:

As the chart above shows, Cindy holds bonds that mature every year from 2045 on. Sally’s bonds begin maturing in 2060, the first year she’ll need to use her investment assets.

Cindy’s index fund portfolio has half its holdings in bonds that mature before 2060, from 2045, 2046, 2047, etc. up to 2059. Sally’s ladder portfolio holds more bonds maturing each year from 2060 to 2074, and the number of bonds increases slightly as maturity year gets later. Cindy’s portfolio holds the same number of bonds maturing each year.

Both portfolios hold the same number of bonds – 411.4 – and have the same value – $411,400 (each bond is worth $1,000).

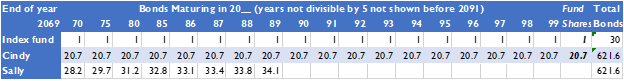

If interest rates don’t change, here is what the portfolios will look like at the end of 2069, ten years into retirement, now showing only the years divisible by 5 before 2086:

Since Cindy’s index fund portfolio holds a third of its holdings in bonds that mature after 2089, from 2090 up to 2099. Sally’s ladder portfolio holds more bonds maturing each year from 2070 to 2089 than Cindy’s does, and her number of bonds increases slightly as maturity year gets larger. However, Sally holds no bonds that mature after 2089, the last year of her plan, whereas Cindy holds 20.7 bonds that mature in each of 2090, 2091, all the way up to 2099.

Just as before, both portfolios hold an equal number – 621.6 – of bonds and have equal value of $621,600 (each bond is worth $1,000).

Cash Flow Differences

Sally and Cindy will fund their retirement spending somewhat differently.

- Each will receive interest from every bond in her portfolio.

- Interest alone will not be enough to cover their planned spending.

- Sally will receive the principal from maturing bonds.

- Cindy, holding a mutual fund, will not receive any principal.

- She will have to sell shares in her mutual fund.

- Effectively, she will sell bonds of every maturity in the mutual fund.

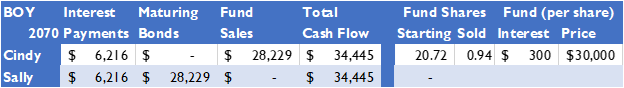

- In 2070, both Cindy and Sally will receive interest from the bonds they held at the end of 2069.

- Sally will also receive principal payments from her bonds maturing in 2070.

- Cindy will sell some of her mutual fund shares.

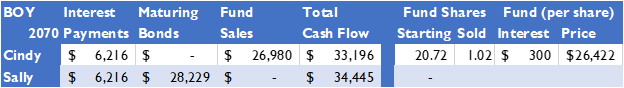

BOY is short for Beginning of Year.

Impact of interest rate changes

Now suppose that the interest rate changes from 1% to 2% at the beginning of 2070.

- Interest payments from Sally’s bonds and Cindy’s mutual fund holding will not change.

- Sally’s 2070 bonds will still mature and pay her $1,000 per bond.

However, the price of the TIPS index mutual fund will decline to $26,422 as the prices of all bonds maturing after 2070 decrease.

Cindy must reduce her spending to $33,196, whereas Sally can continue to spend $34,445 as before.

Cindy will sell 1.02 shares of the fund after the interest rate increases, whereas she planned to sell .94 shares if the interest rate stayed at 1%. Cindy recognizes that the interest payments on her mutual fund will increase slightly each year as new bonds paying 2% replace maturing bonds that paid 1%. After 2070, she’ll receive more interest each year, and she won’t need quite as much cash flow from fund sales.

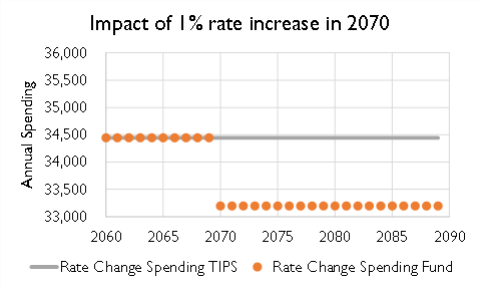

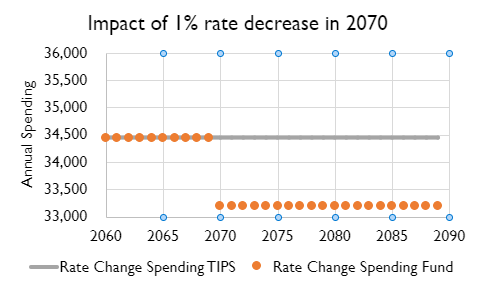

In general, Sally’s TIPS ladder strategy has lower spending risk than Cindy’s index fund approach. Whether interest rates rise or fall, Sally’s spending is unaffected, while Cindy’s falls if interest rates rise, and rises if they fall. The next two charts show the impact of one-time interest rate increases and decreases on spending for Sally’s TIPS ladder strategy (TIPS) and Cindy’s index fund strategy (Fund).

Spending for Sally’s ladder strategy doesn’t suffer if rates rise, but it doesn’t benefit if rates fall, either.

Sally’s ladder strategy matches real cash inflows with planned real cash spending year by year. Interest rate changes affect the present value of her real cash inflows and the present value of her real cash spending by exactly equal amounts. That is why her spending is not affected by interest rate changes.

In contrast, Cindy’s index fund strategy holds bonds with interest and principal payments that come due after Cindy’s last planned year of spending. Interest rate increases reduce the present value of her cash inflows by more than they reduce the present value of her spending. Before the interest rate increase, spending and inflows were in balance. After the increase, Cindy will be short, and she’ll have to reduce her spending.

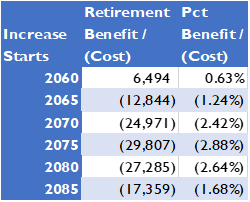

The timing of interest rate changes matters.

If an increase occurs very early in retirement, Cindy is actually a little bit better off. The higher interest rates she receives on bonds added to the index fund later in her retirement offset the immediate decline in the value of her index fund holdings. An increase right in the middle of retirement imposes the largest cost.

The table above summarizes the impact on Cindy’s ability to spend throughout her retirement of a 1% increase in interest rates depending on the year of the increase. An increase in 2060 increases her spending throughout her retirement by nearly $6500, or about .63% of total retirement spending. An increase in 2075 reduces retirement spending by $29,807, or nearly 3%.

The pattern is reversed for a decline in interest rates.

Larger one-time interest rate changes have larger effects. Steady increases reduce spending by larger amounts the longer they persist. Recent history may provide a sense of the potential risk and impact:

- Real interest rates declined about 4% from 1980 to 2020. They increased by nearly 2% in 2022.

- Very approximately, a 2% increase in the middle of her retirement would reduce Cindy’s index fund financed retirement spending by about 5.75%

Is there a TIPS ladder in your future?

Properly designed and implemented, TIPS ladders can reduce your risk of falling short of your spending target in the face of two challenges – surprise inflation and unanticipated real interest rate increases.

There is a downside. If interest rates decline, your spending will not increase – whereas an index fund strategy would support a spending increase.

TIPS ladders come with costs, too:

- They are typically more expensive to build and operate than an index fund strategy.

- If interest rates do rise, the TIPS in your ladder will decline in value. Remembering that the present value of your planned spending has fallen just as much, and that your ability to spend what you planned is unchanged, requires discipline.

If you like the idea of risk reduction for at least part of your planned spending, a TIPS ladder may be for you. If you are comfortable bearing the risk, a TIPS ladder won’t be a good fit.

If you find TIPS ladders attractive, you may want to ask your advisor to work with you to develop a strategy. Even if you are just curious, a conversation with your advisor can help you develop your thinking.

If you aren’t interested, at least you know why some people might be!

For more information on TIPS, see our webinars, TIPS (Treasury Inflation-Protected Securities) and TIPS for Beginners.

Photo by Tech Daily on Unsplash