This Part 3, of a 3-part series, read the other parts here: Part 1, Part 2.

In my previous two articles, I talked about both the relatively small number of Americans who delay receiving Social Security until age 70 (the age that would maximize their benefit), here, and how a breakeven analysis of Social Security is the wrong way to think about Social Security, here.

In this article, I want to quantify the benefit of delaying Social Security. Put another way, I want to answer the question: What would I have to get in the stock market to beat the 8% per year Social Security would give me to wait an extra year before filing for benefits?

To answer this question, let’s use a simple example. Suppose that Danielle turns 67 tomorrow and would be entitled to a $2,500 monthly Social Security benefit ($30,000 per year) if she filed for benefits. If she waits until next year to file, her benefit would be 8% higher, or $2,700 per month ($32,400 per year). To summarize:

Option 1 File for Social Security today and receive $30,000 per year for life.

Option 2 Receive $0 this year and file next year, receiving $32,400 every year for life.

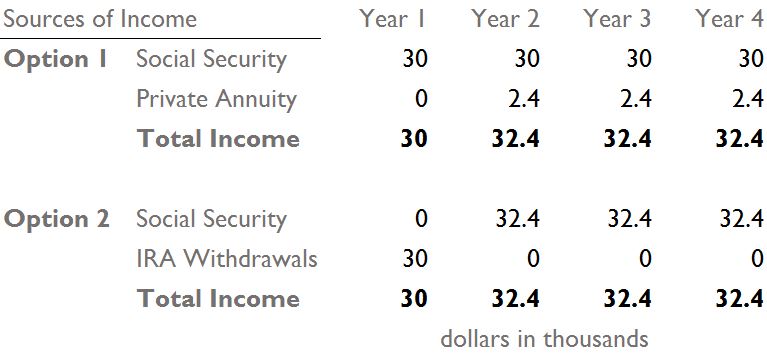

Let’s further assume that Danielle has retirement savings. She can choose to fund $30,000 of spending this year from either Social Security or her IRA. If she takes her benefit today (Option 1), she can keep the $30,000 in her IRA invested in the market with the potential for growth. If she delays Social Security for one year (Option 2), she will have to withdraw $30,000 from her IRA and use that amount for living expenses. (For my analysis I am ignoring the fact that Social Security benefits are taxed differently from IRA withdrawals). We can rewrite her choices as:

Option 1 Take Social Security today and leave $30,000 invested in IRA for an additional year.

Option 2 Withdraw and spend $30,000 from IRA today and file for Social Security in a year.

To decide which option is better, we need to compare apples to apples, or, in this case, an annuity to another annuity. The benefit of delaying Social Security (Option 2) is easy to quantify: by waiting one year, Danielle will receive an 8% larger benefit for life. We can think about this as buying an annuity from Social Security. By giving up one year of benefits, or $30,000, Danielle can buy an annuity next year that will pay her $2,400 per year for life (that’s in addition to her $30,000 base benefit).

To make Option 1 comparable, we have to value the potential benefit in terms of an annuity. Remember that under Option 1, Danielle chooses to take her Social Security benefit immediately. This allows her to leave the $30,000 in her IRA she would have otherwise spent. Accordingly, Danielle benefits from investing her money in the stock market and, in one year, buying an annuity from an insurance company that provides her with $2,400 per year for the rest of her life. How much would this annuity cost?

I requested a blind quote from AIG insurance company for a 68-year-old female (Danielle’s age one year from now) and an annual, inflation-adjusted benefit of $2,400. (The inflation rider is necessary in order to make a valid comparison to Social Security, whose benefit increases every year with CPI). The cost of such an annuity today is $46,744.

Now we can compare Danielle’s options. She can either take Social Security today and buy a $2,400 annual inflation-adjusted annuity from an insurance company with her IRA savings or she can delay Social Security for one year and buy that same annuity from Social Security. Under Option 1, she pays $46,744 one year from now to an insurance company to buy the annuity. Under Option 2, she gives up $30,000 of Social Security benefits today to buy the annuity from the government. Under either scenario, beginning next year she will have $32,400 in annual, inflation-adjusted income:

So to duplicate the 8% higher benefit she would receive from Social Security, Danielle would have to grow the $30,000 in her IRA to $46,744 in one year. If that sounds like a lot, it is. According to my math, Danielle’s IRA would have to grow 55.8% in order for her just to break even (!).

So, what should Danielle do? The answer seems pretty clear. Social Security’s 8% benefit increase is a very good deal. Nothing available in the marketplace comes close.

Importantly, this is just an example. Delaying Social Security is not appropriate for everyone. The above strategy would not work for someone who does not have sufficient savings and needs the income from Social Security right away. It might not be appropriate for someone with a short life expectancy or someone who already has a large amount of guaranteed retirement income and perhaps wants to preserve more assets for her heirs.

Nevertheless, for those people who are stuck deciding between delaying Social Security and taking it sooner, it’s worth comparing apples to apples, or annuities to annuities.